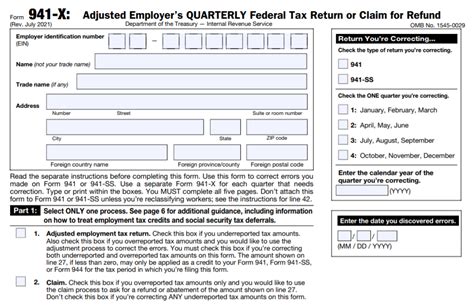

The Form 941-X is a crucial document for employers who need to correct errors or make adjustments to their previously filed Form 941, Employer's Quarterly Federal Tax Return. If you're an employer who has made mistakes on your Form 941, it's essential to know where to mail Form 941-X to ensure timely processing and avoid penalties.

Why You Need to File Form 941-X

Before we dive into where to mail Form 941-X, let's briefly discuss why you need to file this form. Form 941-X is used to correct errors or make adjustments to a previously filed Form 941. This can include correcting errors in wages, tips, or taxes, or reporting changes in employment tax liability. Filing Form 941-X is crucial to ensure compliance with the IRS and avoid penalties and interest on underpaid taxes.

Common Reasons for Filing Form 941-X

Here are some common reasons why employers need to file Form 941-X:

- Correcting errors in wages, tips, or taxes reported on Form 941

- Reporting changes in employment tax liability

- Claiming a refund for overpaid taxes

- Reporting changes in tax credits or deductions

Where to Mail Form 941-X

Now that we've covered why you need to file Form 941-X, let's discuss where to mail it. The IRS has specific addresses for mailing Form 941-X, depending on the type of correction or adjustment you're making.

Mailing Addresses for Form 941-X

Here are the mailing addresses for Form 941-X:

- For refunds or credits: Internal Revenue Service, 1500 Pennsylvania Ave NW, Washington, D.C. 20220

- For payments: Internal Revenue Service, PO Box 802521, Cincinnati, OH 45280-2501

- For corrections or adjustments: Internal Revenue Service, PO Box 9941, Mail Stop 5700, Cincinnati, OH 45285-0904

Tips for Filing Form 941-X

To ensure timely processing and avoid penalties, here are some tips for filing Form 941-X:

- File Form 941-X as soon as possible after discovering errors or changes

- Use the correct mailing address for your type of correction or adjustment

- Include all required documentation and supporting forms

- Keep a copy of your filed Form 941-X for your records

Penalties for Late or Incomplete Filings

Failure to file Form 941-X on time or with incomplete information can result in penalties and interest. Here are some penalties to be aware of:

- Late filing penalty: 5% of the unpaid tax per month, up to 25%

- Late payment penalty: 0.5% of the unpaid tax per month, up to 25%

- Interest on unpaid taxes: calculated from the original due date of the tax return

Conclusion

Filing Form 941-X is a crucial step in correcting errors or making adjustments to your previously filed Form 941. By knowing where to mail Form 941-X and following the tips outlined in this article, you can ensure timely processing and avoid penalties and interest. Remember to file Form 941-X as soon as possible after discovering errors or changes, and keep a copy of your filed form for your records.

FAQ Section

What is Form 941-X used for?

+Form 941-X is used to correct errors or make adjustments to a previously filed Form 941, Employer's Quarterly Federal Tax Return.

What are the common reasons for filing Form 941-X?

+Common reasons for filing Form 941-X include correcting errors in wages, tips, or taxes reported on Form 941, reporting changes in employment tax liability, claiming a refund for overpaid taxes, and reporting changes in tax credits or deductions.

What are the penalties for late or incomplete filings of Form 941-X?

+Penalties for late or incomplete filings of Form 941-X include late filing penalty, late payment penalty, and interest on unpaid taxes.