Filling out tax forms can be a daunting task, but with the right guidance, it can be a manageable process. The California Franchise Tax Board (FTB) Form 540A is a crucial document for California residents to report their income and claim tax credits. In this article, we will break down the 5 steps to fill out CA Form 540A correctly, ensuring that you avoid errors and maximize your tax benefits.

Understanding the Importance of Accurate Tax Filing

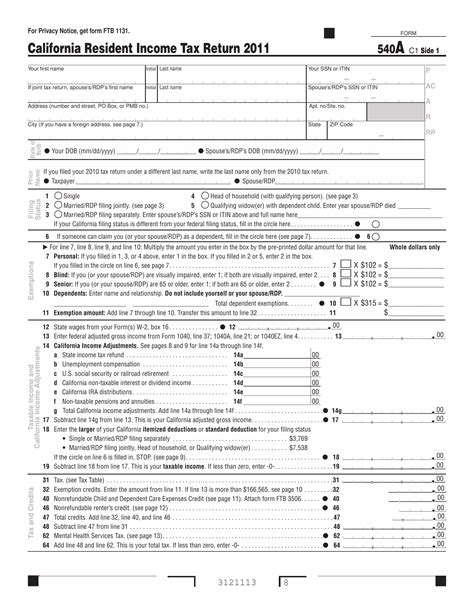

Before we dive into the steps, it's essential to understand the significance of accurate tax filing. The CA Form 540A is used to report your income, deductions, and credits, which will determine your tax liability. Any errors or omissions can lead to delays, penalties, or even an audit. By following these steps, you'll be able to fill out the form correctly and avoid any potential issues.

Step 1: Gather Required Documents and Information

To fill out CA Form 540A correctly, you'll need to gather the following documents and information:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependent's Social Security number or ITIN (if claiming dependents)

- Your employer's name, address, and tax ID number (if employed)

- Your business income and expenses (if self-employed)

- Your interest, dividend, and capital gains income

- Your charitable donations and other deductions

- Your tax credits, such as the Earned Income Tax Credit (EITC)

Step 2: Identify Your Filing Status

Filing Status

Your filing status will determine which tax rates and credits apply to you. The CA Form 540A allows for the following filing statuses:

- Single

- Married/RDP filing jointly

- Married/RDP filing separately

- Head of household

- Qualifying widow(er)

Make sure to choose the correct filing status, as it will impact your tax calculations.

Step 3: Report Your Income

Income Reporting

You'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income and expenses (if self-employed)

- Rental income and expenses

Use the correct forms and schedules to report your income, such as Schedule 1 (Form 540A) for business income and expenses.

Step 4: Claim Your Deductions and Credits

Deductions and Credits

You can claim various deductions and credits to reduce your tax liability. Some common deductions and credits include:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Make sure to claim all the deductions and credits you're eligible for, but be cautious not to overclaim, as this can trigger an audit.

Step 5: Review and Sign Your Return

Final Review

Before submitting your return, review it carefully to ensure that:

- All information is accurate and complete

- Math calculations are correct

- You've signed and dated the return

If you're filing electronically, make sure to follow the instructions carefully to avoid errors.

Additional Tips and Reminders

- Keep a copy of your return and supporting documents for at least three years.

- If you're due a refund, consider direct deposit for faster and more secure payment.

- If you owe taxes, make sure to pay by the deadline to avoid penalties and interest.

By following these 5 steps, you'll be able to fill out CA Form 540A correctly and avoid any potential issues. Remember to stay organized, take your time, and seek professional help if needed.

We'd love to hear from you!

Share your experiences or ask questions about filling out CA Form 540A in the comments below. If you found this article helpful, please share it with your friends and family who may be struggling with tax filing.

FAQ Section:

What is the deadline for filing CA Form 540A?

+The deadline for filing CA Form 540A is typically April 15th of each year, but it may vary depending on your specific situation. Check the California Franchise Tax Board website for more information.

Can I file CA Form 540A electronically?

+Yes, you can file CA Form 540A electronically through the California Franchise Tax Board's website or through a tax preparation software. Electronic filing is faster and more secure than paper filing.

What if I need help filling out CA Form 540A?

+If you need help filling out CA Form 540A, you can consult the California Franchise Tax Board's website, seek the assistance of a tax professional, or contact the FTB's customer service department.