Starting a business in North Carolina can be an exciting venture, but it requires careful planning and compliance with state regulations. One of the essential steps in establishing a business in North Carolina is registering with the state. In this article, we will guide you through the process of completing the North Carolina Business Registration Form NC- BR.

Why Register Your Business in North Carolina?

Registering your business in North Carolina is crucial for several reasons. Firstly, it helps to establish your business as a legitimate entity, which can enhance its credibility and reputation. Secondly, registration is required by law, and failure to comply can result in penalties and fines. Finally, registration provides an opportunity to obtain necessary licenses and permits to operate your business.

What is the North Carolina Business Registration Form NC-BR?

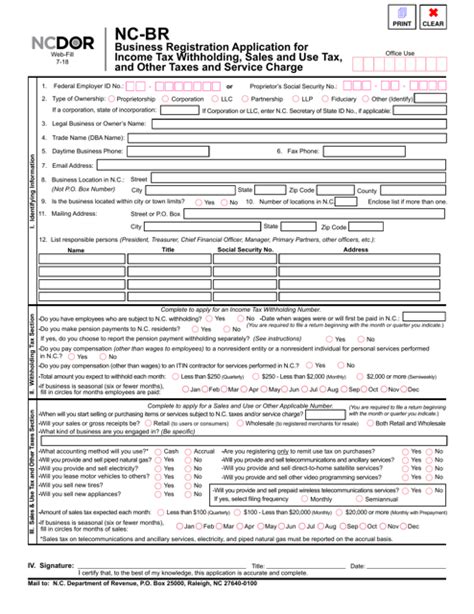

The North Carolina Business Registration Form NC-BR is a document that requires businesses to provide information about their entity, ownership, and operations. The form is used to register businesses with the North Carolina Secretary of State's office and is a mandatory step in establishing a business in the state.

Step-by-Step Guide to Completing the North Carolina Business Registration Form NC-BR

Completing the North Carolina Business Registration Form NC-BR can be a daunting task, especially for new business owners. Here is a step-by-step guide to help you navigate the process:

Step 1: Determine Your Business Structure

Before completing the form, you need to determine your business structure. North Carolina recognizes several types of business structures, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own set of requirements and implications, so it's essential to choose the right one for your business.

Step 2: Gather Required Information

To complete the form, you will need to provide the following information:

- Business name and address

- Business structure (sole proprietorship, partnership, LLC, corporation, etc.)

- Owner/officer information (name, address, and contact details)

- Business description and purpose

- Federal tax ID number (EIN)

- State tax ID number (if applicable)

Step 3: Fill Out the Form

Once you have gathered the required information, you can start filling out the form. The form is divided into several sections, each requiring specific information. Here's a breakdown of the sections:

- Section 1: Business Information

- Business name and address

- Business structure

- Section 2: Owner/Officer Information

- Owner/officer name and address

- Contact details (phone number and email)

- Section 3: Business Description and Purpose

- Brief description of your business

- Purpose of your business

- Section 4: Tax Information

- Federal tax ID number (EIN)

- State tax ID number (if applicable)

Step 4: Sign and Date the Form

Once you have completed the form, sign and date it. The form must be signed by the owner/officer of the business.

Step 5: Submit the Form

The completed form can be submitted online or by mail. If you submit the form online, you will need to create an account with the North Carolina Secretary of State's office. If you submit the form by mail, make sure to include the required filing fee.

Filing Fees and Requirements

The filing fee for the North Carolina Business Registration Form NC-BR varies depending on the type of business structure. Here are the filing fees for different business structures:

- Sole proprietorship: $0 (no filing fee required)

- Partnership: $125

- LLC: $125

- Corporation: $125

In addition to the filing fee, you may also need to obtain necessary licenses and permits to operate your business.

Benefits of Registering Your Business in North Carolina

Registering your business in North Carolina provides several benefits, including:

- Establishes your business as a legitimate entity

- Enhances credibility and reputation

- Provides an opportunity to obtain necessary licenses and permits

- Helps to protect your business name and brand

Common Mistakes to Avoid

When completing the North Carolina Business Registration Form NC-BR, there are several common mistakes to avoid:

- Failure to provide accurate and complete information

- Failure to sign and date the form

- Failure to submit the form with the required filing fee

- Failure to obtain necessary licenses and permits

Conclusion

Registering your business in North Carolina is an essential step in establishing a legitimate and successful business. By following the step-by-step guide outlined in this article, you can complete the North Carolina Business Registration Form NC-BR with ease. Remember to provide accurate and complete information, sign and date the form, and submit it with the required filing fee.

Additional Resources

For more information on registering your business in North Carolina, you can visit the North Carolina Secretary of State's office website. You can also consult with a business attorney or accountant to ensure that you are in compliance with all state regulations.

Encourage Engagement

We hope this article has provided you with a comprehensive guide to completing the North Carolina Business Registration Form NC-BR. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and colleagues who may be interested in starting a business in North Carolina.

FAQ Section

What is the North Carolina Business Registration Form NC-BR?

+The North Carolina Business Registration Form NC-BR is a document that requires businesses to provide information about their entity, ownership, and operations.

How do I submit the North Carolina Business Registration Form NC-BR?

+The completed form can be submitted online or by mail.

What is the filing fee for the North Carolina Business Registration Form NC-BR?

+The filing fee varies depending on the type of business structure.