The complexities of tax forms can be overwhelming for many individuals and businesses. Among the numerous forms used by the Internal Revenue Service (IRS), Form 8958 stands out as a crucial document for certain taxpayers. But what exactly is Form 8958, and how does it apply in real-world scenarios? In this article, we will delve into the specifics of Form 8958 and provide five examples to illustrate its practical applications.

Understanding Form 8958

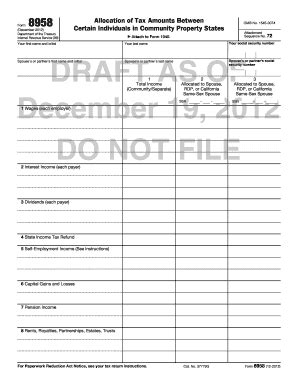

Form 8958, also known as the "Allocation of Tax Amounts" form, is used by taxpayers to allocate tax amounts between different members of a consolidated group. A consolidated group consists of a parent corporation and one or more subsidiary corporations that are treated as a single taxable entity for federal income tax purposes. The form is typically filed by the parent corporation on behalf of the group.

Importance of Form 8958

Accurate completion and timely filing of Form 8958 are essential to ensure that the correct tax amounts are allocated to each member of the consolidated group. Failure to do so can result in penalties, interest, and even audits. By understanding how Form 8958 works in different scenarios, taxpayers can avoid potential pitfalls and ensure compliance with tax regulations.

Example 1: Allocation of Tax Liability

Suppose a parent corporation, XYZ Inc., has two subsidiary corporations, ABC Corp. and DEF Corp. The consolidated group has a total tax liability of $100,000. Using Form 8958, XYZ Inc. allocates 60% of the tax liability to ABC Corp. and 40% to DEF Corp. This allocation is based on the relative profitability of each subsidiary during the tax year.

Example 2: Apportionment of Tax Credits

A consolidated group consisting of a parent corporation, GHI Inc., and its subsidiary, JKL Corp., has a total tax credit of $50,000. GHI Inc. files Form 8958 to apportion 75% of the tax credit to itself and 25% to JKL Corp. This allocation reflects the relative tax liability of each member of the group.

Example 3: Allocation of Alternative Minimum Tax

A consolidated group comprising a parent corporation, MNO Inc., and its subsidiary, PQR Corp., is subject to alternative minimum tax (AMT). MNO Inc. files Form 8958 to allocate 80% of the AMT liability to itself and 20% to PQR Corp. This allocation is based on the relative tax liability of each member of the group.

Example 4: Apportionment of Net Operating Loss

A consolidated group consisting of a parent corporation, STU Inc., and its subsidiary, VWX Corp., has a net operating loss (NOL) of $200,000. STU Inc. files Form 8958 to apportion 60% of the NOL to itself and 40% to VWX Corp. This allocation reflects the relative profitability of each member of the group.

Example 5: Allocation of Tax Basis

A consolidated group comprising a parent corporation, YZC Inc., and its subsidiary, ABC Corp., has a tax basis of $500,000 in a particular asset. YZC Inc. files Form 8958 to allocate 80% of the tax basis to itself and 20% to ABC Corp. This allocation reflects the relative ownership interests of each member of the group.

In conclusion, Form 8958 plays a critical role in the tax compliance of consolidated groups. By understanding how to accurately complete and file this form, taxpayers can avoid potential pitfalls and ensure compliance with tax regulations. The examples provided in this article demonstrate the practical applications of Form 8958 in various scenarios.

Take Action

If you are a member of a consolidated group or are responsible for tax compliance, it is essential to familiarize yourself with Form 8958 and its requirements. Consult with a tax professional or seek guidance from the IRS to ensure accurate completion and timely filing of this critical tax form.

Share Your Thoughts

Have you encountered challenges with Form 8958 or consolidated group tax compliance? Share your experiences and insights in the comments below. Your feedback can help others navigate the complexities of tax regulations.

What is Form 8958 used for?

+Form 8958 is used to allocate tax amounts between different members of a consolidated group.

Who files Form 8958?

+The parent corporation files Form 8958 on behalf of the consolidated group.

What happens if Form 8958 is not filed accurately?

+Inaccurate completion or failure to file Form 8958 can result in penalties, interest, and even audits.