The Internal Revenue Service (IRS) issues various types of notices to taxpayers, and one of the most common is the B Notice. The B Notice is a crucial document that requires attention from taxpayers, particularly businesses and employers. In this article, we will delve into the details of the B Notice, its significance, and what actions you should take upon receiving one.

What is a B Notice?

A B Notice is a formal notification from the IRS that informs you about a mismatch between the name and taxpayer identification number (TIN) on a tax return or information return, such as a 1099 or W-2 form. This mismatch can occur due to various reasons, including:

- Incorrect or missing TINs

- Name and TIN combinations that do not match the IRS's records

- Inconsistent or conflicting information

The B Notice is usually sent to taxpayers who have filed information returns, such as employers, financial institutions, or other businesses. The notice is an opportunity for you to correct the errors and avoid potential penalties.

Why is the B Notice Important?

Receiving a B Notice is a significant event that requires prompt attention. Here are some reasons why:

- Penalty avoidance: By responding to the B Notice, you can avoid penalties associated with incorrect or missing TINs. The IRS may impose penalties of up to $270 per return for incorrect or missing TINs.

- Preventing backup withholding: If you fail to respond to the B Notice, the IRS may require you to perform backup withholding on payments made to the recipient. This can result in additional administrative burdens and potential penalties.

- Maintaining compliance: Responding to the B Notice helps you maintain compliance with tax laws and regulations, reducing the risk of audits and examinations.

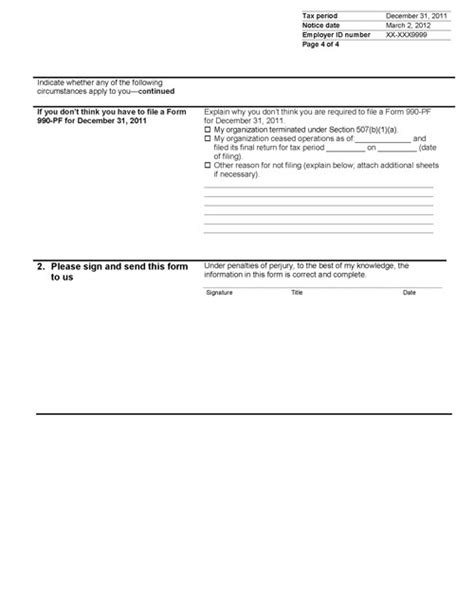

Understanding the B Notice Format

A B Notice typically includes the following information:

- Taxpayer's name and TIN: The name and TIN of the taxpayer or recipient who is affected by the mismatch.

- Mismatch details: A description of the mismatch, including the incorrect or missing TIN.

- Corrective actions: Instructions on how to correct the error, including any necessary documentation or paperwork.

How to Respond to a B Notice

Upon receiving a B Notice, follow these steps:

- Verify the information: Review the notice carefully and verify the information, including the name and TIN.

- Correct the error: If the error is due to an incorrect or missing TIN, correct it and resubmit the information return.

- Provide documentation: If requested, provide documentation to support the corrected information, such as a W-9 form or a copy of the recipient's identification.

- Respond to the IRS: Respond to the IRS in writing, using the address provided on the notice, and include the corrected information and supporting documentation.

Preventing Future B Notices

To minimize the risk of receiving future B Notices, follow these best practices:

- Verify TINs: Verify TINs before submitting information returns to ensure accuracy.

- Use the IRS's TIN Matching Program: Participate in the IRS's TIN Matching Program to validate TINs before submitting returns.

- Maintain accurate records: Keep accurate and up-to-date records of taxpayer information, including names and TINs.

Common Mistakes to Avoid

When responding to a B Notice, avoid the following common mistakes:

- Ignoring the notice: Failing to respond to the B Notice can result in penalties and backup withholding.

- Providing incorrect information: Submitting incorrect or incomplete information can lead to further errors and penalties.

- Missing deadlines: Failing to respond within the specified timeframe can result in penalties and additional administrative burdens.

Conclusion

Receiving a B Notice from the IRS requires prompt attention and action. By understanding the significance of the B Notice, verifying the information, correcting errors, and responding to the IRS, you can avoid penalties and maintain compliance with tax laws and regulations. Remember to follow best practices to prevent future B Notices and avoid common mistakes.

We invite you to share your experiences with B Notices in the comments below. Have you received a B Notice? How did you respond? Share your insights and help others navigate the process.

What is the purpose of a B Notice?

+A B Notice is a formal notification from the IRS that informs you about a mismatch between the name and taxpayer identification number (TIN) on a tax return or information return.

How do I respond to a B Notice?

+Respond to the B Notice by verifying the information, correcting errors, and providing supporting documentation to the IRS.

What are the consequences of ignoring a B Notice?

+Ignoring a B Notice can result in penalties, backup withholding, and additional administrative burdens.