The Vermont E-File Signature Authorization Form 8879-VT is a crucial document for taxpayers in Vermont who want to e-file their tax returns. This form allows taxpayers to authorize their tax preparers or software providers to submit their tax returns electronically to the Vermont Department of Taxes.

In this article, we will delve into the details of the Vermont E-File Signature Authorization Form 8879-VT, explaining its purpose, benefits, and how to complete it.

What is the Vermont E-File Signature Authorization Form 8879-VT?

The Vermont E-File Signature Authorization Form 8879-VT is a document that allows taxpayers to grant permission to their tax preparers or software providers to e-file their tax returns on their behalf. This form is specifically designed for Vermont taxpayers who want to take advantage of the convenience and speed of electronic filing.

Benefits of Using the Vermont E-File Signature Authorization Form 8879-VT

Using the Vermont E-File Signature Authorization Form 8879-VT offers several benefits to taxpayers, including:

- Convenience: By authorizing their tax preparers or software providers to e-file their tax returns, taxpayers can save time and effort.

- Speed: Electronic filing is generally faster than traditional paper filing, allowing taxpayers to receive their refunds sooner.

- Accuracy: E-filing reduces the risk of errors and inaccuracies that can occur with paper filing.

- Security: Electronic filing is a secure way to submit tax returns, as the data is transmitted directly to the Vermont Department of Taxes.

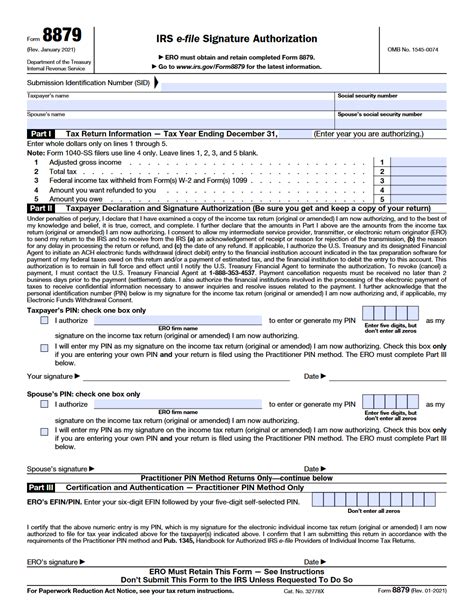

How to Complete the Vermont E-File Signature Authorization Form 8879-VT

To complete the Vermont E-File Signature Authorization Form 8879-VT, taxpayers will need to provide the following information:

- Their name and social security number or individual taxpayer identification number (ITIN)

- The name and federal employer identification number (FEIN) of their tax preparer or software provider

- The type of tax return being filed (e.g., individual, business, etc.)

- The tax year for which the return is being filed

Taxpayers will also need to sign and date the form, indicating their authorization for their tax preparer or software provider to e-file their tax return.

Requirements for Signing the Vermont E-File Signature Authorization Form 8879-VT

To sign the Vermont E-File Signature Authorization Form 8879-VT, taxpayers must meet certain requirements, including:

- Being at least 18 years old

- Being the taxpayer or authorized representative of the taxpayer

- Having a valid social security number or ITIN

- Having a valid federal employer identification number (FEIN) if filing a business tax return

Penalties for Not Filing the Vermont E-File Signature Authorization Form 8879-VT

If taxpayers fail to file the Vermont E-File Signature Authorization Form 8879-VT, they may face penalties and fines, including:

- Delays in processing their tax return

- Rejection of their e-filed tax return

- Fines and penalties for non-compliance

Best Practices for Filing the Vermont E-File Signature Authorization Form 8879-VT

To ensure a smooth and successful e-filing experience, taxpayers should follow these best practices when completing the Vermont E-File Signature Authorization Form 8879-VT:

- Read and understand the instructions carefully before completing the form

- Ensure all required information is accurate and complete

- Sign and date the form legibly

- Keep a copy of the completed form for their records

Common Questions About the Vermont E-File Signature Authorization Form 8879-VT

Here are some common questions about the Vermont E-File Signature Authorization Form 8879-VT:

Q: Who needs to complete the Vermont E-File Signature Authorization Form 8879-VT?

A: Taxpayers who want to e-file their tax returns with the Vermont Department of Taxes need to complete this form.Q: What is the purpose of the Vermont E-File Signature Authorization Form 8879-VT?

A: The purpose of this form is to authorize tax preparers or software providers to e-file tax returns on behalf of taxpayers.Q: Can I file the Vermont E-File Signature Authorization Form 8879-VT electronically?

A: Yes, taxpayers can file this form electronically through the Vermont Department of Taxes website or through their tax preparer or software provider.What happens if I don't file the Vermont E-File Signature Authorization Form 8879-VT?

+If you don't file the Vermont E-File Signature Authorization Form 8879-VT, your e-filed tax return may be rejected or delayed, and you may face penalties and fines for non-compliance.

Can I revoke my authorization to e-file my tax return?

+How long does it take to process my e-filed tax return?

+The processing time for e-filed tax returns varies, but it typically takes 2-4 weeks for the Vermont Department of Taxes to process and issue refunds.

In conclusion, the Vermont E-File Signature Authorization Form 8879-VT is an essential document for taxpayers in Vermont who want to e-file their tax returns. By understanding the purpose, benefits, and requirements of this form, taxpayers can ensure a smooth and successful e-filing experience. If you have any questions or concerns about the Vermont E-File Signature Authorization Form 8879-VT, feel free to ask in the comments below!