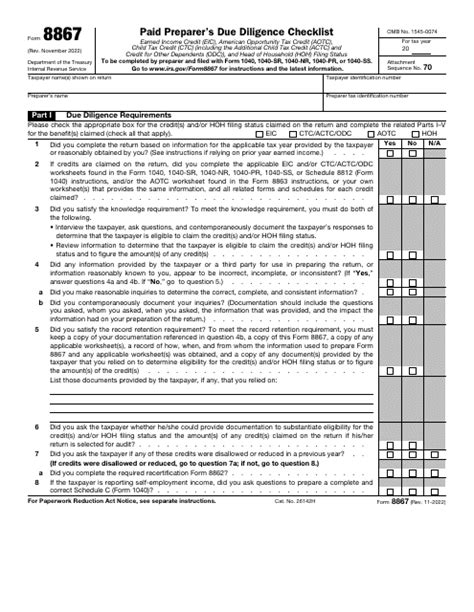

The Form 8867, also known as the "Due Diligence Checklist," is a crucial document used by tax professionals to ensure compliance with the Internal Revenue Service (IRS) requirements for reporting and paying taxes on employment taxes, including payroll taxes and trust fund recovery penalty (TFRP) assessments. In this article, we will delve into the world of Form 8867 due diligence questions, providing a comprehensive guide to help you understand the importance of this document and how to navigate its complexities.

The Importance of Form 8867 Due Diligence Questions

The IRS requires tax professionals to exercise due diligence when preparing employment tax returns, and the Form 8867 is a key tool in this process. The form helps tax professionals verify the accuracy of employment tax returns and identify potential errors or discrepancies. By asking the right due diligence questions, tax professionals can ensure that their clients are in compliance with IRS regulations and avoid potential penalties.

Benefits of Using Form 8867 Due Diligence Questions

Benefits of Using Form 8867 Due Diligence Questions

Using Form 8867 due diligence questions can provide several benefits to tax professionals and their clients. Some of the key benefits include:

- Improved Accuracy: By asking the right due diligence questions, tax professionals can ensure that employment tax returns are accurate and complete, reducing the risk of errors and discrepancies.

- Reduced Penalties: The IRS may impose penalties on employers who fail to comply with employment tax regulations. By using Form 8867 due diligence questions, tax professionals can help their clients avoid these penalties.

- Increased Efficiency: The Form 8867 due diligence questions can help tax professionals streamline their workflow, reducing the time and effort required to prepare employment tax returns.

How to Use Form 8867 Due Diligence Questions

How to Use Form 8867 Due Diligence Questions

To get the most out of Form 8867 due diligence questions, tax professionals should follow these steps:

- Review the Form 8867: Before preparing employment tax returns, review the Form 8867 to ensure that you understand the due diligence questions and requirements.

- Ask the Right Questions: Ask your clients the due diligence questions outlined in the Form 8867 to ensure that you have all the necessary information to prepare accurate employment tax returns.

- Verify the Answers: Verify the answers to the due diligence questions to ensure that they are accurate and complete.

- Document the Answers: Document the answers to the due diligence questions in case of an IRS audit or inquiry.

Form 8867 Due Diligence Questions: A Step-by-Step Guide

Form 8867 Due Diligence Questions: A Step-by-Step Guide

The Form 8867 due diligence questions are divided into several sections, each addressing a specific aspect of employment taxes. Here is a step-by-step guide to help you navigate the due diligence questions:

Section 1: Employment Tax Returns

- What is the employer's name and EIN?

- What is the employer's address and phone number?

- What is the employer's tax year and quarter?

Section 2: Payroll Taxes

- What is the employer's payroll tax liability?

- What is the employer's payroll tax deposit schedule?

- Has the employer made all required payroll tax deposits?

Section 3: Trust Fund Recovery Penalty (TFRP)

- Has the employer been assessed a TFRP?

- What is the amount of the TFRP?

- Has the employer made all required TFRP payments?

Section 4: Employment Tax Credits

- Is the employer eligible for any employment tax credits?

- What is the amount of the employment tax credits?

- Has the employer claimed all eligible employment tax credits?

Best Practices for Using Form 8867 Due Diligence Questions

Best Practices for Using Form 8867 Due Diligence Questions

To get the most out of Form 8867 due diligence questions, follow these best practices:

- Use the Form 8867 due diligence questions as a guide: The Form 8867 due diligence questions are a guide to help you navigate the complexities of employment taxes. Use them to ensure that you are asking the right questions and verifying the answers.

- Document everything: Document all answers to the due diligence questions, including any supporting documentation.

- Stay up-to-date: Stay up-to-date on the latest IRS regulations and guidance on employment taxes.

Conclusion: Mastering Form 8867 Due Diligence Questions

Mastering Form 8867 due diligence questions is essential for tax professionals who want to ensure that their clients are in compliance with IRS regulations. By understanding the importance of Form 8867 due diligence questions and following the best practices outlined in this article, tax professionals can streamline their workflow, reduce the risk of errors and penalties, and provide better service to their clients.

What's Next?

We hope this article has provided you with a comprehensive guide to Form 8867 due diligence questions. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with your colleagues and clients to help them understand the importance of Form 8867 due diligence questions.

FAQ Section

What is Form 8867?

+Form 8867 is a due diligence checklist used by tax professionals to ensure compliance with IRS requirements for reporting and paying employment taxes.

Why is it important to use Form 8867 due diligence questions?

+Using Form 8867 due diligence questions can help tax professionals ensure that employment tax returns are accurate and complete, reducing the risk of errors and penalties.

How do I use Form 8867 due diligence questions?

+Review the Form 8867, ask your clients the due diligence questions, verify the answers, and document everything.