Understanding the intricacies of tax compliance can be a daunting task, especially for individuals and businesses operating in a complex regulatory environment. The Bca 14.05 form is a crucial document for taxpayers in Indonesia, serving as a vital tool for reporting and paying taxes. In this article, we will delve into the details of the Bca 14.05 form, exploring its purpose, download and filing requirements, and providing practical insights to ensure seamless compliance.

What is the Bca 14.05 Form?

The Bca 14.05 form, also known as the "Formulir 14.05", is a tax return form used by taxpayers in Indonesia to report and pay taxes on income earned from various sources, including employment, business, and investments. This form is an essential component of the Indonesian tax system, enabling the government to collect taxes and regulate financial transactions.

Download Requirements for the Bca 14.05 Form

Taxpayers can download the Bca 14.05 form from the official website of the Directorate General of Taxes (DJP) or through the online tax filing system, known as e-Filing. To download the form, taxpayers will need to follow these steps:

- Visit the DJP website () or access the e-Filing system.

- Click on the "Forms" or "Downloads" section.

- Select the Bca 14.05 form from the list of available forms.

- Choose the correct tax year and form type (e.g., individual or corporate).

- Download the form in PDF format.

Filing Requirements for the Bca 14.05 Form

Taxpayers must submit the completed Bca 14.05 form to the DJP by the designated deadline, which typically falls on the 25th of March, June, September, and December. Failure to submit the form on time may result in penalties and fines. Here are the key filing requirements:

- Taxpayer Identification Number (NPWP): Taxpayers must have a valid NPWP to submit the Bca 14.05 form.

- Form Completion: The form must be completed accurately and in its entirety, including all required attachments and supporting documents.

- Submission: The completed form must be submitted to the DJP through the e-Filing system or in person at a designated tax office.

- Payment: Taxpayers must settle any outstanding tax liabilities when submitting the form.

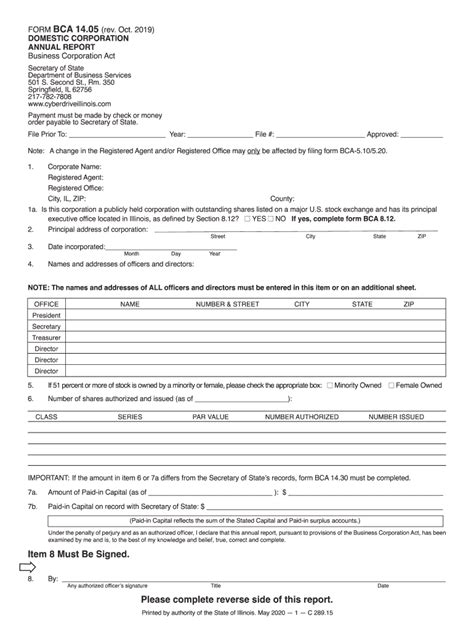

Key Components of the Bca 14.05 Form

The Bca 14.05 form consists of several sections, including:

- Taxpayer Information: Taxpayers must provide their NPWP, name, address, and contact details.

- Income Statement: Taxpayers must report their income from various sources, including employment, business, and investments.

- Tax Deductions and Credits: Taxpayers can claim deductions and credits for expenses related to their income.

- Tax Liability: Taxpayers must calculate their total tax liability, including any penalties and fines.

Benefits of Accurate and Timely Filing

Accurate and timely filing of the Bca 14.05 form is essential for taxpayers to avoid penalties and fines. Some benefits of compliant filing include:

- Avoid Penalties and Fines: Taxpayers can avoid penalties and fines for late or inaccurate filing.

- Reduced Tax Liability: Taxpayers can minimize their tax liability by claiming deductions and credits.

- Improved Compliance: Accurate and timely filing demonstrates a taxpayer's commitment to compliance and reduces the risk of audit.

Common Mistakes to Avoid

Taxpayers should be aware of common mistakes to avoid when completing and submitting the Bca 14.05 form:

- Inaccurate or Incomplete Information: Taxpayers must ensure that all information is accurate and complete.

- Late Filing: Taxpayers must submit the form by the designated deadline.

- Insufficient Supporting Documents: Taxpayers must attach all required supporting documents.

Conclusion

In conclusion, the Bca 14.05 form is a critical component of the Indonesian tax system, enabling taxpayers to report and pay taxes on income earned from various sources. By understanding the download and filing requirements, taxpayers can ensure seamless compliance and avoid penalties and fines. Remember to accurate and timely filing is essential for reducing tax liability and improving compliance.

We invite you to share your experiences and insights on the Bca 14.05 form in the comments section below. Don't hesitate to ask questions or seek clarification on any aspect of the form.

FAQ Section

What is the purpose of the Bca 14.05 form?

+The Bca 14.05 form is used by taxpayers in Indonesia to report and pay taxes on income earned from various sources.

Where can I download the Bca 14.05 form?

+Taxpayers can download the Bca 14.05 form from the official website of the Directorate General of Taxes (DJP) or through the online tax filing system, known as e-Filing.

What are the consequences of late or inaccurate filing?

+Taxpayers who file late or inaccurately may be subject to penalties and fines.