The IRS Form 8885 is a crucial document for individuals who want to claim the Saver's Credit, a tax credit designed to encourage low- and moderate-income workers to save for retirement. The Saver's Credit can provide a significant boost to your retirement savings, and in this article, we will guide you through the process of claiming it using IRS Form 8885.

Understanding the Saver's Credit

The Saver's Credit is a non-refundable tax credit that is designed to encourage eligible individuals to contribute to a retirement plan, such as a 401(k) or an IRA. The credit is calculated based on the amount contributed to the retirement plan, and it can be worth up to $2,000 for individuals and $4,000 for couples.

Eligibility Requirements for the Saver's Credit

To be eligible for the Saver's Credit, you must meet certain requirements. These include:

- You must be 18 years or older by the end of the tax year.

- You must not be a full-time student.

- You must not be claimed as a dependent on someone else's tax return.

- Your income must be below a certain threshold, which varies based on your filing status.

- You must have contributed to a retirement plan, such as a 401(k) or an IRA.

Income Limits for the Saver's Credit

The income limits for the Saver's Credit vary based on your filing status. For the 2022 tax year, the income limits are as follows:

- Single filers: $32,500 or less

- Head of household: $48,750 or less

- Joint filers: $65,000 or less

How to Claim the Saver's Credit

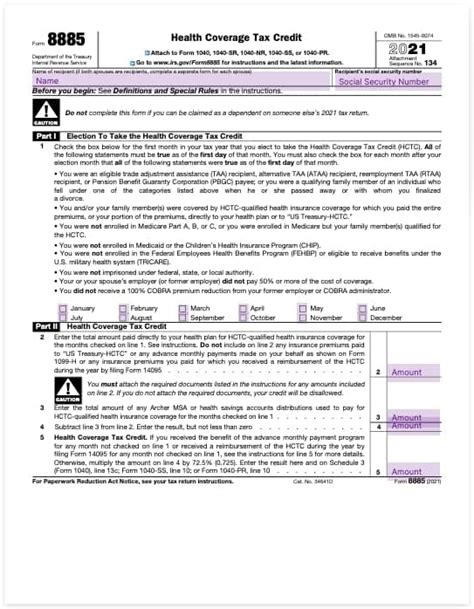

To claim the Saver's Credit, you will need to file IRS Form 8885. This form is used to calculate the credit and report it on your tax return. Here's a step-by-step guide to claiming the Saver's Credit:

- Determine your eligibility: Make sure you meet the eligibility requirements for the Saver's Credit.

- Gather your documents: Collect your retirement plan contribution records and your tax return documents.

- Complete Form 8885: Fill out IRS Form 8885, which can be found on the IRS website or through tax software.

- Calculate the credit: Use the form to calculate the Saver's Credit based on your retirement plan contributions and income.

- Report the credit: Report the Saver's Credit on your tax return, Form 1040.

Calculating the Saver's Credit

The Saver's Credit is calculated based on the amount contributed to a retirement plan and your income. The credit is worth up to 50% of your retirement plan contributions, up to a maximum of $2,000 for individuals and $4,000 for couples.

Saver's Credit Rates

The Saver's Credit rates vary based on your income and filing status. For the 2022 tax year, the rates are as follows:

- 50% of retirement plan contributions for single filers with incomes below $19,500 and joint filers with incomes below $39,000

- 20% of retirement plan contributions for single filers with incomes between $19,501 and $32,500 and joint filers with incomes between $39,001 and $65,000

- 10% of retirement plan contributions for single filers with incomes between $32,501 and $32,500 and joint filers with incomes between $65,001 and $65,000

Frequently Asked Questions about the Saver's Credit

Here are some frequently asked questions about the Saver's Credit:

Q: What is the Saver's Credit?

A: The Saver's Credit is a non-refundable tax credit designed to encourage low- and moderate-income workers to save for retirement.

Q: Who is eligible for the Saver's Credit?

A: To be eligible for the Saver's Credit, you must be 18 years or older, not a full-time student, not claimed as a dependent on someone else's tax return, and have an income below a certain threshold.

Q: How do I claim the Saver's Credit?

A: To claim the Saver's Credit, you will need to file IRS Form 8885 and report the credit on your tax return, Form 1040.

Q: What is the maximum amount of the Saver's Credit?

A: The maximum amount of the Saver's Credit is $2,000 for individuals and $4,000 for couples.

Conclusion and Next Steps

Claiming the Saver's Credit can provide a significant boost to your retirement savings. By following the steps outlined in this article and using IRS Form 8885, you can take advantage of this valuable tax credit. Don't forget to share this article with friends and family who may be eligible for the Saver's Credit, and leave a comment below if you have any questions or need further guidance.

What is the deadline for claiming the Saver's Credit?

+The deadline for claiming the Saver's Credit is typically April 15th of each year, which is the deadline for filing your tax return.

Can I claim the Saver's Credit if I contribute to a Roth IRA?

+No, you cannot claim the Saver's Credit if you contribute to a Roth IRA. The Saver's Credit is only available for contributions to traditional IRAs and employer-sponsored retirement plans, such as 401(k) plans.

Can I claim the Saver's Credit if I am self-employed?

+Yes, you can claim the Saver's Credit if you are self-employed. However, you must have net earnings from self-employment of at least $400 to be eligible.