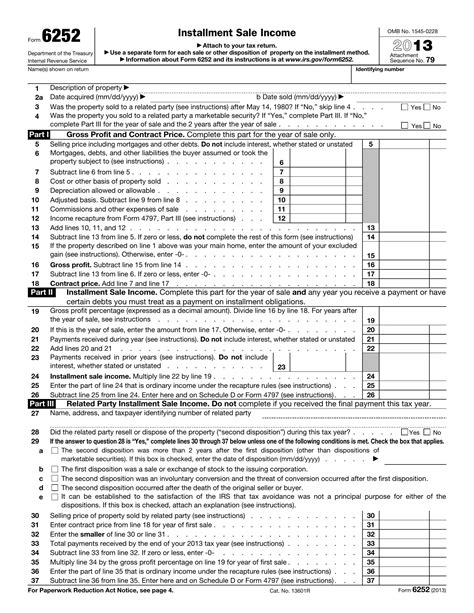

Filing taxes can be a daunting task, especially when dealing with complex forms like Form 6252. The Installment Sale Income form is used to report income from installment sales, which can be a bit tricky to navigate. However, with the right guidance, you can fill out Form 6252 with ease and accuracy. In this article, we'll provide you with 5 valuable tips to help you fill out Form 6252 correctly.

What is Form 6252?

Before we dive into the tips, let's quickly go over what Form 6252 is and who needs to file it. Form 6252 is used to report income from installment sales, which are sales where the buyer pays for the property or asset in installments over time. This can include sales of real estate, businesses, or other assets. If you've made an installment sale, you'll need to file Form 6252 with your tax return.

Tip 1: Understand the Basics of Installment Sales

To fill out Form 6252 correctly, you need to understand the basics of installment sales. An installment sale is a sale where the buyer pays for the property or asset in installments over time. The seller receives a portion of the sale price in the year of the sale, and the remaining balance is paid in installments over subsequent years.

For example, let's say you sell a piece of real estate for $100,000, and the buyer pays $20,000 in cash and agrees to pay the remaining $80,000 in installments over 5 years. In this case, you would report the $20,000 as income in the year of the sale, and the remaining $80,000 would be reported as income over the next 5 years.

Tip 2: Gather All Necessary Documents

To fill out Form 6252 accurately, you'll need to gather all necessary documents related to the installment sale. This includes:

- The sales contract or agreement

- The settlement statement or closing documents

- Any payment records or receipts

Having all these documents handy will make it easier to fill out Form 6252 and ensure that you're reporting the correct income.

Tip 3: Calculate the Gross Profit

To report the correct income on Form 6252, you'll need to calculate the gross profit from the installment sale. The gross profit is the difference between the sale price and the basis of the property or asset.

For example, let's say you sold a piece of real estate for $100,000, and the basis of the property was $60,000. The gross profit would be $40,000 ($100,000 - $60,000).

Tip 4: Report the Income Correctly

Once you've calculated the gross profit, you'll need to report the income correctly on Form 6252. You'll need to report the income in the year of the sale, as well as any subsequent years where you receive installment payments.

For example, let's say you sold a piece of real estate for $100,000, and the buyer paid $20,000 in cash and agreed to pay the remaining $80,000 in installments over 5 years. You would report the $20,000 as income in the year of the sale, and the remaining $80,000 would be reported as income over the next 5 years.

Tip 5: Seek Professional Help if Needed

Filling out Form 6252 can be complex, especially if you're not familiar with installment sales or tax law. If you're unsure about how to fill out Form 6252 or have questions about your specific situation, it's always a good idea to seek professional help.

A tax professional or accountant can help you navigate the complexities of Form 6252 and ensure that you're reporting the correct income.

Conclusion

Filling out Form 6252 can be a challenge, but with the right guidance, you can do it accurately and efficiently. By understanding the basics of installment sales, gathering all necessary documents, calculating the gross profit, reporting the income correctly, and seeking professional help if needed, you'll be well on your way to filling out Form 6252 with ease.

We hope this article has been helpful in providing you with tips and guidance on how to fill out Form 6252. If you have any further questions or need additional assistance, please don't hesitate to reach out.

FAQ Section

What is Form 6252 used for?

+Form 6252 is used to report income from installment sales, which are sales where the buyer pays for the property or asset in installments over time.

Who needs to file Form 6252?

+If you've made an installment sale, you'll need to file Form 6252 with your tax return.

How do I calculate the gross profit on Form 6252?

+The gross profit is the difference between the sale price and the basis of the property or asset.