Completing tax forms can be a daunting task, especially for those who are new to the process. In Wisconsin, the WT-6 form is a crucial document for employers to report their state income tax withholding. In this article, we will provide a comprehensive guide on how to complete the WT-6 form correctly, highlighting five essential steps to ensure accuracy and compliance.

Why is the WT-6 Form Important?

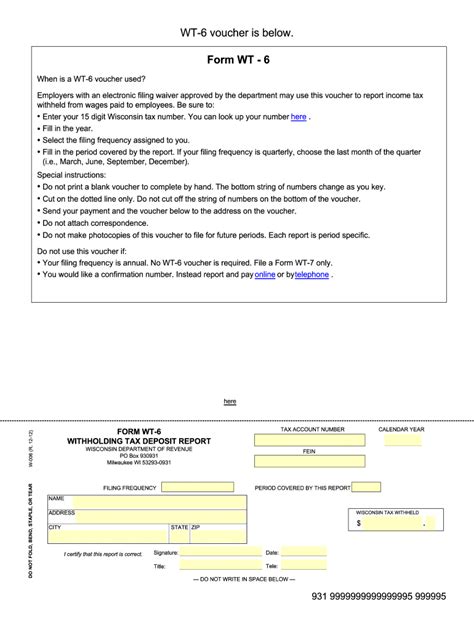

Before we dive into the completion process, let's understand the significance of the WT-6 form. The WT-6 form is used by employers in Wisconsin to report their state income tax withholding to the Wisconsin Department of Revenue. This form is typically submitted quarterly, and it's essential to complete it accurately to avoid any penalties or fines.

5 Ways to Complete the WT-6 Form Correctly

1. Gather Required Information and Documents

To start completing the WT-6 form, you'll need to gather the following information and documents:

- Employer's name, address, and federal employer identification number (FEIN)

- Total Wisconsin income tax withheld during the quarter

- Total Wisconsin wages paid during the quarter

- Number of employees and total number of exemptions claimed

- Records of employee withholding certificates (WT-4)

Having these documents and information readily available will help you complete the form efficiently and accurately.

2. Determine the Correct Filing Period and Due Date

Determining the Correct Filing Period

The WT-6 form is typically filed quarterly, with the following due dates:

- January 31st for the fourth quarter of the previous year (October 1 - December 31)

- April 30th for the first quarter of the current year (January 1 - March 31)

- July 31st for the second quarter of the current year (April 1 - June 30)

- October 31st for the third quarter of the current year (July 1 - September 30)

Make sure to determine the correct filing period and due date to avoid any penalties or fines.

3. Complete the WT-6 Form Accurately

Now that you have gathered the required information and determined the correct filing period, it's time to complete the WT-6 form. Here are some essential steps to follow:

- Enter the employer's name, address, and FEIN in the top section of the form

- Report the total Wisconsin income tax withheld during the quarter in Section 1

- Report the total Wisconsin wages paid during the quarter in Section 2

- Report the number of employees and total number of exemptions claimed in Section 3

- Certify the accuracy of the information and sign the form

Make sure to complete the form accurately and thoroughly to avoid any errors or penalties.

4. Submit the WT-6 Form On Time

Submission Options

The WT-6 form can be submitted online, by mail, or by fax. Here are the submission options:

- Online: Submit the form through the Wisconsin Department of Revenue's online portal

- Mail: Mail the form to the Wisconsin Department of Revenue, PO Box 8901, Madison, WI 53708-8901

- Fax: Fax the form to (608) 267-1030

Make sure to submit the form on time to avoid any penalties or fines.

5. Maintain Accurate Records

Finally, it's essential to maintain accurate records of the WT-6 form and supporting documents. Here are some tips:

- Keep a copy of the completed WT-6 form and supporting documents for at least four years

- Use a secure and organized filing system to store the records

- Make sure to update the records regularly to reflect any changes or corrections

By maintaining accurate records, you'll be able to ensure compliance and avoid any penalties or fines.

FAQ Section

What is the WT-6 form used for?

+The WT-6 form is used by employers in Wisconsin to report their state income tax withholding to the Wisconsin Department of Revenue.

How often do I need to file the WT-6 form?

+The WT-6 form is typically filed quarterly, with due dates on January 31st, April 30th, July 31st, and October 31st.

What happens if I don't file the WT-6 form on time?

+If you don't file the WT-6 form on time, you may be subject to penalties and fines. It's essential to file the form accurately and on time to avoid any consequences.

Share Your Thoughts

We hope this article has provided you with a comprehensive guide on how to complete the WT-6 form correctly. If you have any questions or comments, please share them with us in the section below. Additionally, if you found this article helpful, please share it with your friends and colleagues who may benefit from it.