The state of Illinois requires individuals and businesses to make estimated tax payments throughout the year if they expect to owe more than $500 in taxes. This is where Form IL 1040-ES comes in – a crucial document for Illinois taxpayers to report and pay their estimated income tax. In this article, we will delve into the world of Form IL 1040-ES, exploring its importance, benefits, and step-by-step instructions on how to complete it.

What is Form IL 1040-ES?

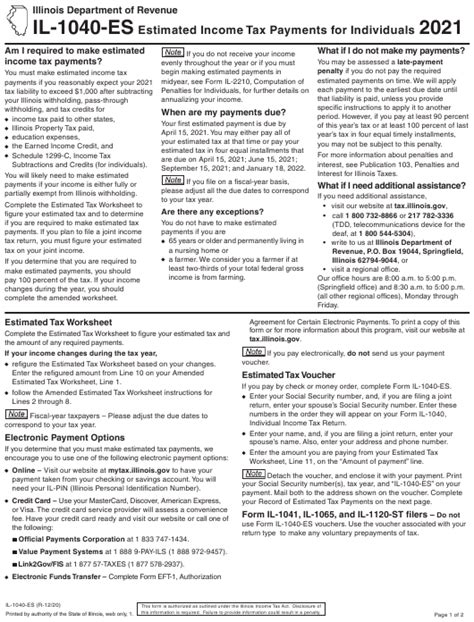

Form IL 1040-ES is the Illinois Estimated Income Tax Return, used by individuals and businesses to make quarterly estimated tax payments to the Illinois Department of Revenue (IDOR). This form is a crucial part of the tax payment process, as it helps taxpayers avoid penalties and interest on underpaid taxes.

Who Needs to File Form IL 1040-ES?

Not everyone needs to file Form IL 1040-ES. Generally, individuals and businesses that expect to owe more than $500 in taxes for the year must make estimated tax payments. This includes:

- Individuals with self-employment income, investments, or rental income

- Businesses with taxable income, such as corporations, partnerships, and S corporations

- Trusts and estates with taxable income

Benefits of Filing Form IL 1040-ES

Filing Form IL 1040-ES provides several benefits to taxpayers, including:

- Avoiding penalties and interest on underpaid taxes

- Reducing the amount of taxes owed at the end of the year

- Helping to budget and plan for tax payments throughout the year

- Demonstrating compliance with Illinois tax laws and regulations

Step-by-Step Instructions for Filing Form IL 1040-ES

Filing Form IL 1040-ES is a straightforward process that can be completed online or by mail. Here are the step-by-step instructions:

Step 1: Determine Your Estimated Tax Liability

To complete Form IL 1040-ES, you will need to estimate your tax liability for the year. You can use the Illinois Estimated Tax Worksheet to calculate your estimated tax liability.

Step 2: Complete the Form IL 1040-ES

Once you have determined your estimated tax liability, you can complete Form IL 1040-ES. The form will require you to provide the following information:

- Your name, address, and Social Security number or Employer Identification Number (EIN)

- Your estimated tax liability for the year

- The amount of tax you are paying with the form

Step 3: Make Your Payment

You can make your estimated tax payment online, by phone, or by mail. If you are making your payment online, you can use the Illinois Department of Revenue's website to make a payment.

Due Dates for Form IL 1040-ES

Form IL 1040-ES is due on a quarterly basis, with the following due dates:

- April 15th for the first quarter (January 1 – March 31)

- June 15th for the second quarter (April 1 – May 31)

- September 15th for the third quarter (June 1 – August 31)

- January 15th of the following year for the fourth quarter (September 1 – December 31)

Penalties and Interest for Late or Underpaid Taxes

If you fail to make your estimated tax payments or underpay your taxes, you may be subject to penalties and interest. The Illinois Department of Revenue may impose a penalty of up to 20% of the underpaid tax, plus interest on the underpaid amount.

Conclusion

Filing Form IL 1040-ES is an important part of the tax payment process in Illinois. By understanding the benefits and step-by-step instructions for filing Form IL 1040-ES, taxpayers can avoid penalties and interest on underpaid taxes and ensure compliance with Illinois tax laws and regulations.

We hope this article has provided you with a comprehensive understanding of Form IL 1040-ES and its importance in the tax payment process. If you have any questions or comments, please feel free to share them with us.

What is the purpose of Form IL 1040-ES?

+Form IL 1040-ES is used by individuals and businesses to make estimated tax payments to the Illinois Department of Revenue.

Who needs to file Form IL 1040-ES?

+Individuals and businesses that expect to owe more than $500 in taxes for the year must file Form IL 1040-ES.

What are the due dates for Form IL 1040-ES?

+Form IL 1040-ES is due on a quarterly basis, with the following due dates: April 15th, June 15th, September 15th, and January 15th of the following year.