As a homeowner in Texas, understanding the various tax exemptions available to you can be a great way to reduce your property tax burden. One of the most beneficial exemptions is the Homestead Exemption, which can provide significant savings for eligible homeowners. However, navigating the application process can be daunting, especially for those who are new to homeownership or unfamiliar with the requirements. In this comprehensive guide, we will break down the HCAD Homestead Exemption form, providing you with a clear understanding of the process and what you need to do to take advantage of this valuable exemption.

For many Texans, owning a home is a significant investment, and managing the associated expenses is crucial to maintaining financial stability. Property taxes can be a substantial burden, but exemptions like the Homestead Exemption can help alleviate some of this financial pressure. The Homestead Exemption is designed to provide relief to homeowners who occupy their property as their primary residence, and it can result in significant savings on annual property taxes.

To be eligible for the Homestead Exemption, you must meet specific requirements, including owning and occupying the property as your primary residence on January 1 of the tax year. This exemption is not available for rental properties, second homes, or investment properties. As a homeowner, it's essential to understand the rules and regulations surrounding this exemption to ensure you are taking advantage of the savings available to you.

What is the HCAD Homestead Exemption Form?

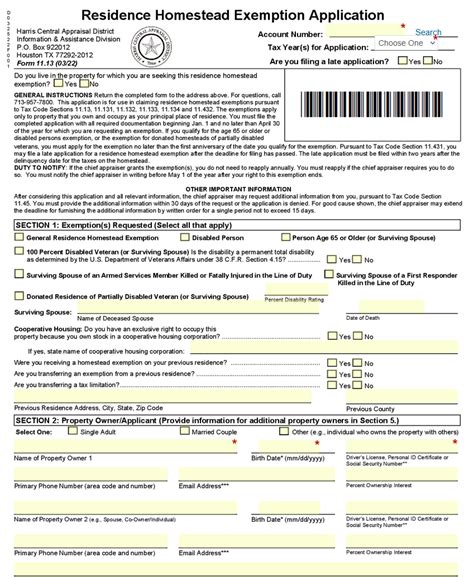

The HCAD Homestead Exemption form is the official application required to claim the Homestead Exemption in Harris County, Texas. This form is used to gather information about the property owner, the property itself, and the owner's eligibility for the exemption. The form must be completed accurately and submitted to the Harris County Appraisal District (HCAD) along with any required supporting documentation.

Required Information and Documentation

To complete the HCAD Homestead Exemption form, you will need to provide specific information and documentation, including:

- Property owner's name and address

- Property address and account number

- Proof of residency, such as a driver's license or utility bill

- Proof of ownership, such as a deed or title

- Social Security number or Individual Taxpayer Identification Number (ITIN)

It's essential to ensure that all information is accurate and complete, as any errors or omissions may result in delays or denial of the exemption.

How to Apply for the Homestead Exemption

Applying for the Homestead Exemption is a relatively straightforward process, but it does require attention to detail and compliance with the submission deadlines. Here are the steps to follow:

- Gather required documentation: Collect all necessary documents, including proof of residency, ownership, and identification.

- Download and complete the form: Obtain the HCAD Homestead Exemption form from the HCAD website or pick one up in person. Complete the form accurately and thoroughly.

- Submit the application: Mail or hand-deliver the completed application to the HCAD office. Be sure to include all required documentation.

- Review and follow up: Review your application carefully before submission. If you have any questions or concerns, contact the HCAD office for assistance.

Deadlines and Timeframes

The deadline for filing the Homestead Exemption application is April 30 of each year. However, it's recommended that you submit your application as soon as possible after January 1 to ensure timely processing. If you miss the deadline, you may still be eligible for a partial exemption, but you will need to contact the HCAD office to discuss your options.

Benefits of the Homestead Exemption

The Homestead Exemption provides several benefits to eligible homeowners, including:

- Reduced property taxes: The exemption can result in significant savings on annual property taxes, which can help reduce the financial burden of homeownership.

- Increased property value: By reducing the taxable value of your property, the Homestead Exemption can help increase the value of your home.

- Protection from tax increases: The exemption can provide a level of protection against tax increases, as the taxable value of your property is capped at a certain percentage of the market value.

Common Questions and Answers

Q: What is the deadline for filing the Homestead Exemption application? A: The deadline for filing the Homestead Exemption application is April 30 of each year.

Q: Can I apply for the Homestead Exemption if I am not a U.S. citizen? A: Yes, you can apply for the Homestead Exemption if you are not a U.S. citizen, but you must provide a valid Social Security number or ITIN.

Q: How much can I expect to save on my property taxes with the Homestead Exemption? A: The amount you can expect to save on your property taxes with the Homestead Exemption varies depending on the taxable value of your property and the tax rates in your area.

Conclusion: Take Advantage of the Homestead Exemption

The Homestead Exemption is a valuable tax savings opportunity for eligible Texas homeowners. By understanding the application process and requirements, you can take advantage of this exemption and reduce your property tax burden. Don't miss out on the savings available to you – apply for the Homestead Exemption today!

What is the Homestead Exemption?

+The Homestead Exemption is a tax exemption available to eligible Texas homeowners who occupy their property as their primary residence.

How do I apply for the Homestead Exemption?

+To apply for the Homestead Exemption, download and complete the HCAD Homestead Exemption form, gather required documentation, and submit the application to the HCAD office.

What are the benefits of the Homestead Exemption?

+The Homestead Exemption provides several benefits, including reduced property taxes, increased property value, and protection from tax increases.