As a business owner in Connecticut, it's essential to understand the state's tax laws and filing requirements to avoid penalties and ensure compliance. One of the critical tax forms you'll need to file is the CT-941, which is used for quarterly tax withholding and unemployment insurance contributions. In this comprehensive guide, we'll walk you through the process of filing the CT-941 form, including the benefits, working mechanisms, and steps to follow.

What is the CT-941 Form?

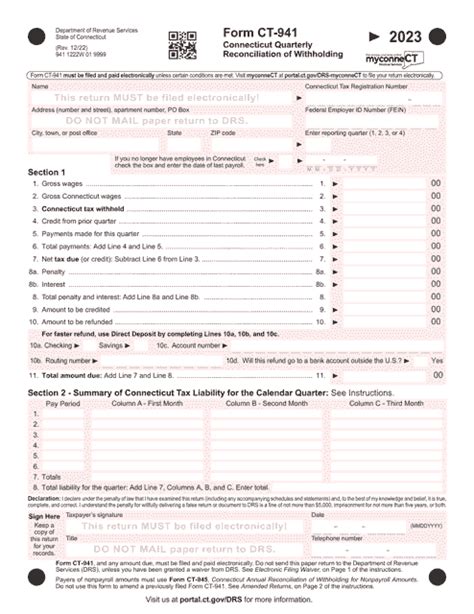

The CT-941 form is a quarterly tax withholding and unemployment insurance contribution report that employers in Connecticut must file with the Connecticut Department of Labor (CTDOL) and the Connecticut Department of Revenue Services (CTDRS). The form is used to report the amount of state income tax withheld from employees' wages, as well as unemployment insurance contributions.

Benefits of Filing the CT-941 Form

Filing the CT-941 form is crucial for Connecticut employers, as it helps to:

- Report state income tax withholding and unemployment insurance contributions

- Comply with state tax laws and regulations

- Avoid penalties and fines for non-compliance

- Provide accurate information for tax audits and reviews

Who Needs to File the CT-941 Form?

The following employers must file the CT-941 form:

- Employers with one or more employees in Connecticut

- Employers who have paid wages subject to Connecticut state income tax withholding

- Employers who are required to make unemployment insurance contributions

Steps to File the CT-941 Form

To file the CT-941 form, follow these steps:

- Gather required information: Collect the necessary data, including employee wages, state income tax withheld, and unemployment insurance contributions.

- Complete the form: Fill out the CT-941 form, ensuring accuracy and completeness.

- File the form: Submit the form to the CTDOL and CTDRS by the quarterly deadline (April 30th, July 31st, October 31st, and January 31st).

- Make payments: Pay any required taxes and contributions by the quarterly deadline.

CT-941 Form Filing Deadlines

The CT-941 form must be filed by the following quarterly deadlines:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Penalties for Late or Non-Filing

Failure to file the CT-941 form or making late payments can result in penalties and fines. The CTDOL and CTDRS may impose the following penalties:

- Late filing penalty: 5% of the unpaid tax due

- Late payment penalty: 1% of the unpaid tax due per month

- Interest on unpaid tax: 12% per annum

Common Errors to Avoid

To avoid errors and penalties, ensure you:

- File the CT-941 form by the quarterly deadline

- Report accurate employee wages and state income tax withheld

- Make timely payments of taxes and contributions

- Maintain accurate records and supporting documentation

Electronic Filing Options

The CTDOL and CTDRS offer electronic filing options for the CT-941 form, including:

- Online filing through the CTDOL website

- Electronic Funds Transfer (EFT) for tax payments

- Web-based filing through approved third-party providers

Conclusion and Next Steps

Filing the CT-941 form is a critical requirement for Connecticut employers. By understanding the form's purpose, benefits, and filing requirements, you can ensure compliance with state tax laws and regulations. If you're unsure about any aspect of the CT-941 form, consider consulting with a tax professional or seeking guidance from the CTDOL or CTDRS.

Don't hesitate to reach out to us with any questions or comments about the CT-941 form. Share your experiences and tips for filing the form, and help others navigate the process.

What is the CT-941 form used for?

+The CT-941 form is used to report state income tax withholding and unemployment insurance contributions.

Who needs to file the CT-941 form?

+Employers with one or more employees in Connecticut, who have paid wages subject to Connecticut state income tax withholding, and who are required to make unemployment insurance contributions.

What are the penalties for late or non-filing?

+Penalties for late or non-filing include a 5% late filing penalty, 1% late payment penalty per month, and interest on unpaid tax at 12% per annum.