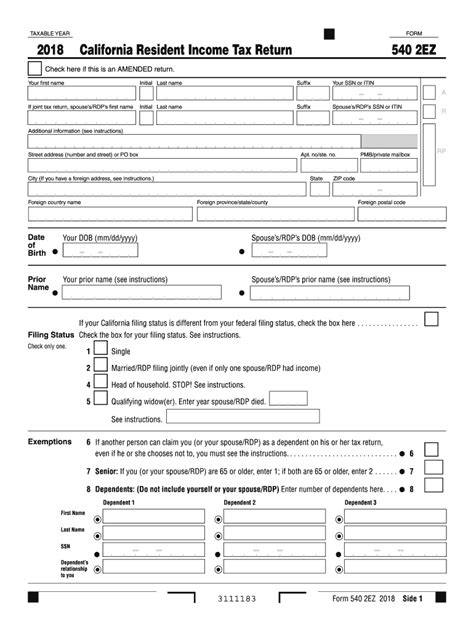

Filing taxes can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a breeze. If you're a California resident, you're likely familiar with Form 540 2EZ, a simplified tax return form designed for individuals with straightforward tax situations. In this article, we'll walk you through the 5 easy steps to complete Form 540 2EZ, making tax filing a hassle-free experience.

Understanding the Basics

Before we dive into the steps, let's quickly understand what Form 540 2EZ is and who can use it. Form 540 2EZ is a simplified tax return form used by the California Franchise Tax Board (FTB) for individuals with simple tax situations. You can use this form if you meet the following criteria:

- You have only one source of income (e.g., a job, retirement, or investments)

- You don't have any dependents

- You don't itemize deductions

- You don't have any self-employment income

- You don't have any capital gains or losses

If you meet these criteria, you're ready to move on to the 5 easy steps to complete Form 540 2EZ.

Step 1: Gather Required Documents

To start filling out Form 540 2EZ, you'll need to gather some essential documents. These include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for any other income (e.g., interest, dividends, or retirement)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your California driver's license or state ID number (if applicable)

Having these documents ready will make the process smoother and less time-consuming.

Step 2: Fill Out Personal Information

Once you have your documents ready, start filling out Form 540 2EZ. Begin with the personal information section, where you'll need to provide your:

- Name

- Social Security number or ITIN

- Date of birth

- Address

- Phone number (optional)

Make sure to fill out this section accurately, as any mistakes may delay the processing of your tax return.

Step 3: Report Your Income

Next, report your income from your W-2 and 1099 forms. You'll need to:

- Enter your total income from all sources

- Report any tax withheld from your income

- Claim any earned income tax credit (EITC) you're eligible for

Remember to only report income that's subject to California state tax.

Step 4: Calculate Your Tax

Now it's time to calculate your tax liability. Form 540 2EZ provides a simple tax calculation worksheet to help you determine your tax. You'll need to:

- Calculate your total tax liability

- Apply any tax credits you're eligible for

- Determine if you owe any additional tax or are due a refund

Step 5: Sign and Submit Your Return

Finally, sign and submit your completed Form 540 2EZ. You can file your return electronically or by mail. If you owe any additional tax, make sure to include a payment with your return. If you're due a refund, you can choose to have it direct deposited into your bank account.

Final Thoughts

Filing taxes doesn't have to be a complex and time-consuming process. By following these 5 easy steps to complete Form 540 2EZ, you'll be on your way to a hassle-free tax filing experience. Remember to gather all required documents, fill out personal information accurately, report your income correctly, calculate your tax liability, and sign and submit your return. If you have any questions or concerns, don't hesitate to reach out to the California Franchise Tax Board (FTB) for assistance.

Share Your Thoughts

Have you filed Form 540 2EZ before? Share your experience in the comments below! Do you have any questions or concerns about the process? Let us know, and we'll do our best to help.

Form 540 2EZ is a simplified tax return form used by the California Franchise Tax Board (FTB) for individuals with straightforward tax situations. You can use Form 540 2EZ if you have only one source of income, don't have any dependents, don't itemize deductions, don't have any self-employment income, and don't have any capital gains or losses. You can file Form 540 2EZ electronically or by mail. If you owe any additional tax, make sure to include a payment with your return. If you're due a refund, you can choose to have it direct deposited into your bank account.What is Form 540 2EZ?

+

Who can use Form 540 2EZ?

+

How do I file Form 540 2EZ?

+