As a taxpayer, it's essential to fill out tax forms accurately to avoid delays, penalties, or even audits. One such form is the Mail Form 8453, which is used to attach supporting documents to electronically filed individual tax returns. In this article, we will guide you through the process of filling out Mail Form 8453 correctly, highlighting the five key steps to ensure accuracy and compliance.

What is Mail Form 8453?

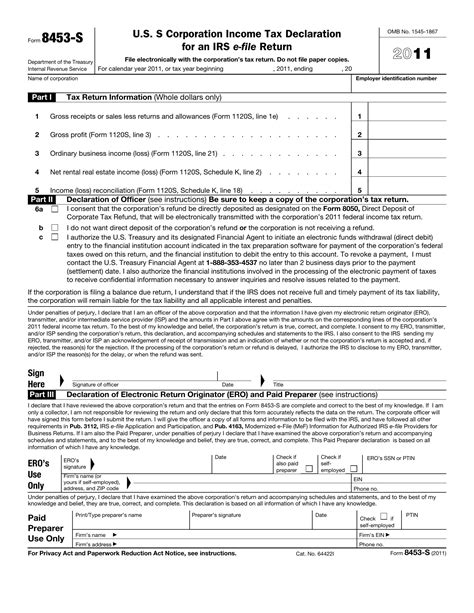

Before we dive into the steps, let's briefly explain what Mail Form 8453 is. The Mail Form 8453, also known as the "U.S. Individual Income Tax Transmittal for an IRS e-file Return," is a tax form used to send supporting documents, such as W-2s, 1099s, and schedules, to the Internal Revenue Service (IRS) when filing an electronic tax return. This form is used to ensure that all required documentation is attached to the tax return, making it easier for the IRS to process and verify the return.

Step 1: Gather Required Documents

The first step to filling out Mail Form 8453 correctly is to gather all the required supporting documents. These documents may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Schedules, such as Schedule A for itemized deductions or Schedule C for business income

- Other supporting documentation, such as receipts for charitable donations or medical expenses

Make sure to have all these documents ready before filling out the form.

Step 2: Fill Out Your Tax Return Information

The next step is to fill out the tax return information section of the form. This section requires you to provide your name, social security number, and address. You will also need to enter the tax return type (e.g., Form 1040, Form 1040A, or Form 1040EZ) and the tax year for which you are filing.

Step 3: List Supporting Documents

In this section, you will need to list all the supporting documents you are attaching to the form. Be sure to include the type of document, the document number (if applicable), and the date. You can list up to six supporting documents per form. If you have more than six documents, you will need to attach an additional Form 8453.

Step 4: Sign and Date the Form

Once you have completed the form, sign and date it. This is an essential step, as the IRS requires a signed and dated form to process your tax return.

Step 5: Attach Supporting Documents and Mail

Finally, attach all the supporting documents to the form and mail it to the IRS address listed on the form. Make sure to use a secure envelope and keep a copy of the form and supporting documents for your records.

Additional Tips:

- Use a pen with black or blue ink to sign the form.

- Make sure to write your name and address legibly.

- Use a paperclip or staple to attach supporting documents to the form.

- Keep a copy of the form and supporting documents for your records.

Common Mistakes to Avoid

When filling out Mail Form 8453, it's essential to avoid common mistakes that can delay or even reject your tax return. Some common mistakes to avoid include:

- Failing to sign and date the form

- Not attaching all required supporting documents

- Listing incorrect or incomplete information

- Not using a secure envelope to mail the form

By following these steps and avoiding common mistakes, you can ensure that your Mail Form 8453 is filled out correctly and your tax return is processed without any issues.

Conclusion

Filling out Mail Form 8453 correctly is crucial to ensure that your tax return is processed accurately and efficiently. By following the five steps outlined in this article, you can ensure that your form is complete and accurate. Remember to gather all required documents, fill out your tax return information, list supporting documents, sign and date the form, and attach supporting documents before mailing it to the IRS. By avoiding common mistakes and following these steps, you can ensure a smooth and hassle-free tax filing experience.

Share Your Experience

Have you ever had to fill out Mail Form 8453? Share your experience and any tips you may have in the comments below. If you have any questions or need further clarification on any of the steps, feel free to ask.

What is the purpose of Mail Form 8453?

+The purpose of Mail Form 8453 is to attach supporting documents to an electronically filed individual tax return.

What documents do I need to attach to Mail Form 8453?

+You will need to attach supporting documents such as W-2s, 1099s, and schedules to Mail Form 8453.

How do I sign and date Mail Form 8453?

+You should sign and date Mail Form 8453 using a pen with black or blue ink.