The Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments, has been a topic of interest for many individuals affected by qualified disasters. In this article, we will delve into the details of the Form 8915-F release date and provide you with a comprehensive understanding of what you need to know.

The Form 8915-F is a crucial document for individuals who have taken qualified disaster distributions from their retirement plans, such as 401(k) or IRA, due to a qualified disaster. The form allows individuals to report these distributions and repayments to the Internal Revenue Service (IRS). With the ever-changing landscape of tax laws and regulations, it's essential to stay informed about the Form 8915-F release date and its implications.

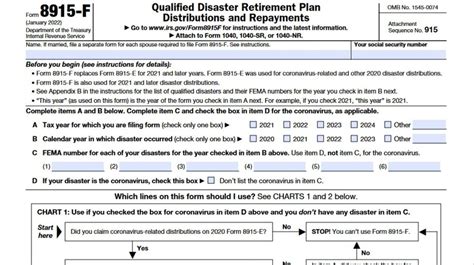

What is Form 8915-F?

The Form 8915-F is used to report qualified disaster distributions and repayments. Qualified disaster distributions are withdrawals from a retirement plan made due to a qualified disaster, such as a hurricane, wildfire, or flood. These distributions are not subject to the 10% penalty for early withdrawals, but they are still subject to income tax.

Key Components of Form 8915-F

The Form 8915-F consists of several key components, including:

- Part I: Reporting of qualified disaster distributions

- Part II: Reporting of repayments

- Part III: Calculation of tax owed or refund due

It's essential to accurately complete each part of the form to ensure compliance with IRS regulations.

Form 8915-F Release Date

The Form 8915-F release date is typically announced by the IRS in the spring of each year. The exact release date may vary, but it's usually around March or April. Once the form is released, individuals can begin filing their returns.

How to Obtain Form 8915-F

You can obtain the Form 8915-F from the IRS website or by contacting the IRS directly. It's essential to use the most up-to-date version of the form to ensure compliance with current regulations.

Who Needs to File Form 8915-F?

Individuals who have taken qualified disaster distributions from their retirement plans need to file Form 8915-F. This includes:

- Individuals who have taken distributions from a 401(k) or IRA due to a qualified disaster

- Individuals who have repaid qualified disaster distributions

- Individuals who need to report tax owed or a refund due on qualified disaster distributions

Consequences of Not Filing Form 8915-F

Failure to file Form 8915-F can result in penalties and interest on unpaid taxes. It's essential to file the form accurately and on time to avoid any consequences.

How to Complete Form 8915-F

Completing Form 8915-F requires careful attention to detail. Here are some steps to follow:

- Review the instructions carefully

- Gather all necessary documents, including records of qualified disaster distributions and repayments

- Complete each part of the form accurately

- Calculate tax owed or refund due

- Sign and date the form

Common Mistakes to Avoid

When completing Form 8915-F, it's essential to avoid common mistakes, such as:

- Inaccurate reporting of qualified disaster distributions and repayments

- Failure to calculate tax owed or refund due correctly

- Not signing and dating the form

Additional Resources

If you need additional help completing Form 8915-F, consider consulting the following resources:

- IRS website

- Tax professional

- Financial advisor

Stay Informed

Stay informed about the Form 8915-F release date and any changes to the form or regulations. This will ensure you're always in compliance with current laws and regulations.

What is the Form 8915-F release date?

+The Form 8915-F release date is typically announced by the IRS in the spring of each year, around March or April.

Who needs to file Form 8915-F?

+Individuals who have taken qualified disaster distributions from their retirement plans need to file Form 8915-F.

What are the consequences of not filing Form 8915-F?

+Failure to file Form 8915-F can result in penalties and interest on unpaid taxes.

If you have any questions or concerns about Form 8915-F or its release date, feel free to comment below. Share this article with others who may find it informative, and don't forget to stay informed about any changes to the form or regulations.