The Utah Corporate Tax Return, also known as Form TC-40, is a required tax document that must be filed by corporations operating in the state of Utah. The Utah State Tax Commission mandates that all corporations, including those classified as S corporations, file this return annually. In this comprehensive guide, we will walk you through the process of filing Form TC-40, highlighting key aspects, benefits, and essential steps to ensure compliance with Utah's tax regulations.

Understanding the Utah Corporate Tax Return (Form TC-40)

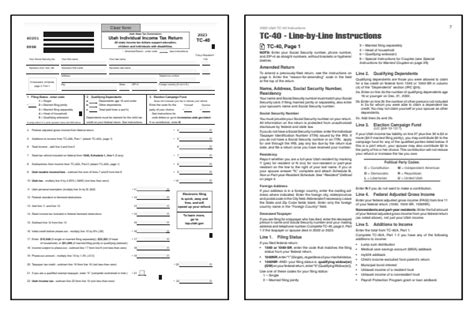

The Utah Corporate Tax Return, Form TC-40, is used to report a corporation's income, deductions, and tax liability for the tax year. The form consists of multiple sections, schedules, and supporting documentation, which must be accurately completed and submitted to the Utah State Tax Commission.

Who Must File Form TC-40?

The following entities are required to file Form TC-40:

- C corporations

- S corporations

- Limited liability companies (LLCs) that elect to be taxed as corporations

- Other business entities that are classified as corporations for federal tax purposes

Filing Requirements and Deadlines

To ensure compliance with Utah's tax regulations, corporations must file Form TC-40 annually. The filing deadline for Form TC-40 is typically the 15th day of the fourth month following the end of the corporation's tax year. For example, if a corporation's tax year ends on December 31, the Form TC-40 filing deadline would be April 15.

Extensions and Late Filing Penalties

If a corporation is unable to meet the filing deadline, it may request an automatic six-month extension by filing Form TC-737, Utah Application for Automatic Extension of Time to File a Corporation Tax Return. However, an extension does not waive the late payment penalty or interest on any tax due.

Form TC-40 Components and Supporting Documentation

The Utah Corporate Tax Return, Form TC-40, consists of multiple sections and schedules, which require the following information:

- Corporation identification and contact information

- Income and deductions

- Tax computation and payment

- Supporting schedules and documentation, including:

- Schedule K-1 (Utah Shareholder's or Partner's Share of Income, Deductions, Credits, etc.)

- Schedule C (Utah Corporation Business Income and Deductions)

- Schedule D (Utah Corporation Capital Gains and Losses)

- Form 1099-MISC (Miscellaneous Income)

Electronic Filing and Payment Options

The Utah State Tax Commission offers electronic filing and payment options for Form TC-40, including:

- E-file through the Tax Commission's website

- Pay taxes online using a credit card or e-check

- File and pay through a tax professional or software provider

Penalties and Interest for Non-Compliance

Failure to file Form TC-40 or pay the required tax may result in penalties and interest, including:

- Late filing penalty: 5% of the tax due for each month or part of a month, up to 25%

- Late payment penalty: 1% of the tax due for each month or part of a month, up to 25%

- Interest on unpaid tax: calculated at the rate of 6% per annum

Audit and Compliance Procedures

The Utah State Tax Commission may audit a corporation's tax return to ensure compliance with state tax laws. If a corporation is selected for audit, it will receive a notification letter with instructions on how to proceed.

Conclusion and Next Steps

Filing the Utah Corporate Tax Return, Form TC-40, is a critical step in maintaining compliance with state tax regulations. By understanding the filing requirements, deadlines, and components of the form, corporations can ensure accurate and timely submission of their tax returns. If you have questions or concerns about Form TC-40, consult the Utah State Tax Commission's website or contact a tax professional for guidance.

We encourage you to share your experiences and insights about filing Form TC-40 in the comments below. Your feedback will help us improve this guide and provide better support for Utah corporations.

What is the filing deadline for Form TC-40?

+The filing deadline for Form TC-40 is typically the 15th day of the fourth month following the end of the corporation's tax year.

Can I file Form TC-40 electronically?

+Yes, the Utah State Tax Commission offers electronic filing and payment options for Form TC-40.

What are the penalties for non-compliance with Form TC-40?

+Failure to file Form TC-40 or pay the required tax may result in penalties and interest, including late filing and payment penalties, and interest on unpaid tax.