As a business owner in Illinois, understanding the state's corporate tax laws is crucial to ensure compliance and avoid any potential penalties. One of the most important tax forms for corporations in Illinois is the Form IL-1120, also known as the Illinois Corporate Income Tax Return. In this article, we will provide a comprehensive guide to help you navigate the process of filing Form IL-1120 and comply with the state's corporate tax requirements.

Understanding Form IL-1120

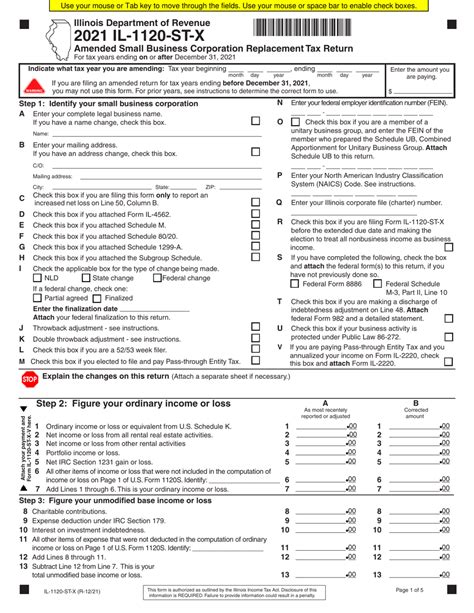

Form IL-1120 is the annual corporate income tax return required by the Illinois Department of Revenue (IDOR) for corporations doing business in the state. The form is used to report the corporation's income, deductions, and credits, as well as to calculate the amount of tax owed to the state.

Who Needs to File Form IL-1120?

Corporations that are required to file Form IL-1120 include:

- Domestic corporations (incorporated in Illinois)

- Foreign corporations (incorporated outside of Illinois) that conduct business in the state

- S corporations (pass-through entities) that elect to be taxed as corporations

- Limited liability companies (LLCs) that elect to be taxed as corporations

When is Form IL-1120 Due?

The due date for Form IL-1120 is the 15th day of the fourth month following the close of the corporation's tax year. For calendar-year corporations, the due date is April 15th. If the due date falls on a weekend or holiday, the form is due on the next business day.

What Information is Required on Form IL-1120?

The following information is required on Form IL-1120:

- Corporation's name, address, and Employer Identification Number (EIN)

- Tax year and accounting method

- Gross income and deductions

- Tax credits and exemptions

- Calculation of Illinois net income and tax liability

How to Calculate Illinois Net Income

To calculate Illinois net income, corporations must follow the instructions provided in the Form IL-1120 instructions. The general steps are as follows:

- Calculate federal taxable income using the corporation's federal tax return (Form 1120)

- Add or subtract any Illinois-specific adjustments to federal taxable income

- Calculate Illinois net income by applying the Illinois corporate tax rate (currently 9.5%) to the adjusted federal taxable income

What Are the Tax Rates for Illinois Corporations?

The Illinois corporate tax rate is 9.5% of net income. However, there are some tax exemptions and credits available to corporations, such as:

- The Illinois Small Business Job Creation Tax Credit

- The Illinois Research and Development Tax Credit

- The Illinois Angel Investment Tax Credit

How to File Form IL-1120

Form IL-1120 can be filed electronically or by mail. Electronic filing is available through the IDOR's website or through an approved tax software provider. Mailed returns should be sent to the following address:

Illinois Department of Revenue 501 S. Second St. Springfield, IL 62756-0001

Penalties for Late Filing or Non-Filing of Form IL-1120

Failure to file Form IL-1120 on time or failure to pay the required tax can result in penalties and interest. The IDOR may impose the following penalties:

- Late filing penalty: 10% of the unpaid tax

- Late payment penalty: 10% of the unpaid tax

- Interest on unpaid tax: 12% per annum

Conclusion

Filing Form IL-1120 is a critical step in complying with Illinois corporate tax laws. By understanding the requirements and deadlines for filing, corporations can avoid penalties and ensure they are taking advantage of available tax credits and exemptions. If you have any questions or concerns about filing Form IL-1120, it is recommended that you consult with a tax professional or the IDOR.

Call to Action

We hope this guide has provided you with a comprehensive understanding of Form IL-1120 and Illinois corporate tax laws. If you have any questions or would like to discuss your corporation's tax situation, please leave a comment below or contact a tax professional. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the due date for Form IL-1120?

+The due date for Form IL-1120 is the 15th day of the fourth month following the close of the corporation's tax year.

What is the Illinois corporate tax rate?

+The Illinois corporate tax rate is 9.5% of net income.

Can I file Form IL-1120 electronically?

+Yes, Form IL-1120 can be filed electronically through the IDOR's website or through an approved tax software provider.