As a responsible citizen, it's essential to understand the importance of tax compliance and the various forms involved in the process. One such form is the 15G form, which can help you save tax on your fixed deposits and other investments. In this article, we'll provide a comprehensive guide on how to fill the 15G form, its benefits, and the required documentation.

What is Form 15G?

Form 15G is a declaration form that can be submitted by individuals to avoid Tax Deducted at Source (TDS) on their fixed deposits, recurring deposits, and other investments. By furnishing this form, the individual declares that their income is below the taxable limit, and therefore, TDS should not be deducted.

Benefits of Filing Form 15G

Filing Form 15G can provide several benefits, including:

- No TDS deduction on fixed deposits and recurring deposits

- Reduced tax liability

- Increased cash flow

- Simplified tax compliance process

Eligibility Criteria for Filing Form 15G

To be eligible to file Form 15G, the following conditions must be met:

- The individual must be a resident Indian

- The individual's tax liability for the financial year should be nil

- The individual's income from all sources should be below the taxable limit

- The individual should not have any tax dues or outstanding tax liabilities

Documents Required for Filing Form 15G

The following documents are required to file Form 15G:

- PAN card

- Aadhaar card

- Proof of address

- Proof of income (Form 16, salary certificate, etc.)

- Proof of tax returns filed (if applicable)

Step-by-Step Guide to Filling Form 15G

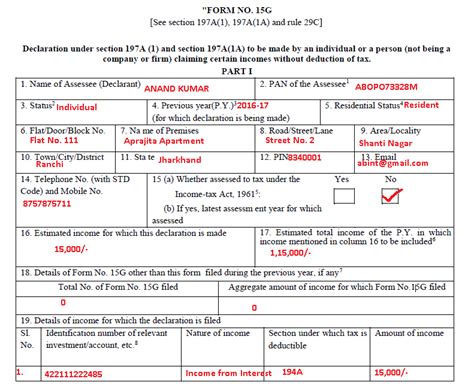

Here's a step-by-step guide to filling Form 15G:

- Download the Form: Download Form 15G from the official website of the Income Tax Department or obtain a copy from your bank or financial institution.

- Fill in the Details: Fill in the required details, including your name, address, PAN, and Aadhaar number.

- Declare Your Income: Declare your income from all sources, including salary, interest on fixed deposits, and other investments.

- Declare Your Tax Liability: Declare your tax liability for the financial year.

- Sign the Form: Sign the form in the presence of a witness.

- Submit the Form: Submit the form to your bank or financial institution.

Common Mistakes to Avoid While Filing Form 15G

While filing Form 15G, the following common mistakes should be avoided:

- Incorrect PAN or Aadhaar Number: Ensure that your PAN and Aadhaar numbers are correct and match the details in your tax returns.

- Incomplete or Incorrect Income Declaration: Ensure that your income declaration is complete and accurate.

- Incorrect Tax Liability Declaration: Ensure that your tax liability declaration is accurate and matches your tax returns.

Consequences of Not Filing Form 15G

If you don't file Form 15G, the following consequences may arise:

- TDS Deduction: TDS will be deducted on your fixed deposits and recurring deposits.

- Tax Liability: You may be liable to pay tax on your income.

- Penalty and Interest: You may be liable to pay penalty and interest on your tax dues.

Conclusion

Filing Form 15G can help you save tax on your fixed deposits and other investments. By following the step-by-step guide provided in this article, you can ensure that your Form 15G is filled correctly and avoid any common mistakes. However, if you're unsure about any aspect of the form or the filing process, it's always best to consult a tax professional or seek guidance from the Income Tax Department.

What is the purpose of Form 15G?

+Form 15G is a declaration form that can be submitted by individuals to avoid Tax Deducted at Source (TDS) on their fixed deposits and other investments.

Who is eligible to file Form 15G?

+To be eligible to file Form 15G, the individual must be a resident Indian, their tax liability for the financial year should be nil, and their income from all sources should be below the taxable limit.

What are the consequences of not filing Form 15G?

+If you don't file Form 15G, TDS will be deducted on your fixed deposits and recurring deposits, you may be liable to pay tax on your income, and you may be liable to pay penalty and interest on your tax dues.