As a citizen, it's essential to be aware of the condition of your property, whether you're a homeowner or a renter. A 4-point inspection form is a crucial document that helps identify potential issues with your property's major systems. However, filling out this form can be a daunting task, especially if you're not familiar with the technical aspects of your property. In this article, we'll break down the 4-point inspection form and provide you with a comprehensive guide on how to fill it out easily.

The Importance of a 4-Point Inspection Form

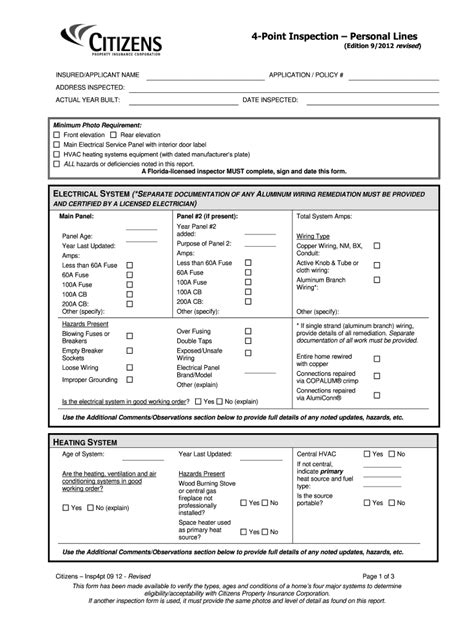

A 4-point inspection form is a document that evaluates the condition of a property's four major systems: roofing, electrical, plumbing, and HVAC (heating, ventilation, and air conditioning). This form is typically required by insurance companies to assess the risk of insuring a property. By filling out this form, you can identify potential issues with your property and take corrective action to prevent costly repairs or even accidents.

Understanding the 4-Point Inspection Form

Before we dive into the details of filling out the form, let's take a closer look at what each section entails:

Roofing

- Age of the roof

- Type of roofing material

- Condition of the roof (good, fair, poor)

- Presence of any leaks or damage

Electrical

- Age of the electrical system

- Type of electrical panel

- Presence of any flickering lights or outlets

- Condition of the electrical system (good, fair, poor)

Plumbing

- Age of the plumbing system

- Type of plumbing material

- Presence of any leaks or water damage

- Condition of the plumbing system (good, fair, poor)

HVAC

- Age of the HVAC system

- Type of HVAC system

- Presence of any issues with heating or cooling

- Condition of the HVAC system (good, fair, poor)

How to Fill Out the 4-Point Inspection Form

Now that we've covered the basics of the 4-point inspection form, let's go through the step-by-step process of filling it out:

Step 1: Gather Information

Before you start filling out the form, gather all the necessary information about your property's systems. This includes:

- Age of each system

- Type of material used for each system

- Any records of maintenance or repairs

- Any notices or warnings from your insurance company

Step 2: Inspect Each System

Conduct a thorough inspection of each system, taking note of any issues or potential problems. Make sure to check for:

- Leaks or water damage

- Flickering lights or outlets

- Issues with heating or cooling

- Any signs of wear and tear

Step 3: Fill Out the Form

Using the information you've gathered and the results of your inspection, fill out the 4-point inspection form. Make sure to:

- Answer all questions honestly and accurately

- Provide detailed descriptions of any issues or problems

- Attach any supporting documentation, such as receipts or invoices

Tips for Filling Out the 4-Point Inspection Form

To make the process of filling out the 4-point inspection form easier, here are some tips to keep in mind:

- Take your time and be thorough

- Use a camera to document any issues or problems

- Keep a record of any maintenance or repairs

- Don't hesitate to seek help if you're unsure about anything

Conclusion

Filling out a 4-point inspection form may seem like a daunting task, but with the right guidance, it can be a straightforward process. By following the steps outlined in this article, you can ensure that your property's major systems are in good working condition and avoid any potential issues. Remember to take your time, be thorough, and don't hesitate to seek help if you need it.

What is a 4-point inspection form?

+A 4-point inspection form is a document that evaluates the condition of a property's four major systems: roofing, electrical, plumbing, and HVAC.

Why is a 4-point inspection form important?

+A 4-point inspection form is important because it helps identify potential issues with a property's major systems, which can prevent costly repairs or even accidents.

How often should I fill out a 4-point inspection form?

+It's recommended to fill out a 4-point inspection form annually, or as required by your insurance company.