The state of Hawaii requires employers to file a unique tax form, known as the N-11, to report income taxes withheld from their employees' wages. As an employer in Hawaii, it's essential to understand the ins and outs of this form to ensure compliance with state tax laws. In this article, we'll delve into the world of Hawaii Form N-11, providing you with a comprehensive guide to help you navigate the filing process.

The Importance of Hawaii Form N-11

The Hawaii Form N-11 is a crucial document for employers in the state, as it helps the government track income taxes withheld from employee wages. The form is used to report the total amount of taxes withheld, as well as the number of employees and the total wages paid. This information is essential for the state to calculate the correct amount of taxes owed.

Failure to file the N-11 form accurately and on time can result in penalties and fines, which can be costly for employers. Moreover, the form is used to determine the employer's tax liability, so it's essential to ensure that all information is accurate and up-to-date.

Who Needs to File Hawaii Form N-11?

Not all employers in Hawaii need to file the N-11 form. The following employers are required to file:

- Employers who have employees who earn wages subject to Hawaii income tax withholding

- Employers who have employees who earn tips and have reported those tips to the employer

- Employers who have employees who are subject to federal income tax withholding

Employers who do not meet these criteria may not need to file the N-11 form. However, it's always best to consult with a tax professional or the Hawaii Department of Taxation to confirm whether or not you need to file.

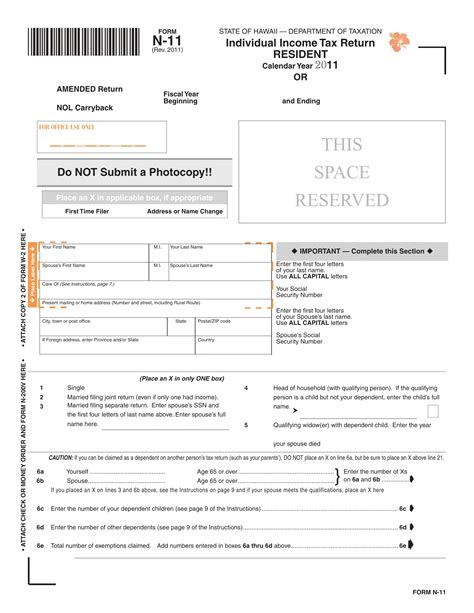

What Information is Required on Hawaii Form N-11?

The Hawaii Form N-11 requires employers to provide various pieces of information, including:

- Employer's name and address

- Employer's federal identification number (FEIN)

- Tax year and quarter

- Total wages paid to employees

- Total taxes withheld from employee wages

- Number of employees

- Tax deposit information

Employers must also provide information about their tax deposits, including the amount deposited and the date of deposit.

How to Calculate Taxes Withheld

Calculating taxes withheld from employee wages can be a complex process. Employers must use the Hawaii income tax withholding tables to determine the correct amount of taxes to withhold. The tables take into account the employee's filing status, number of allowances, and wages earned.

Employers can also use the Hawaii Department of Taxation's online calculator to help with the calculation. It's essential to ensure that all calculations are accurate, as incorrect calculations can result in penalties and fines.

Filing Hawaii Form N-11

The Hawaii Form N-11 must be filed quarterly, with the following due dates:

- April 20th for the first quarter (January 1 - March 31)

- July 20th for the second quarter (April 1 - June 30)

- October 20th for the third quarter (July 1 - September 30)

- January 20th of the following year for the fourth quarter (October 1 - December 31)

Employers can file the form online through the Hawaii Department of Taxation's website or by mail. It's essential to ensure that the form is filed on time, as late filing can result in penalties and fines.

Penalties and Fines

Failure to file the N-11 form accurately and on time can result in penalties and fines. The Hawaii Department of Taxation can impose the following penalties:

- Late filing penalty: 5% of the tax due for each month or part of a month

- Late payment penalty: 1/2% of the tax due for each month or part of a month

- Interest: 8% per annum on the tax due

Employers can avoid penalties and fines by ensuring that the form is filed accurately and on time.

Common Mistakes to Avoid

When filing the Hawaii Form N-11, employers should avoid the following common mistakes:

- Filing the form late

- Failing to report all taxes withheld

- Failing to report all wages paid

- Failing to provide accurate tax deposit information

- Failing to sign and date the form

By avoiding these common mistakes, employers can ensure that their N-11 form is filed accurately and on time.

Conclusion

The Hawaii Form N-11 is a critical document for employers in the state, as it helps the government track income taxes withheld from employee wages. Employers must ensure that the form is filed accurately and on time to avoid penalties and fines. By understanding the requirements and deadlines for filing the N-11 form, employers can ensure compliance with state tax laws and avoid costly mistakes.

We encourage you to share your thoughts and experiences with filing the Hawaii Form N-11 in the comments below. If you have any questions or concerns, please don't hesitate to reach out to us.

Who is required to file the Hawaii Form N-11?

+Employers who have employees who earn wages subject to Hawaii income tax withholding, employers who have employees who earn tips and have reported those tips to the employer, and employers who have employees who are subject to federal income tax withholding.

What is the deadline for filing the Hawaii Form N-11?

+The deadline for filing the Hawaii Form N-11 is the 20th day of the month following the end of the quarter. For example, the deadline for the first quarter (January 1 - March 31) is April 20th.

What are the penalties for late filing of the Hawaii Form N-11?

+The penalties for late filing of the Hawaii Form N-11 include a late filing penalty of 5% of the tax due for each month or part of a month, a late payment penalty of 1/2% of the tax due for each month or part of a month, and interest of 8% per annum on the tax due.