As a partner in a partnership or limited liability company (LLC) taxed as a partnership, you are likely familiar with the complexities of partnership tax returns. One of the most critical components of the partnership tax return is the Form K-1 1120s, which reports a partner's share of income, deductions, and credits. In this article, we will delve into the world of Form K-1 1120s, exploring its importance, components, and how to accurately complete it.

What is Form K-1 1120s?

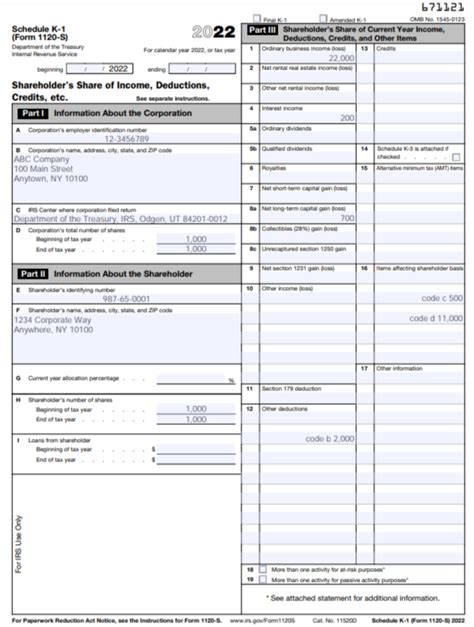

Form K-1 1120s is an informational tax form used to report a partner's share of income, deductions, and credits from a partnership or LLC taxed as a partnership. The form is a crucial component of the partnership tax return, as it provides the necessary information for partners to report their share of partnership income on their individual tax returns. The form is typically prepared by the partnership's tax preparer or accountant and is provided to each partner by the partnership.

Components of Form K-1 1120s

Form K-1 1120s consists of several sections, each reporting specific information about the partner's share of income, deductions, and credits. The main components of the form include:

- Partner's Information: This section reports the partner's name, address, and taxpayer identification number (TIN).

- Partner's Share of Income: This section reports the partner's share of income from the partnership, including ordinary business income, rental income, and interest income.

- Partner's Share of Deductions: This section reports the partner's share of deductions, including business expenses, depreciation, and interest expenses.

- Partner's Share of Credits: This section reports the partner's share of credits, including the low-income housing credit and the rehabilitation credit.

- Other Information: This section reports other information, including the partner's share of self-employment tax, alternative minimum tax, and foreign taxes.

How to Complete Form K-1 1120s

Completing Form K-1 1120s requires careful attention to detail and a thorough understanding of the partnership's financial information. Here are some steps to follow:

- Gather Financial Information: Gather all necessary financial information, including the partnership's income statement, balance sheet, and general ledger.

- Determine Partner's Share: Determine each partner's share of income, deductions, and credits based on their ownership percentage.

- Complete Form K-1 1120s: Complete Form K-1 1120s for each partner, reporting their share of income, deductions, and credits.

- Review and Verify: Review and verify the information reported on Form K-1 1120s to ensure accuracy.

Importance of Form K-1 1120s

Form K-1 1120s plays a critical role in the partnership tax return process. Here are some reasons why:

- Accurate Reporting: Form K-1 1120s ensures accurate reporting of a partner's share of income, deductions, and credits.

- Partner's Tax Return: Form K-1 1120s provides the necessary information for partners to report their share of partnership income on their individual tax returns.

- IRS Compliance: Form K-1 1120s helps partnerships comply with IRS regulations and avoid potential penalties.

Common Mistakes to Avoid

When completing Form K-1 1120s, there are several common mistakes to avoid:

- Inaccurate Information: Ensure that all information reported on Form K-1 1120s is accurate and complete.

- Late Filing: File Form K-1 1120s on time to avoid late-filing penalties.

- Insufficient Documentation: Maintain sufficient documentation to support the information reported on Form K-1 1120s.

Best Practices for Form K-1 1120s

Here are some best practices to follow when completing Form K-1 1120s:

- Seek Professional Help: Seek the help of a tax professional or accountant to ensure accurate completion of Form K-1 1120s.

- Maintain Accurate Records: Maintain accurate and complete records to support the information reported on Form K-1 1120s.

- Review and Verify: Review and verify the information reported on Form K-1 1120s to ensure accuracy.

Conclusion

In conclusion, Form K-1 1120s is a critical component of the partnership tax return process. By understanding the importance of Form K-1 1120s and following best practices, partnerships can ensure accurate reporting of a partner's share of income, deductions, and credits. If you are a partner in a partnership or LLC taxed as a partnership, it is essential to work with a tax professional or accountant to ensure accurate completion of Form K-1 1120s.

We encourage you to share your thoughts and experiences with Form K-1 1120s in the comments below.

What is the purpose of Form K-1 1120s?

+Form K-1 1120s is an informational tax form used to report a partner's share of income, deductions, and credits from a partnership or LLC taxed as a partnership.

Who is required to file Form K-1 1120s?

+Partnerships and LLCs taxed as partnerships are required to file Form K-1 1120s for each partner.

What is the deadline for filing Form K-1 1120s?

+The deadline for filing Form K-1 1120s is typically March 15th of each year.