Understanding Form 8958, also known as the "Allocation of Tax Amounts Between Certain Individuals in Community Property States" form, is crucial for taxpayers who are residents of community property states and are going through a divorce or separation. This form is used to allocate tax amounts between spouses in community property states, which can have a significant impact on their tax obligations. In this article, we will explore five ways to understand Form 8958 and make the process less daunting.

What is Form 8958 and Why is it Important?

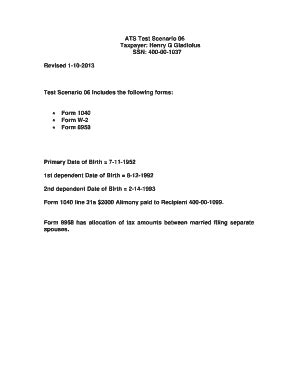

Form 8958 is an Internal Revenue Service (IRS) form that is used by taxpayers in community property states to allocate tax amounts between spouses. Community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In these states, married couples are considered to own property and assets jointly, and are therefore responsible for sharing the tax obligations.

The form is important because it allows taxpayers to allocate tax amounts between spouses, which can affect their tax liabilities. By completing Form 8958, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties.

Who Needs to File Form 8958?

Taxpayers who are residents of community property states and are going through a divorce or separation need to file Form 8958. This includes:

- Married couples who are filing jointly and are residents of community property states

- Married couples who are filing separately and are residents of community property states

- Registered domestic partners who are residents of community property states

- Taxpayers who are separated or divorced and are residents of community property states

It's essential to note that Form 8958 is only required for taxpayers who are residents of community property states. Taxpayers who are not residents of these states do not need to file this form.

What Information is Required on Form 8958?

To complete Form 8958, taxpayers will need to provide the following information:

- The names and Social Security numbers of both spouses

- The addresses of both spouses

- The state of residence

- The tax year for which the form is being filed

- The tax amounts being allocated between spouses

Taxpayers will also need to attach a copy of their divorce or separation agreement to the form.

How to Complete Form 8958

Completing Form 8958 can be a complex process, but by following these steps, taxpayers can ensure that they are filing the form correctly:

- Download the form from the IRS website or obtain a copy from a tax professional.

- Read the instructions carefully and gather all required information.

- Complete the form by providing the required information, including the names and Social Security numbers of both spouses, addresses, state of residence, tax year, and tax amounts being allocated.

- Attach a copy of the divorce or separation agreement to the form.

- Sign and date the form.

- File the form with the IRS by the required deadline.

Tips for Filing Form 8958

Here are some tips to keep in mind when filing Form 8958:

- Make sure to file the form on time to avoid penalties and interest.

- Ensure that all required information is provided, including the names and Social Security numbers of both spouses.

- Attach a copy of the divorce or separation agreement to the form.

- Keep a copy of the form for your records.

- Consider consulting a tax professional if you are unsure about how to complete the form.

Common Mistakes to Avoid When Filing Form 8958

When filing Form 8958, taxpayers should avoid the following common mistakes:

- Failing to provide required information, such as the names and Social Security numbers of both spouses.

- Failing to attach a copy of the divorce or separation agreement.

- Failing to sign and date the form.

- Filing the form late, which can result in penalties and interest.

- Not keeping a copy of the form for your records.

By avoiding these common mistakes, taxpayers can ensure that they are filing Form 8958 correctly and avoiding any potential penalties.

Conclusion

Understanding Form 8958 is crucial for taxpayers who are residents of community property states and are going through a divorce or separation. By following the tips and guidelines outlined in this article, taxpayers can ensure that they are filing the form correctly and avoiding any potential penalties. Remember to consult a tax professional if you are unsure about how to complete the form, and keep a copy of the form for your records.

Who needs to file Form 8958?

+Taxpayers who are residents of community property states and are going through a divorce or separation need to file Form 8958.

What information is required on Form 8958?

+To complete Form 8958, taxpayers will need to provide the names and Social Security numbers of both spouses, addresses, state of residence, tax year, and tax amounts being allocated.

What are the consequences of not filing Form 8958?

+Failing to file Form 8958 can result in penalties and interest.