The Permanent Account Number (PAN) is a vital document for individuals and businesses in India, serving as a unique identifier for tax purposes. The PAN card application form can seem daunting, but by breaking it down into manageable steps, you can ensure a smooth and successful application process.

In this article, we will guide you through the 6 steps to fill the PAN card application form, making it easier for you to understand and complete the process.

Step 1: Determine Your Eligibility and Required Documents

Before starting the application process, it's essential to determine your eligibility for a PAN card. The Income Tax Department issues PAN cards to the following entities:

- Individual taxpayers

- Hindu Undivided Family (HUF)

- Body of Individuals (BOI)

- Association of Persons (AOP)

- Trusts

- Firms

- Companies

- Local authorities

- Artificial Juridical Persons

Ensure you have the necessary documents to support your application. These may include:

- Proof of identity (Aadhaar card, voter ID, passport, etc.)

- Proof of address (Aadhaar card, utility bills, bank statement, etc.)

- Date of birth proof (birth certificate, school leaving certificate, etc.)

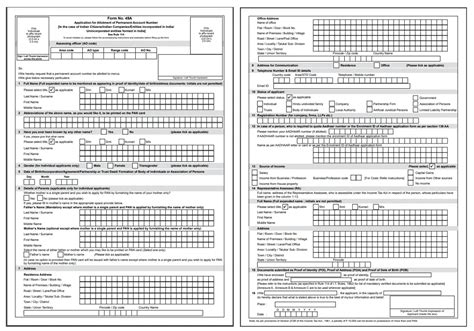

Step 2: Choose the Correct Form and Fill in the Basics

The Income Tax Department provides two types of PAN card application forms:

- Form 49A: For Indian citizens, entities incorporated in India, and unincorporated entities formed in India

- Form 49AA: For foreign citizens, entities incorporated outside India, and unincorporated entities formed outside India

Download the correct form from the official NSDL or UTIITSL website or visit a nearby PAN card facilitation center.

Fill in the basic information, including:

- Name and surname

- Date of birth

- Father's name (in case of individual applicants)

- Address

Important:

- Ensure your name matches the one on your proof of identity documents.

- Provide your correct date of birth to avoid any discrepancies.

Step 3: Enter Your Contact and Address Details

In this section, provide your contact and address details:

- Email ID

- Phone number

- Address (residential and office, if applicable)

- Pin code

Important:

- Ensure your email ID and phone number are active, as the Income Tax Department may use these to communicate with you.

- Provide a valid address, as the PAN card will be dispatched to this address.

Step 4: Specify Your Income and Tax Details

If you're an individual applicant, provide information about your income and tax details:

- Income source (salary, business, etc.)

- Total income

- Tax deduction account number (TAN)

If you're a non-individual applicant, provide information about your business or entity:

- Business name

- Type of business

- Date of incorporation

Important:

- Ensure you provide accurate income and tax details to avoid any discrepancies.

- If you're a non-individual applicant, provide the correct business information to avoid delays in processing.

Step 5: Sign and Authenticate the Form

Once you've filled in the form, sign it in the designated areas. Ensure your signature matches the one on your proof of identity documents.

If you're a non-individual applicant, the authorized signatory must sign the form.

Important:

- Ensure you sign the form correctly, as incorrect or missing signatures may lead to rejection.

- If you're a non-individual applicant, ensure the authorized signatory signs the form to avoid delays.

Step 6: Submit the Form and Supporting Documents

After completing the form, submit it along with the required supporting documents to the nearest PAN card facilitation center or online through the NSDL or UTIITSL website.

Ensure you pay the applicable fee, which can be done online or through a demand draft.

Important:

- Ensure you submit the correct documents and fee to avoid rejection or delays.

- Keep a copy of the submitted form and documents for your records.

By following these 6 steps, you can ensure a smooth and successful PAN card application process. Remember to double-check your form and documents to avoid any errors or discrepancies.

If you have any questions or concerns, feel free to ask in the comments below. Share this article with others who may find it helpful.

What is the purpose of a PAN card?

+A PAN card is a unique identifier assigned to individuals and businesses for tax purposes. It helps the Income Tax Department track financial transactions and ensure compliance with tax laws.

Can I apply for a PAN card online?

+Yes, you can apply for a PAN card online through the NSDL or UTIITSL website. You can also submit your application through a nearby PAN card facilitation center.

What documents are required for a PAN card application?

+The required documents may include proof of identity, address, and date of birth. For non-individual applicants, additional documents such as business registration certificates and income tax returns may be required.