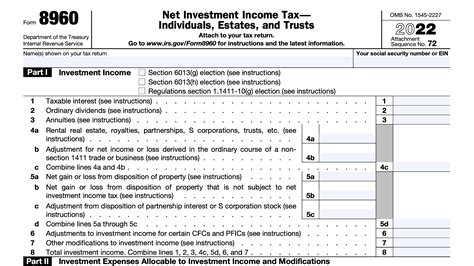

The Form 8960 is a crucial document used by the Internal Revenue Service (IRS) to report net investment income (NII) and to calculate the net investment income tax (NIIT). This tax is levied on certain types of investment income, such as interest, dividends, and capital gains, and is applicable to individuals, estates, and trusts. In this article, we will provide a comprehensive, step-by-step guide on how to fill out and file Form 8960.

Understanding the Purpose of Form 8960

Before we dive into the instructions, it's essential to understand the purpose of Form 8960. The form is used to report NII and to calculate the NIIT, which is a 3.8% tax on certain types of investment income. The tax is intended to help fund the Affordable Care Act (ACA), also known as Obamacare.

Who Needs to File Form 8960?

Not everyone needs to file Form 8960. The form is typically required for individuals, estates, and trusts that have NII above a certain threshold. For the 2022 tax year, the threshold is:

- $250,000 for married couples filing jointly

- $200,000 for single filers

- $250,000 for qualifying widow(er)s

- $150,000 for estates and trusts

If your NII is below these thresholds, you may not need to file Form 8960. However, it's always best to consult with a tax professional or the IRS to determine if you are required to file.

Gathering Required Documents

Before you start filling out Form 8960, you'll need to gather some required documents. These include:

- Your tax return (Form 1040)

- Your Schedule A (Itemized Deductions)

- Your Schedule D (Capital Gains and Losses)

- Your Form 1099-B (Proceeds from Broker and Barter Exchange Transactions)

- Your Form K-1 (Partner's Share of Income, Deductions, Credits, etc.)

Step-by-Step Instructions for Filing Form 8960

Now that you have gathered the required documents, it's time to start filling out Form 8960. Here's a step-by-step guide to help you through the process:

Section 1: Identifying Information

The first section of Form 8960 requires you to provide your identifying information. This includes your name, address, and taxpayer identification number (TIN).

Section 2: Reporting NII

In this section, you'll need to report your NII. This includes:

- Interest income (e.g., interest from bonds, CDs, and savings accounts)

- Dividend income (e.g., dividends from stocks and mutual funds)

- Capital gains (e.g., gains from the sale of stocks, bonds, and real estate)

- Other types of investment income (e.g., rental income, royalty income)

You'll need to calculate your total NII and report it on Line 1 of the form.

Section 3: Calculating the NIIT

In this section, you'll need to calculate the NIIT. This involves calculating your modified adjusted gross income (MAGI) and comparing it to the threshold amount.

- If your MAGI is below the threshold, you may not need to pay the NIIT.

- If your MAGI is above the threshold, you'll need to calculate the NIIT using the tax rates and brackets provided on the form.

Section 4: Reporting the NIIT

In this section, you'll need to report the NIIT. This involves calculating the total tax liability and reporting it on Line 5 of the form.

Section 5: Signing and Dating the Form

The final section of Form 8960 requires you to sign and date the form. This is an important step, as it certifies that the information provided is accurate and complete.

Filing Form 8960

Once you have completed Form 8960, you'll need to file it with the IRS. You can file the form electronically or by mail.

- If you file electronically, you'll need to use the IRS's electronic filing system, which is available on the IRS website.

- If you file by mail, you'll need to send the form to the address listed in the instructions.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when filing Form 8960:

- Make sure to keep a copy of the form for your records.

- If you have any questions or concerns, consult with a tax professional or the IRS.

- The NIIT is a complex tax, and the instructions provided on the form may not cover all situations. If you have any doubts, it's always best to err on the side of caution and seek professional advice.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing Form 8960:

- Failing to report all NII

- Failing to calculate the NIIT correctly

- Failing to sign and date the form

- Failing to file the form on time

Conclusion

Filing Form 8960 can be a complex and time-consuming process. However, by following the step-by-step instructions provided in this article, you can ensure that you file the form correctly and avoid any potential mistakes. Remember to keep a copy of the form for your records and to consult with a tax professional or the IRS if you have any questions or concerns.

FAQs

Here are some frequently asked questions about Form 8960:

Who needs to file Form 8960?

+Individuals, estates, and trusts with NII above a certain threshold need to file Form 8960.

What is the threshold for filing Form 8960?

+The threshold for filing Form 8960 is $250,000 for married couples filing jointly, $200,000 for single filers, $250,000 for qualifying widow(er)s, and $150,000 for estates and trusts.

What types of income are subject to the NIIT?

+The NIIT applies to certain types of investment income, including interest, dividends, capital gains, and other types of investment income.

We hope this article has provided you with a comprehensive guide to filing Form 8960. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it useful.