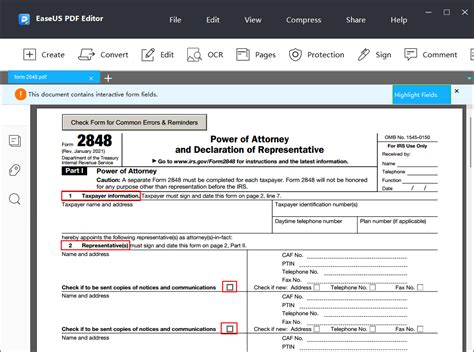

The IRS Form M-2848, also known as the Power of Attorney and Declaration of Representative, is a crucial document that allows taxpayers to appoint a representative to handle their tax matters on their behalf. Filling out this form correctly is essential to ensure that the appointed representative has the necessary authority to act on behalf of the taxpayer. In this article, we will guide you through the process of filling out Form M-2848 correctly.

Understanding the Importance of Form M-2848

Before we dive into the process of filling out the form, it's essential to understand the importance of Form M-2848. This form is used by taxpayers to appoint a representative, such as a tax professional or attorney, to handle their tax matters. The appointed representative can perform various tasks on behalf of the taxpayer, including communicating with the IRS, signing tax returns, and receiving confidential tax information.

Section 1: Taxpayer Information

The first section of Form M-2848 requires taxpayers to provide their personal and tax-related information.

- Line 1: Enter the taxpayer's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Line 2: Enter the taxpayer's date of birth.

- Line 3: Enter the taxpayer's phone number and email address.

Section 2: Representative Information

The second section of Form M-2848 requires taxpayers to provide information about the appointed representative.

- Line 4: Enter the representative's name, address, and Employer Identification Number (EIN) or Social Security number.

- Line 5: Enter the representative's phone number and email address.

Section 3: Powers of Attorney

The third section of Form M-2848 requires taxpayers to specify the powers of attorney granted to the appointed representative.

- Line 6: Check the boxes to specify the powers of attorney granted to the representative, such as signing tax returns, receiving confidential tax information, and communicating with the IRS.

Section 4: Declaration of Representative

The fourth section of Form M-2848 requires the appointed representative to sign and date the form.

- Line 7: The representative must sign and date the form to confirm their appointment.

Section 5: Signature of Taxpayer

The fifth section of Form M-2848 requires the taxpayer to sign and date the form.

- Line 8: The taxpayer must sign and date the form to confirm their appointment of the representative.

Common Mistakes to Avoid

When filling out Form M-2848, taxpayers should avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all information provided is accurate and complete.

- Unsigned or undated form: Ensure that both the taxpayer and the representative sign and date the form.

- Incorrect powers of attorney: Ensure that the correct powers of attorney are granted to the representative.

Conclusion

Filling out Form M-2848 correctly is crucial to ensure that the appointed representative has the necessary authority to act on behalf of the taxpayer. By following the steps outlined in this article, taxpayers can ensure that their Form M-2848 is completed accurately and effectively. If you have any questions or concerns about filling out Form M-2848, it's always best to consult with a tax professional or attorney.

Additional Resources

For more information about Form M-2848, taxpayers can visit the IRS website or consult with a tax professional or attorney.

Get Help

If you have any questions or concerns about filling out Form M-2848, please comment below or share this article with someone who may need help.

What is Form M-2848 used for?

+Form M-2848 is used by taxpayers to appoint a representative to handle their tax matters on their behalf.

Who can sign Form M-2848?

+The taxpayer and the appointed representative must both sign and date the form.

What are the powers of attorney granted to the representative?

+The powers of attorney granted to the representative include signing tax returns, receiving confidential tax information, and communicating with the IRS.