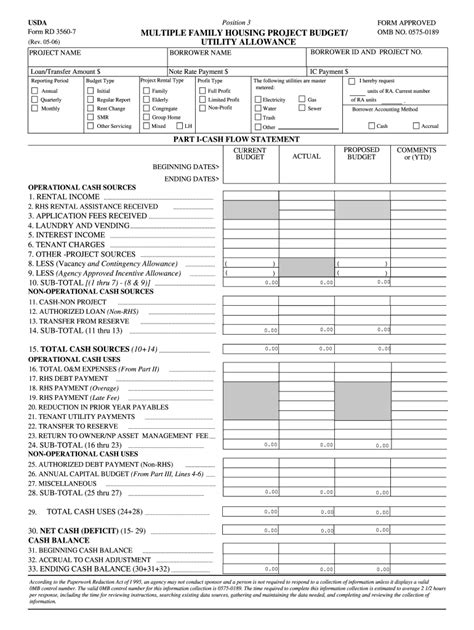

Creating a budget is a crucial step in managing your finances effectively, and for those seeking to purchase a home through the Neighborhood Assistance Corporation of America (NACA), completing the NACA budget form is a necessary part of the process. The NACA budget form is designed to help you understand your income and expenses, and to ensure that you can afford the mortgage payments on your new home. In this article, we will break down the 5 steps to complete the NACA budget form.

Step 1: Gather Your Financial Documents

Before you start filling out the NACA budget form, you will need to gather all of your financial documents. This includes:

- Pay stubs

- Bank statements

- Tax returns

- Credit card statements

- Loan documents

- Investment accounts

- Retirement accounts

Having all of your financial documents in one place will make it easier to complete the budget form and ensure that you are providing accurate information.

Understanding Your Income

Your income is the foundation of your budget, and it is essential to understand how much money you have coming in each month. This includes:

Types of Income

- Salary or wages

- Tips or commissions

- Self-employment income

- Investment income

- Retirement income

- Social Security benefits

When calculating your income, be sure to include all sources of income, including any side jobs or freelance work.

Step 2: Calculate Your Net Income

Your net income is the amount of money you have left over after taxes and other deductions are taken out of your paycheck. To calculate your net income, you will need to:

Calculate Your Gross Income

- Add up all of your income from the sources listed above

- Subtract any taxes or deductions that are taken out of your paycheck

Step 3: List Your Monthly Expenses

Your monthly expenses are the costs that you incur each month, including:

Fixed Expenses

- Rent or mortgage payments

- Utilities (electricity, water, gas, internet)

- Car payments

- Insurance (health, auto, home)

- Minimum credit card payments

- Loan payments

Variable Expenses

- Groceries

- Entertainment (dining out, movies, hobbies)

- Travel

- Gifts

- Miscellaneous expenses

When listing your monthly expenses, be sure to include every expense, no matter how small it may seem.

Step 4: Calculate Your Debt-to-Income Ratio

Your debt-to-income ratio is the percentage of your monthly gross income that goes towards paying off debt. To calculate your debt-to-income ratio, you will need to:

Calculate Your Total Monthly Debt Payments

- Add up all of your monthly debt payments, including credit cards, loans, and mortgages

- Divide your total monthly debt payments by your gross income

Step 5: Review and Submit Your Budget Form

Once you have completed the NACA budget form, review it carefully to ensure that all of the information is accurate. Make sure to:

Double-Check Your Math

- Review your calculations to ensure that they are accurate

- Make sure that you have included all of your income and expenses

Submit Your Budget Form

- Submit your completed budget form to NACA for review

- Be prepared to provide additional documentation or information as needed

By following these 5 steps, you can complete the NACA budget form and take the first step towards owning your own home.

What is the NACA budget form?

+The NACA budget form is a document that helps you understand your income and expenses, and ensures that you can afford the mortgage payments on your new home.

What documents do I need to complete the NACA budget form?

+You will need to gather all of your financial documents, including pay stubs, bank statements, tax returns, credit card statements, loan documents, investment accounts, and retirement accounts.

How do I calculate my net income?

+To calculate your net income, you will need to add up all of your income from the sources listed above, and then subtract any taxes or deductions that are taken out of your paycheck.

We hope this article has been helpful in guiding you through the process of completing the NACA budget form. If you have any questions or need further assistance, please don't hesitate to ask.