Employers who pay wages to employees are required to file Form 941, the Employer's Quarterly Federal Tax Return, to report their employment taxes. However, mistakes can happen, and errors may occur on the original filing. This is where Form 941-X comes in – the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. It's used to correct errors, make adjustments, or claim a refund for previously filed Form 941 returns. The process of mailing Form 941-X correctly is crucial to avoid delays, penalties, or even the rejection of your correction or refund claim. Here are five tips to ensure you mail Form 941-X correctly.

Understanding the Purpose of Form 941-X

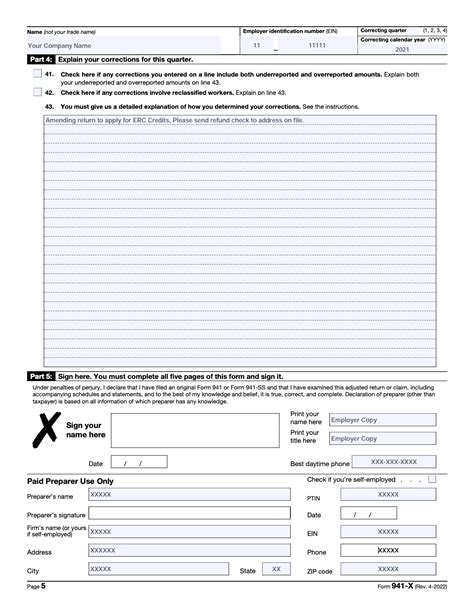

Before diving into the tips for mailing Form 941-X, it's essential to understand its purpose. Form 941-X is used to correct errors on a previously filed Form 941. This can include mathematical errors, incorrect reporting of tax liability, or even to claim a refund due to overpayment. The form serves as an amendment to the original return, providing a clear and accurate reflection of your employment taxes.

Tips for Mailing Form 941-X Correctly

1. Ensure Accuracy and Completeness

The first step in mailing Form 941-X correctly is to ensure that the form is accurate and complete. This includes correctly identifying the tax period, accurately calculating any adjustments or refunds, and providing clear explanations for the changes. Inaccuracies or omissions can lead to delays or even the rejection of your correction or refund claim.

2. Choose the Correct Address

It's crucial to mail Form 941-X to the correct address. The IRS provides specific addresses for mailing Form 941-X, depending on your location and whether you're including a payment or not. Ensure you check the IRS website or contact them directly to confirm the correct mailing address for your situation.

3. Attach Supporting Documents

To support your correction or refund claim, you may need to attach supporting documents to Form 941-X. These can include corrected wage and tax statements (Forms W-2c), amended payroll tax returns (Forms W-3c), or other documentation that explains the changes. Ensure these documents are accurately completed and clearly explain the adjustments.

4. Keep Records of Your Mailing

Maintaining records of your mailing is essential for tracking and verifying that Form 941-X was received by the IRS. Consider using certified mail or a trackable shipping method. Keep a copy of Form 941-X, along with any supporting documents, for your records.

5. Submit Electronically If Possible

The IRS encourages electronic filing of tax returns and amendments whenever possible. If you're required to file Form 941 electronically, you may also be able to submit Form 941-X electronically. This can speed up the processing time and reduce the risk of errors or loss during mailing.

Final Check

Before mailing Form 941-X, perform a final check to ensure everything is accurate, complete, and correctly addressed. This includes verifying the tax period, calculations, and explanations, as well as confirming the mailing address and including any necessary supporting documents.

By following these tips for mailing Form 941-X correctly, you can avoid potential issues and ensure that your correction or refund claim is processed efficiently. Remember, accuracy and completeness are key to a successful filing.

Now that you've learned how to mail Form 941-X correctly, take the next step in managing your employment taxes effectively. Whether you're correcting errors, claiming refunds, or simply ensuring compliance, understanding the intricacies of employment tax forms is crucial for businesses of all sizes.

What is Form 941-X used for?

+Form 941-X is used to correct errors, make adjustments, or claim a refund for previously filed Form 941 returns.

Where should I mail Form 941-X?

+The correct mailing address for Form 941-X depends on your location and whether you're including a payment or not. Check the IRS website or contact them directly to confirm the address.

Can I file Form 941-X electronically?

+Yes, if you're required to file Form 941 electronically, you may also be able to submit Form 941-X electronically. This can speed up the processing time and reduce the risk of errors or loss during mailing.