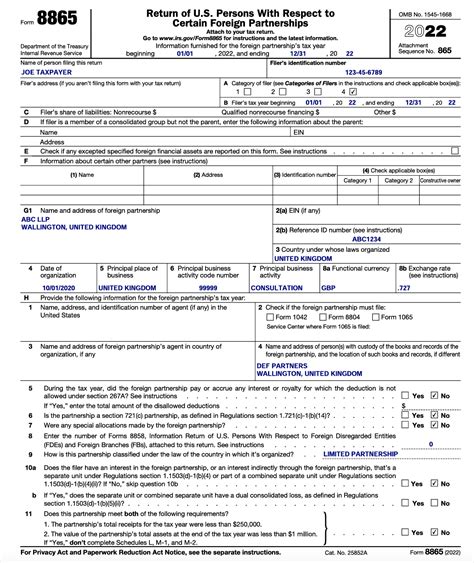

Filing Form 8865, also known as the Return of U.S. Persons With Respect to Certain Foreign Partnerships, is a crucial step for U.S. taxpayers who are involved with foreign partnerships. One of the key components of this form is Schedule P, which requires filers to report certain information related to the foreign partnership. In this article, we will provide five essential tips for filing Form 8865 Schedule P to ensure accuracy and compliance with the IRS regulations.

Understanding the Purpose of Schedule P

Before we dive into the tips, it's essential to understand the purpose of Schedule P. This schedule is used to report information about the foreign partnership's income, deductions, and credits that are allocated to U.S. partners. The information reported on Schedule P is used to calculate the U.S. partner's share of income, deductions, and credits from the foreign partnership.

Tip 1: Gather All Required Information

To accurately complete Schedule P, you will need to gather all required information about the foreign partnership. This includes:

- The partnership's name, address, and employer identification number (EIN)

- The country where the partnership is located

- The partnership's fiscal year-end date

- The partnership's income, deductions, and credits

- The U.S. partner's share of income, deductions, and credits

Make sure to obtain this information from the foreign partnership's financial statements, tax returns, or other relevant documents.

Tip 2: Determine the Reporting Category

Schedule P requires filers to determine the reporting category for the foreign partnership. The reporting category depends on the type of partnership and the U.S. partner's interest in the partnership. The three reporting categories are:

- Category 1: Partnerships that are not required to file Form 1065, U.S. Return of Partnership Income

- Category 2: Partnerships that are required to file Form 1065, but the U.S. partner's interest is less than 10%

- Category 3: Partnerships that are required to file Form 1065, and the U.S. partner's interest is 10% or more

Determine the correct reporting category based on the foreign partnership's type and the U.S. partner's interest.

Completing Schedule P

Once you have gathered all required information and determined the reporting category, you can begin completing Schedule P.

Tip 3: Report Income, Deductions, and Credits

On Schedule P, you will need to report the foreign partnership's income, deductions, and credits allocated to the U.S. partner. This includes:

- Ordinary business income

- Interest income

- Dividend income

- Capital gains and losses

- Deductions and credits

Use the foreign partnership's financial statements and tax returns to accurately report this information.

Tip 4: Calculate the U.S. Partner's Share

To calculate the U.S. partner's share of income, deductions, and credits, you will need to multiply the partnership's income, deductions, and credits by the U.S. partner's percentage of ownership. This will give you the U.S. partner's share of income, deductions, and credits.

Tip 5: Attach Supporting Documentation

When filing Form 8865, you will need to attach supporting documentation to Schedule P. This includes:

- A copy of the foreign partnership's financial statements

- A copy of the foreign partnership's tax return

- A statement explaining the calculation of the U.S. partner's share of income, deductions, and credits

Make sure to attach all required supporting documentation to ensure accuracy and compliance with IRS regulations.

Additional Tips and Considerations

- Make sure to file Form 8865 and Schedule P on time to avoid penalties and interest.

- Use Form 8865 instructions and Schedule P instructions to ensure accurate completion of the forms.

- Consult with a tax professional if you have any questions or concerns about filing Form 8865 and Schedule P.

By following these five tips, you can ensure accurate and compliant filing of Form 8865 Schedule P. Remember to gather all required information, determine the reporting category, report income, deductions, and credits, calculate the U.S. partner's share, and attach supporting documentation. Additionally, make sure to file on time and consult with a tax professional if needed.

We hope this article has provided valuable insights and tips for filing Form 8865 Schedule P. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of Schedule P?

+Schedule P is used to report information about the foreign partnership's income, deductions, and credits that are allocated to U.S. partners.

What is the reporting category for Schedule P?

+The reporting category depends on the type of partnership and the U.S. partner's interest in the partnership. The three reporting categories are Category 1, Category 2, and Category 3.

What is the deadline for filing Form 8865 and Schedule P?

+The deadline for filing Form 8865 and Schedule P is April 15th of each year, unless an automatic 6-month extension is filed.