Forming an LLC in Delaware can be a great way to establish your business, but it's essential to understand the pros and cons before making a decision. Delaware has a reputation for being a business-friendly state, with a highly developed corporate law system and a Court of Chancery that specializes in business disputes. However, it's crucial to weigh the benefits against the potential drawbacks to determine if forming an LLC in Delaware is right for you.

Delaware's business-friendly environment is one of the primary reasons why many companies choose to incorporate or form an LLC in the state. The Delaware General Corporation Law (DGCL) and the Delaware Limited Liability Company Act (DLLCA) provide a flexible and modern framework for businesses to operate. Additionally, Delaware's highly respected Court of Chancery provides a specialized forum for resolving business disputes, which can be beneficial for companies that anticipate potential litigation.

Benefits of Forming an LLC in Delaware

Forming an LLC in Delaware offers several benefits, including:

- Tax benefits: Delaware does not impose a state tax on out-of-state income, which means that LLCs can avoid paying state taxes on income earned outside of Delaware.

- Flexibility in management structure: Delaware law allows LLCs to adopt a variety of management structures, including member-managed and manager-managed LLCs.

- Strong protection for personal assets: Delaware law provides strong protection for the personal assets of LLC members, which can help to reduce the risk of personal liability.

- Access to a highly respected Court of Chancery: Delaware's Court of Chancery is a specialized forum for resolving business disputes, which can be beneficial for companies that anticipate potential litigation.

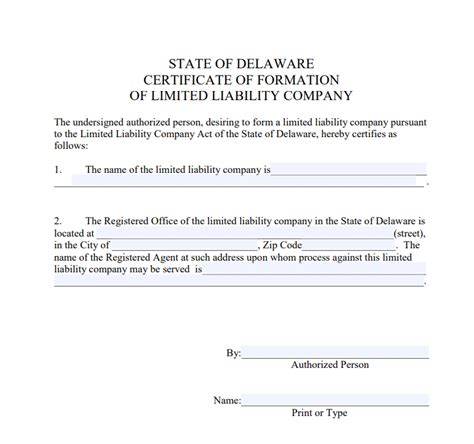

Delaware LLC Formation Requirements

To form an LLC in Delaware, you will need to meet the following requirements:

- Choose a unique business name: Your LLC name must be unique and not already in use by another Delaware business.

- File articles of organization: You will need to file articles of organization with the Delaware Secretary of State's office, which will include basic information about your LLC, such as its name, address, and management structure.

- Obtain a registered agent: Delaware requires LLCs to have a registered agent, who will receive service of process and other important documents on behalf of the LLC.

- Create an operating agreement: An operating agreement outlines the management structure, ownership, and other important details of your LLC.

Delaware LLC Costs and Fees

Forming an LLC in Delaware requires paying various costs and fees, including:

- Filing fee: The filing fee for articles of organization is currently $300.

- Annual report fee: Delaware LLCs are required to file an annual report with the Delaware Secretary of State's office, which costs $350.

- Registered agent fee: The cost of hiring a registered agent can vary depending on the agent and the services provided.

- Operating agreement: Creating an operating agreement can be done at a relatively low cost, but it's essential to have a well-drafted agreement in place.

Delaware LLC Maintenance and Compliance

To maintain your Delaware LLC, you will need to:

- File annual reports: Delaware LLCs are required to file an annual report with the Delaware Secretary of State's office.

- Maintain a registered agent: You will need to ensure that your registered agent is up-to-date and compliant with Delaware law.

- Keep accurate records: You will need to keep accurate records of your LLC's financial and business activities.

- Comply with Delaware law: You will need to comply with Delaware law and regulations, including those related to taxes, employment, and environmental issues.

Is Forming an LLC in Delaware Right for You?

Forming an LLC in Delaware can be a great way to establish your business, but it's essential to weigh the benefits against the potential drawbacks. Delaware's business-friendly environment, tax benefits, and strong protection for personal assets make it an attractive option for many companies. However, the costs and fees associated with forming and maintaining a Delaware LLC may be higher than in other states.

If you're considering forming an LLC in Delaware, it's essential to:

- Consult with an attorney: It's crucial to consult with an attorney who is familiar with Delaware law and can help you navigate the formation process.

- Weigh the benefits and drawbacks: Carefully weigh the benefits and drawbacks of forming an LLC in Delaware, including the costs and fees associated with formation and maintenance.

- Consider your business goals: Consider your business goals and whether forming an LLC in Delaware aligns with those goals.

By carefully considering these factors, you can make an informed decision about whether forming an LLC in Delaware is right for you.

We invite you to share your thoughts and experiences with forming an LLC in Delaware. Have you formed an LLC in Delaware? What were your experiences like? Share your comments below!

What are the benefits of forming an LLC in Delaware?

+Delaware offers several benefits for LLCs, including tax benefits, flexibility in management structure, strong protection for personal assets, and access to a highly respected Court of Chancery.

How much does it cost to form an LLC in Delaware?

+The filing fee for articles of organization is currently $300. Additionally, you will need to pay an annual report fee of $350 and hire a registered agent.

What are the requirements for forming an LLC in Delaware?

+To form an LLC in Delaware, you will need to choose a unique business name, file articles of organization, obtain a registered agent, and create an operating agreement.