Tax season is upon us, and for many, it's a time of stress and confusion. One of the most common questions that filers have is about the difference between Form 8879 and Form 1040. While both forms are crucial for filing taxes, they serve distinct purposes and are used in different contexts.

In this article, we'll delve into the world of tax forms and explore the differences between Form 8879 and Form 1040. We'll examine the purpose of each form, who needs to file them, and what information is required. By the end of this article, you'll have a clear understanding of which form you need to file and how to avoid any potential pitfalls.

What is Form 1040?

Form 1040 is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. It's the most commonly used tax form, and it's used by individuals to report their income, deductions, and credits. The form is used to calculate the amount of taxes owed or the amount of refund due to the taxpayer.

Form 1040 is a comprehensive form that requires filers to provide detailed information about their income, including wages, salaries, tips, and self-employment income. It also requires information about deductions, such as mortgage interest, charitable donations, and medical expenses. Additionally, filers must report any tax credits they're eligible for, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

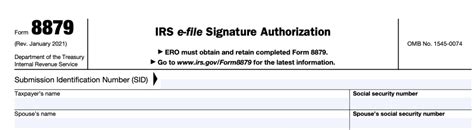

What is Form 8879?

Form 8879 is a specialized form used by the IRS for electronic filing of individual income tax returns. It's a declaration form that taxpayers use to authenticate their electronic signature and confirm their identity. In essence, it's a digital equivalent of signing a paper tax return.

Form 8879 is required for taxpayers who file their taxes electronically using tax software or a tax professional. The form requires taxpayers to provide their name, Social Security number or Individual Taxpayer Identification Number (ITIN), and date of birth. It also requires a declaration that the taxpayer has reviewed the return and is signing it under penalty of perjury.

Key differences between Form 8879 and Form 1040

Here are the main differences between Form 8879 and Form 1040:

- Purpose: Form 1040 is used for reporting income, deductions, and credits, while Form 8879 is used for authenticating electronic signatures and confirming taxpayer identity.

- Filing requirements: Form 1040 is required for all individuals who need to file a tax return, while Form 8879 is only required for taxpayers who file their taxes electronically.

- Information required: Form 1040 requires detailed information about income, deductions, and credits, while Form 8879 requires only basic taxpayer information, such as name, Social Security number, and date of birth.

Who needs to file Form 8879?

Taxpayers who file their taxes electronically using tax software or a tax professional need to file Form 8879. This includes:

- Taxpayers who use tax software, such as TurboTax or H&R Block

- Taxpayers who hire a tax professional to prepare and file their taxes

- Taxpayers who file their taxes online through the IRS website

Tips for filing Form 8879

Here are some tips for filing Form 8879:

- Make sure you have the correct software: Ensure that you're using tax software that supports electronic filing and has the necessary security measures in place.

- Review your return carefully: Before signing Form 8879, review your tax return carefully to ensure that all information is accurate and complete.

- Use a secure connection: When filing electronically, use a secure internet connection to protect your personal and financial information.

Tips for filing Form 1040

Here are some tips for filing Form 1040:

- Gather all necessary documents: Make sure you have all necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Use the correct filing status: Choose the correct filing status, such as single, married filing jointly, or head of household.

- Take advantage of deductions and credits: Claim all eligible deductions and credits to minimize your tax liability.

Common mistakes to avoid

Here are some common mistakes to avoid when filing Form 8879 and Form 1040:

- Inaccurate or incomplete information: Ensure that all information on both forms is accurate and complete.

- Failure to sign or date: Make sure to sign and date both forms correctly.

- Incorrect filing status: Choose the correct filing status to avoid delays or penalties.

Conclusion

In conclusion, Form 8879 and Form 1040 are two distinct forms that serve different purposes in the tax filing process. While Form 1040 is used for reporting income, deductions, and credits, Form 8879 is used for authenticating electronic signatures and confirming taxpayer identity. By understanding the differences between these two forms, taxpayers can ensure a smooth and error-free tax filing experience.

We hope this article has been helpful in explaining the differences between Form 8879 and Form 1040. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form 8879?

+Form 8879 is a declaration form used by the IRS for electronic filing of individual income tax returns. It's used to authenticate electronic signatures and confirm taxpayer identity.

Who needs to file Form 8879?

+Taxpayers who file their taxes electronically using tax software or a tax professional need to file Form 8879.

What is the difference between Form 8879 and Form 1040?

+Form 1040 is used for reporting income, deductions, and credits, while Form 8879 is used for authenticating electronic signatures and confirming taxpayer identity.