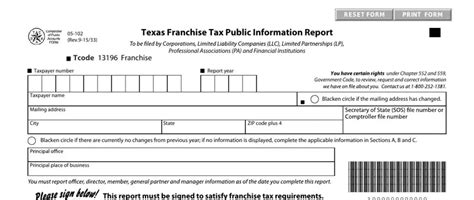

What is Form 05-102 Texas?

Form 05-102 Texas, also known as the "Certificate of Formation - Nonprofit Corporation," is a crucial document required for the formation of a nonprofit corporation in the state of Texas. The Texas Secretary of State provides this form, which must be completed and submitted as part of the incorporation process.

Importance of Form 05-102 Texas

Form 05-102 Texas serves as the primary document for establishing a nonprofit corporation in Texas. It provides essential information about the organization, its purpose, and its leadership. The form must be accurately completed and submitted to the Texas Secretary of State's office to ensure the proper formation of the nonprofit corporation.

Key Components of Form 05-102 Texas

Form 05-102 Texas consists of several key components, including:

- Entity Name and Type: The name and type of the nonprofit corporation must be specified.

- Purpose and Duration: The purpose and duration of the nonprofit corporation must be stated.

- Registered Agent and Office: The name and address of the registered agent and office must be provided.

- Directors and Officers: The names and addresses of the initial directors and officers must be listed.

- Incorporator Information: The name and address of the incorporator must be provided.

Steps to Complete Form 05-102 Texas

To complete Form 05-102 Texas, follow these steps:

- Download the form: Obtain the form from the Texas Secretary of State's website or by contacting their office.

- Complete the form: Fill out the form accurately, providing all required information.

- Sign the form: The incorporator must sign the form.

- Submit the form: Submit the completed form to the Texas Secretary of State's office, along with the required filing fee.

Benefits of Filing Form 05-102 Texas

Filing Form 05-102 Texas provides several benefits, including:

- Establishment of a Nonprofit Corporation: The form establishes the nonprofit corporation in the state of Texas.

- Tax-Exempt Status: The nonprofit corporation may be eligible for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

- Limited Liability Protection: The nonprofit corporation provides limited liability protection for its directors, officers, and members.

Common Mistakes to Avoid When Filing Form 05-102 Texas

When filing Form 05-102 Texas, avoid the following common mistakes:

- Inaccurate Information: Ensure that all information provided on the form is accurate and complete.

- Incomplete Form: Make sure to complete all required sections of the form.

- Insufficient Filing Fee: Ensure that the correct filing fee is submitted with the form.

Conclusion

Form 05-102 Texas is a critical document required for the formation of a nonprofit corporation in the state of Texas. By understanding the key components, steps to complete, and benefits of filing the form, individuals can ensure a smooth incorporation process. Avoid common mistakes, such as inaccurate information and insufficient filing fees, to prevent delays or rejection of the form.

We hope this article has provided valuable insights into Form 05-102 Texas. If you have any questions or comments, please feel free to share them below.

Take Action:

- Share this article with others who may be interested in forming a nonprofit corporation in Texas.

- Comment below with any questions or concerns you may have about Form 05-102 Texas.

- Visit the Texas Secretary of State's website for more information on nonprofit corporations and the incorporation process.

What is the purpose of Form 05-102 Texas?

+Form 05-102 Texas, also known as the "Certificate of Formation - Nonprofit Corporation," is a crucial document required for the formation of a nonprofit corporation in the state of Texas.

What are the key components of Form 05-102 Texas?

+The key components of Form 05-102 Texas include entity name and type, purpose and duration, registered agent and office, directors and officers, and incorporator information.

What are the benefits of filing Form 05-102 Texas?

+Filing Form 05-102 Texas provides several benefits, including establishment of a nonprofit corporation, tax-exempt status, and limited liability protection.