As the tax season approaches, many individuals and businesses are scrambling to gather the necessary documents to file their tax returns. One of the most important documents for taxpayers who have received government payments is Form CCC 1099-G. In this article, we will delve into the world of Form CCC 1099-G, exploring what it is, who needs it, and how to use it to ensure accurate tax filing.

What is Form CCC 1099-G?

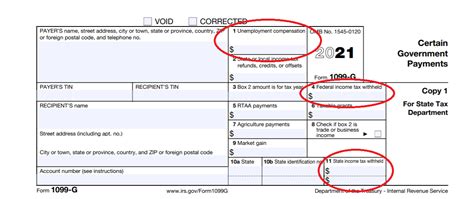

Form CCC 1099-G, also known as the Certain Government Payments Form, is a tax document issued by government agencies to report various types of payments made to individuals and businesses. The most common types of payments reported on this form include:

- Unemployment compensation

- State and local income tax refunds

- Agricultural payments

- Commodity credit corporation loans

Who Needs Form CCC 1099-G?

Taxpayers who have received government payments during the tax year should receive a Form CCC 1099-G from the relevant government agency. This form is essential for accurate tax filing, as it reports the amount of payments made and provides critical information for claiming deductions and credits.

How to Read and Understand Form CCC 1099-G

To ensure accurate tax filing, it's crucial to understand the various components of Form CCC 1099-G. Here's a breakdown of the key sections:

- Box 1: Unemployment Compensation: Reports the total amount of unemployment compensation paid to the taxpayer.

- Box 2: State and Local Income Tax Refunds: Reports the total amount of state and local income tax refunds paid to the taxpayer.

- Box 3: Agricultural Payments: Reports the total amount of agricultural payments made to the taxpayer.

- Box 4: Commodity Credit Corporation Loans: Reports the total amount of commodity credit corporation loans made to the taxpayer.

How to Use Form CCC 1099-G for Tax Filing

When filing taxes, taxpayers should report the information from Form CCC 1099-G on their tax return. Here's how:

- Unemployment Compensation: Report the amount in Box 1 on Line 21 of Form 1040.

- State and Local Income Tax Refunds: Report the amount in Box 2 on Line 10 of Form 1040.

- Agricultural Payments: Report the amount in Box 3 on Schedule F (Form 1040).

- Commodity Credit Corporation Loans: Report the amount in Box 4 on Schedule F (Form 1040).

Common Errors to Avoid

When using Form CCC 1099-G for tax filing, taxpayers should be aware of common errors to avoid:

- Incorrect reporting: Ensure that the amounts reported on Form CCC 1099-G are accurate and match the amounts reported on the tax return.

- Missing information: Verify that all necessary information is included on the tax return, including the payer's name, address, and tax identification number.

Tips for Taxpayers

Here are some valuable tips for taxpayers who receive Form CCC 1099-G:

- Keep accurate records: Keep a copy of Form CCC 1099-G and all supporting documentation for at least three years in case of an audit.

- Verify accuracy: Carefully review Form CCC 1099-G for accuracy and report any discrepancies to the issuing agency.

- Seek professional help: If unsure about how to report information from Form CCC 1099-G, consider consulting a tax professional.

Conclusion

Form CCC 1099-G is a critical tax document for taxpayers who have received government payments. By understanding the purpose, components, and usage of this form, taxpayers can ensure accurate tax filing and avoid common errors. Remember to keep accurate records, verify accuracy, and seek professional help when needed.

What is the purpose of Form CCC 1099-G?

+Form CCC 1099-G reports various types of government payments made to individuals and businesses, including unemployment compensation, state and local income tax refunds, agricultural payments, and commodity credit corporation loans.

Who needs to receive Form CCC 1099-G?

+Taxpayers who have received government payments during the tax year should receive a Form CCC 1099-G from the relevant government agency.

How do I report information from Form CCC 1099-G on my tax return?

+Report the amounts from Form CCC 1099-G on the corresponding lines of your tax return, such as Line 21 for unemployment compensation and Line 10 for state and local income tax refunds.

We hope this comprehensive guide to Form CCC 1099-G has been informative and helpful. If you have any further questions or concerns, please feel free to comment below or share this article with others who may find it useful.