The world of tax filing can be overwhelming, especially when dealing with complex forms and regulations. One such form that often raises questions is the Turbotax Form 8606, which is used to report nondeductible IRAs. In this article, we will break down the ins and outs of this form, making it easier for you to understand and navigate.

What is Form 8606?

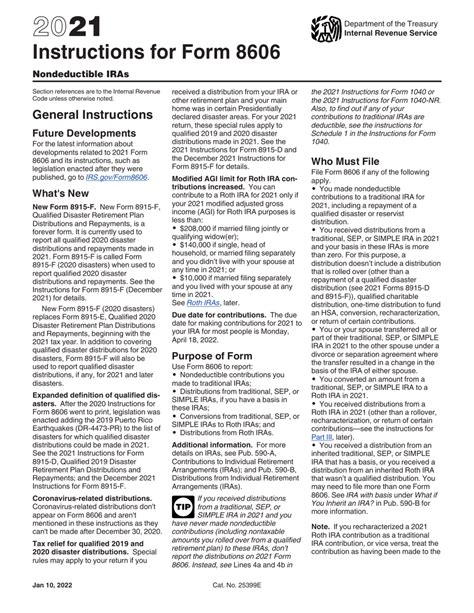

Form 8606, also known as the Individual Retirement Account (IRA) Information Form, is a tax form used by the Internal Revenue Service (IRS) to report transactions related to Individual Retirement Accounts (IRAs) and Coverdell Education Savings Accounts (ESAs). This form is typically filed by individuals who have made nondeductible contributions to their IRAs or have received distributions from these accounts.

Why is Form 8606 Important?

Filing Form 8606 is crucial for several reasons:

- Accurate Reporting: The form ensures that you accurately report your IRA transactions, which helps the IRS track your account activity and verify your tax liability.

- Tax Benefits: By reporting your nondeductible contributions, you may be eligible for tax benefits when you withdraw funds from your IRA in retirement.

- Avoiding Penalties: Failure to file Form 8606 can result in penalties and fines. By filing the form correctly, you can avoid these consequences.

How to Fill Out Form 8606

Filling out Form 8606 can be a daunting task, but breaking it down into sections makes it more manageable. Here's a step-by-step guide to help you fill out the form:

Section 1: IRA Information

In this section, you'll need to provide information about your IRA, including:

- Account Number: Enter your IRA account number.

- Account Type: Specify the type of IRA you have (e.g., traditional, Roth, or SEP-IRA).

Section 2: Contributions

Here, you'll report your nondeductible contributions to your IRA. You'll need to:

- Enter the Amount: Report the total amount of nondeductible contributions you made to your IRA during the tax year.

- Specify the Contribution Type: Indicate whether the contributions were made to a traditional or Roth IRA.

Section 3: Distributions

In this section, you'll report any distributions you received from your IRA. You'll need to:

- Enter the Distribution Amount: Report the total amount of distributions you received from your IRA during the tax year.

- Specify the Distribution Type: Indicate whether the distributions were made from a traditional or Roth IRA.

Tips for Filing Form 8606

To ensure a smooth filing process, keep the following tips in mind:

- Gather Required Documents: Make sure you have all necessary documents, including your IRA statements and contribution records.

- Use Turbotax or Consult a Tax Professional: Consider using tax software like Turbotax or consulting a tax professional to ensure accuracy and avoid errors.

- File on Time: Submit your form by the tax filing deadline to avoid penalties and fines.

Common Mistakes to Avoid

When filing Form 8606, be aware of the following common mistakes:

- Inaccurate Reporting: Double-check your calculations and ensure you're reporting accurate information.

- Missing Information: Make sure you complete all required sections and provide necessary documentation.

- Late Filing: Submit your form on time to avoid penalties and fines.

Conclusion

Filing Form 8606 may seem daunting, but by breaking it down into sections and following the tips outlined above, you can ensure an accurate and stress-free filing process.