Completing Form IL-2848, also known as the Power of Attorney and Declaration of Representative, is a crucial step for individuals and businesses looking to authorize a representative to handle their tax affairs with the Illinois Department of Revenue. This form allows taxpayers to grant authority to a third party, such as a tax professional or attorney, to represent them in matters related to their tax account.

However, completing Form IL-2848 can be a daunting task, especially for those who are unfamiliar with the process. In this article, we will provide a comprehensive guide on how to complete Form IL-2848 successfully, highlighting the key sections, requirements, and best practices to ensure accuracy and avoid common mistakes.

Understanding the Purpose and Scope of Form IL-2848

Before we dive into the completion process, it's essential to understand the purpose and scope of Form IL-2848. This form is used to authorize a representative to act on behalf of the taxpayer in matters related to their tax account, including filing tax returns, making payments, and responding to notices and audits. The representative can be an individual, such as a tax professional or attorney, or a business entity.

Who Needs to Complete Form IL-2848?

Form IL-2848 is required for any individual or business that wants to authorize a representative to handle their tax affairs with the Illinois Department of Revenue. This includes:

- Individuals who want to appoint a tax professional or attorney to represent them in tax matters

- Businesses that want to authorize a representative to handle their tax account

- Estates and trusts that need to appoint a representative to manage their tax affairs

Step-by-Step Guide to Completing Form IL-2848

Now that we understand the purpose and scope of Form IL-2848, let's move on to the step-by-step guide on how to complete it successfully.

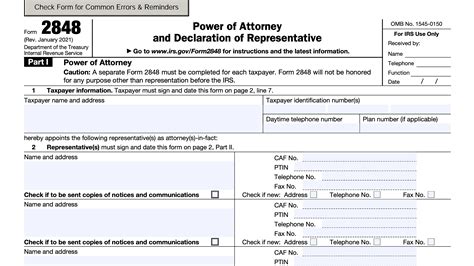

Section 1: Taxpayer Information

In this section, you will need to provide your taxpayer information, including your name, address, and taxpayer identification number (TIN). Make sure to enter your information accurately, as any errors may delay the processing of your form.

Section 2: Representative Information

In this section, you will need to provide information about the representative you are authorizing to act on your behalf. This includes their name, address, and TIN. You will also need to indicate the type of representative you are appointing, such as a tax professional or attorney.

Section 3: Authorization

In this section, you will need to specify the type of authority you are granting to your representative. This includes the authority to file tax returns, make payments, and respond to notices and audits. You will also need to indicate the specific tax years and periods for which you are granting authority.

Section 4: Signature

In this section, you will need to sign and date the form, indicating that you have authorized the representative to act on your behalf. Make sure to sign the form in the presence of a notary public, as this is required for validation.

Tips and Best Practices for Completing Form IL-2848

To ensure that you complete Form IL-2848 successfully, here are some tips and best practices to keep in mind:

- Read the instructions carefully before completing the form

- Use black ink to sign the form, as this is required for validation

- Make sure to sign the form in the presence of a notary public

- Keep a copy of the completed form for your records

- Submit the form to the Illinois Department of Revenue promptly to avoid delays

Common Mistakes to Avoid When Completing Form IL-2848

When completing Form IL-2848, there are several common mistakes to avoid, including:

- Incomplete or inaccurate taxpayer information

- Failure to sign the form in the presence of a notary public

- Insufficient authority granted to the representative

- Failure to submit the form to the Illinois Department of Revenue promptly

By following the step-by-step guide and tips outlined in this article, you can ensure that you complete Form IL-2848 successfully and avoid common mistakes. Remember to read the instructions carefully, use black ink to sign the form, and submit the form to the Illinois Department of Revenue promptly.

Conclusion

Completing Form IL-2848 is a crucial step for individuals and businesses looking to authorize a representative to handle their tax affairs with the Illinois Department of Revenue. By following the step-by-step guide and tips outlined in this article, you can ensure that you complete the form successfully and avoid common mistakes. Remember to read the instructions carefully, use black ink to sign the form, and submit the form to the Illinois Department of Revenue promptly.

We hope this article has been helpful in guiding you through the process of completing Form IL-2848. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is the purpose of Form IL-2848?

+Form IL-2848 is used to authorize a representative to act on behalf of the taxpayer in matters related to their tax account.

Who needs to complete Form IL-2848?

+Form IL-2848 is required for any individual or business that wants to authorize a representative to handle their tax affairs with the Illinois Department of Revenue.

What are the common mistakes to avoid when completing Form IL-2848?

+Common mistakes to avoid include incomplete or inaccurate taxpayer information, failure to sign the form in the presence of a notary public, insufficient authority granted to the representative, and failure to submit the form to the Illinois Department of Revenue promptly.