The U.S. Citizenship and Immigration Services (USCIS) Form I-290B is a crucial document for individuals seeking to appeal or motion a decision made by the USCIS. One of the key aspects of filing this form is understanding the associated fees. In this article, we will delve into the details of the USCIS Form I-290B filing fee, exploring its importance, current costs, and how to submit payment.

Understanding the Purpose of USCIS Form I-290B

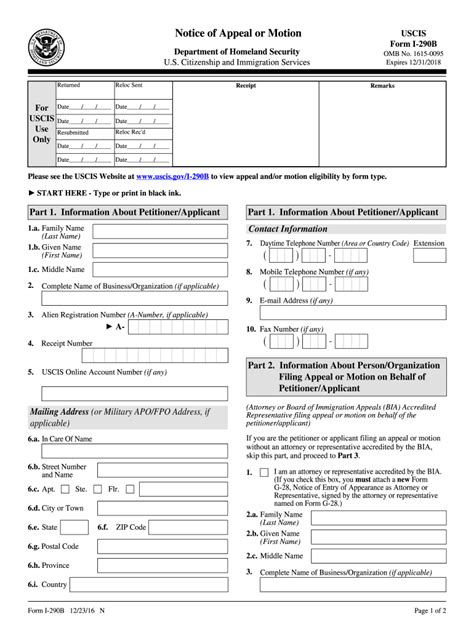

The USCIS Form I-290B, also known as the Notice of Appeal or Motion, is used to appeal or motion a decision made by the USCIS. This form is typically filed when an individual disagrees with a decision made on their immigration application or petition. The USCIS Form I-290B allows individuals to request that the USCIS reconsider its decision or take further action.

Why Is the Filing Fee Important?

The USCIS Form I-290B filing fee is an essential aspect of the appeals process. The fee is used to cover the costs associated with processing and reviewing the appeal or motion. In addition, the fee serves as a deterrent to frivolous appeals, ensuring that only legitimate cases are brought before the USCIS.

Current USCIS Form I-290B Filing Fee

As of 2023, the USCIS Form I-290B filing fee is $675. This fee is subject to change, and it is essential to check the USCIS website for the most up-to-date information on filing fees.

How to Submit Payment for the USCIS Form I-290B Filing Fee

Payment for the USCIS Form I-290B filing fee can be submitted in several ways:

- Check or Money Order: A check or money order payable to the U.S. Department of Homeland Security can be included with the Form I-290B.

- Credit Card: The USCIS also accepts credit card payments using Form G-1450, Authorization for Credit Card Transactions.

- Online Payment: In some cases, online payment may be available through the USCIS website.

It is essential to ensure that the payment is properly submitted and included with the Form I-290B to avoid delays or rejection of the appeal or motion.

Waiver of Filing Fee

In some cases, individuals may be eligible for a waiver of the USCIS Form I-290B filing fee. To be eligible for a fee waiver, individuals must demonstrate that they are unable to pay the fee due to financial hardship. A fee waiver request can be submitted using Form I-912, Request for Fee Waiver.

Requirements for Fee Waiver

To qualify for a fee waiver, individuals must meet one of the following requirements:

- Receiving a Means-Tested Benefit: Individuals who are currently receiving a means-tested benefit, such as Medicaid or food stamps, may be eligible for a fee waiver.

- Household Income at or Below 150% of the Federal Poverty Guidelines: Individuals with a household income at or below 150% of the federal poverty guidelines may be eligible for a fee waiver.

- Financial Hardship: Individuals who can demonstrate financial hardship, such as significant medical expenses or a recent job loss, may be eligible for a fee waiver.

Conclusion

The USCIS Form I-290B filing fee is a critical aspect of the appeals process. Understanding the current filing fee, how to submit payment, and the requirements for a fee waiver can help individuals navigate the process with confidence. By following the guidelines outlined in this article, individuals can ensure that their appeal or motion is properly submitted and reviewed by the USCIS.

What's Next?

If you have any questions or concerns about the USCIS Form I-290B filing fee, please don't hesitate to reach out. Share your thoughts and experiences with the appeals process in the comments below. Don't forget to share this article with others who may be going through a similar situation.

FAQs

What is the current USCIS Form I-290B filing fee?

+The current USCIS Form I-290B filing fee is $675.

How do I submit payment for the USCIS Form I-290B filing fee?

+Payment can be submitted using a check or money order payable to the U.S. Department of Homeland Security, credit card using Form G-1450, or online payment through the USCIS website.

Am I eligible for a waiver of the USCIS Form I-290B filing fee?

+You may be eligible for a fee waiver if you receive a means-tested benefit, have a household income at or below 150% of the federal poverty guidelines, or can demonstrate financial hardship.