Mastering the art of filing Form MI-1040 is crucial for individuals and businesses in Michigan, as it ensures compliance with state tax laws and avoids potential penalties. The Michigan Department of Treasury requires individuals and businesses to file this form to report their income, deductions, and credits. In this article, we will explore the seven ways to master Form MI-1040 filing, making it easier for you to navigate the process.

Understanding the Basics of Form MI-1040

Form MI-1040 is the standard form used for personal income tax returns in Michigan. It is essential to understand the basics of this form to ensure accurate filing. The form consists of multiple sections, including income, deductions, credits, and payments. Familiarizing yourself with these sections will help you navigate the form efficiently.

Gathering Necessary Documents

Before starting the filing process, it is crucial to gather all necessary documents. These documents include:

- W-2 forms from employers

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Having these documents ready will ensure that you have all the necessary information to complete the form accurately.

Filing Status and Residency

Michigan residents are required to file Form MI-1040 if their gross income exceeds certain thresholds. The filing status and residency of the individual or business will determine the filing requirements. Understanding your filing status and residency will help you determine which sections of the form to complete.

- Resident: Individuals who have lived in Michigan for the entire tax year

- Non-resident: Individuals who have lived in Michigan for only part of the tax year

- Part-year resident: Individuals who have moved to or from Michigan during the tax year

Understanding Income and Deductions

Income and deductions are critical components of Form MI-1040. Understanding what constitutes income and deductions will help you complete the form accurately.

- Income: Includes wages, salaries, tips, and self-employment income

- Deductions: Includes charitable donations, medical expenses, and mortgage interest

Navigating Credits and Payments

Credits and payments are essential components of Form MI-1040. Understanding the different types of credits and payments will help you complete the form accurately.

- Credits: Includes earned income tax credit, child tax credit, and education credits

- Payments: Includes withholding, estimated tax payments, and prior year overpayments

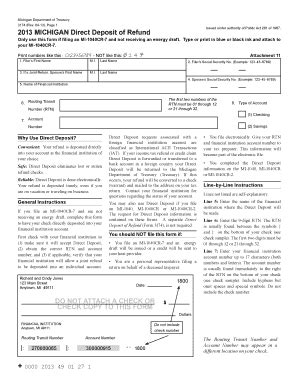

E-Filing and Paper Filing

Form MI-1040 can be filed electronically or by paper. E-filing is a faster and more efficient way to file, but paper filing is still an option for those who prefer it.

- E-filing: Faster processing time and reduced errors

- Paper filing: Must be postmarked by the filing deadline

Amending a Return

If you need to make changes to your original return, you can file an amended return using Form MI-1040X.

- Must be filed within three years of the original filing deadline

- Can be used to correct errors or report additional income

Conclusion and Next Steps

Mastering Form MI-1040 filing requires attention to detail and a thorough understanding of the form's components. By following these seven ways, you will be well on your way to accurately filing your Michigan state income tax return. Remember to gather necessary documents, understand your filing status and residency, and navigate income, deductions, credits, and payments.

We encourage you to share your experiences and tips for mastering Form MI-1040 filing in the comments below. Additionally, if you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask.

FAQ Section

What is the deadline for filing Form MI-1040?

+The deadline for filing Form MI-1040 is April 15th of each year.

Can I file Form MI-1040 electronically?

+Yes, you can file Form MI-1040 electronically through the Michigan Department of Treasury's website.

What is the penalty for late filing of Form MI-1040?

+The penalty for late filing of Form MI-1040 is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.