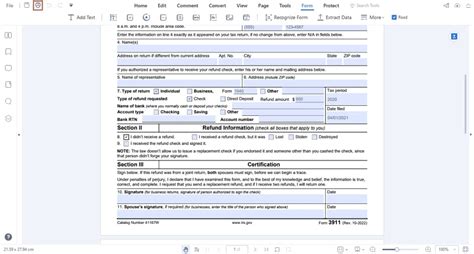

As the tax season approaches, individuals and businesses alike are scrambling to gather all the necessary documents and forms to file their taxes accurately and on time. One such form that may be required by some taxpayers is the IRS Form 3911, also known as the "Taxpayer Statement Regarding Refund." This form is used to report any discrepancies or issues with a taxpayer's refund, and it's essential to have a printable version of the form to ensure accuracy and completeness.

In this article, we will explore five ways to obtain a printable IRS Form 3911, making it easier for taxpayers to file their taxes and resolve any refund-related issues.

Method 1: Download from the IRS Website

The most straightforward way to obtain a printable IRS Form 3911 is to download it directly from the official IRS website. The IRS provides a wide range of tax forms and publications on their website, including Form 3911. To download the form, follow these steps:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab at the top of the page.

- Enter "Form 3911" in the search bar and select the correct form from the search results.

- Click on the "Download" button to save the form to your computer.

- Print the form using your preferred printer settings.

Benefits of Downloading from the IRS Website

Downloading Form 3911 from the IRS website has several benefits, including:

- Convenience: The form is easily accessible and can be downloaded at any time.

- Accuracy: The form is guaranteed to be accurate and up-to-date.

- Free: There is no cost to download the form.

Method 2: Order by Phone

If you prefer not to download the form or need assistance with the process, you can order a printable IRS Form 3911 by phone. The IRS provides a toll-free number that you can call to request forms and publications. To order by phone, follow these steps:

- Call the IRS at 1-800-829-3676 (individuals) or 1-800-829-4933 (businesses).

- Follow the automated prompts to request Form 3911.

- Provide your name and address to receive the form by mail.

Benefits of Ordering by Phone

Ordering Form 3911 by phone has several benefits, including:

- Personal assistance: IRS representatives are available to assist with the ordering process.

- No computer required: You don't need a computer or internet access to order the form.

Method 3: Visit a Local IRS Office

If you prefer to obtain a printable IRS Form 3911 in person, you can visit a local IRS office. The IRS has numerous offices located throughout the country, and representatives are available to assist with tax-related questions and provide forms. To find a local IRS office, follow these steps:

- Visit the IRS website at .

- Click on the "Help and Resources" tab at the top of the page.

- Select "Contact Your Local IRS Office" from the drop-down menu.

- Enter your zip code or city and state to find a local office near you.

- Visit the office during business hours to request Form 3911.

Benefits of Visiting a Local IRS Office

Visiting a local IRS office has several benefits, including:

- Personal assistance: IRS representatives are available to assist with tax-related questions and provide forms.

- No waiting: You can receive the form immediately, without waiting for it to arrive by mail.

Method 4: Use a Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, often provides access to printable IRS forms, including Form 3911. These programs can guide you through the tax filing process and provide the necessary forms to complete your return. To obtain a printable Form 3911 using tax preparation software, follow these steps:

- Purchase and install the tax preparation software on your computer.

- Follow the program's instructions to complete your tax return.

- Print Form 3911 using the software's built-in printing feature.

Benefits of Using Tax Preparation Software

Using tax preparation software has several benefits, including:

- Convenience: The software guides you through the tax filing process and provides the necessary forms.

- Accuracy: The software ensures accuracy and completeness of your tax return.

- Time-saving: The software saves time and reduces the risk of errors.

Method 5: Contact a Tax Professional

If you need assistance with obtaining a printable IRS Form 3911 or have complex tax-related questions, consider contacting a tax professional. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide guidance and support throughout the tax filing process. To contact a tax professional, follow these steps:

- Search online for tax professionals in your area.

- Contact the tax professional to schedule a consultation or appointment.

- Discuss your tax needs and request Form 3911.

Benefits of Contacting a Tax Professional

Contacting a tax professional has several benefits, including:

- Expert guidance: Tax professionals provide expert guidance and support throughout the tax filing process.

- Personalized service: Tax professionals offer personalized service and attention to your specific tax needs.

- Accuracy: Tax professionals ensure accuracy and completeness of your tax return.

What is IRS Form 3911 used for?

+IRS Form 3911 is used to report any discrepancies or issues with a taxpayer's refund.

How can I get a printable IRS Form 3911?

+You can download the form from the IRS website, order it by phone, visit a local IRS office, use tax preparation software, or contact a tax professional.

Is IRS Form 3911 required for all tax returns?

+No, IRS Form 3911 is only required for taxpayers who need to report discrepancies or issues with their refund.

In conclusion, obtaining a printable IRS Form 3911 is a straightforward process that can be completed using various methods. Whether you download the form from the IRS website, order it by phone, visit a local IRS office, use tax preparation software, or contact a tax professional, you can ensure that you have the necessary form to complete your tax return accurately and on time.