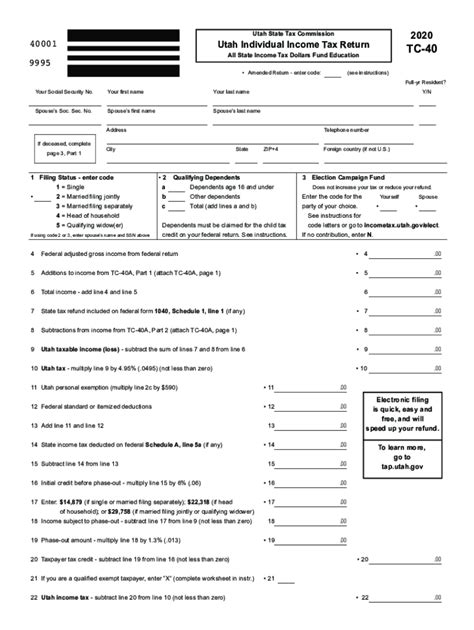

Utah State Tax Commission's Form TC-40 is a crucial document for individuals and businesses to report their income tax obligations. As a taxpayer, it's essential to understand the instructions for filling out this form to avoid any errors or penalties. In this article, we will provide a comprehensive, step-by-step guide to help you navigate the Utah Form TC-40 instructions.

Why Accurate Reporting Matters

Before diving into the instructions, it's crucial to understand the importance of accurate reporting. The Utah State Tax Commission relies on the information provided in Form TC-40 to determine your tax liability. Any errors or omissions can lead to delayed refunds, penalties, or even audits. By following these instructions carefully, you can ensure that your tax return is processed efficiently and accurately.

Gathering Required Documents

Before starting the form, gather all necessary documents, including:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- W-2 forms from all employers

- 1099 forms for freelance work, self-employment, or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Any other relevant tax documents

Step 1: Identifying Your Filing Status

On the top of Form TC-40, identify your filing status by checking one of the following boxes:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Your filing status determines your tax rates, deductions, and credits. Ensure you select the correct status to avoid errors.

Step 2: Reporting Income

Report all income from various sources, including:

- Wages, salaries, and tips (W-2 forms)

- Self-employment income (Schedule C)

- Interest and dividends (1099-INT and 1099-DIV)

- Capital gains and losses (Schedule D)

- Other income (Schedule E)

List each income source separately, using the corresponding lines and columns. Be sure to include all required documentation.

Step 3: Claiming Deductions and Credits

Utah allows various deductions and credits to reduce your tax liability. Claim the following:

- Standard deduction or itemized deductions (Schedule A)

- Personal exemption

- Mortgage interest and property tax deductions (Schedule A)

- Charitable contributions (Schedule A)

- Education credits (Form TC-40A)

- Child tax credit (Form TC-40B)

Carefully review the instructions for each deduction and credit to ensure you meet the eligibility criteria.

Step 4: Calculating Tax Liability

Calculate your total tax liability using the Utah income tax tables or the tax calculator. Ensure you apply the correct tax rates based on your filing status and income level.

Step 5: Reporting Withholding and Payments

Report any withholding from your income sources, including:

- Employer withholding (W-2 forms)

- Estimated tax payments (Form TC-40ES)

- Prior-year tax payments

Also, report any payments made towards your tax liability, including:

- Quarterly estimated tax payments

- Annual tax payments

Step 6: Signing and Filing the Form

Sign and date the form, ensuring all information is accurate and complete. Submit the form to the Utah State Tax Commission by the deadline (April 15th for individual taxpayers).

Additional Tips and Reminders

- Keep accurate records of your tax-related documents for at least three years.

- If you're unable to file by the deadline, submit Form TC-40EXT to request an automatic six-month extension.

- If you owe taxes, consider making payments online or by phone to avoid penalties and interest.

By following these step-by-step instructions, you'll be able to accurately complete Utah Form TC-40 and avoid any potential errors or penalties. Remember to carefully review the instructions and seek professional help if needed.

What's Next?

If you have any questions or concerns about the Utah Form TC-40 instructions, feel free to comment below. Share this article with friends and family who may need assistance with their tax returns. Don't forget to check out our other tax-related articles for more helpful guides and tips.

What is the deadline for filing Utah Form TC-40?

+The deadline for filing Utah Form TC-40 is April 15th for individual taxpayers.

What if I'm unable to file by the deadline?

+If you're unable to file by the deadline, submit Form TC-40EXT to request an automatic six-month extension.

How do I report self-employment income on Utah Form TC-40?

+Report self-employment income on Schedule C, which is attached to Form TC-40.