The world of Individual Retirement Accounts (IRAs) can be complex, especially when it comes to calculating the total basis. The IRS Form 8606 is a crucial document for reporting non-deductible contributions to IRAs, and understanding how to calculate the total basis is essential for accurate reporting. In this article, we'll delve into the world of Form 8606 and provide you with 5 tips to calculate the total basis in IRAs.

Understanding Form 8606

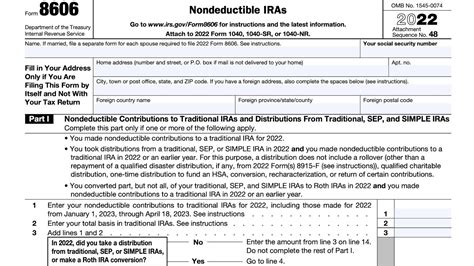

Before we dive into the tips, let's quickly understand what Form 8606 is all about. Form 8606 is used to report non-deductible contributions to traditional IRAs, as well as conversions from traditional IRAs to Roth IRAs. The form helps the IRS track the basis of your IRA, which is essential for determining the taxable amount of distributions.

Tip 1: Gather All Relevant Documents

To calculate the total basis, you'll need to gather all relevant documents, including:

- Form 8606 from previous years

- IRA contribution statements

- IRA conversion statements

- IRA distribution statements

These documents will help you track your non-deductible contributions, conversions, and distributions, which are essential for calculating the total basis.

Tip 2: Determine Your Non-Deductible Contributions

Non-deductible contributions are contributions made to a traditional IRA that are not deductible on your tax return. To determine your non-deductible contributions, you'll need to review your IRA contribution statements and identify the contributions that were not deducted on your tax return.

For example, let's say you contributed $5,000 to a traditional IRA in 2020, and only $3,000 was deductible on your tax return. The remaining $2,000 would be considered a non-deductible contribution.

Tip 3: Calculate Your Conversions

Conversions occur when you convert a traditional IRA to a Roth IRA. To calculate your conversions, you'll need to review your IRA conversion statements and identify the amount converted.

For example, let's say you converted $10,000 from a traditional IRA to a Roth IRA in 2020. This amount would be reported on Form 8606 as a conversion.

Tip 4: Calculate Your Distributions

Distributions occur when you withdraw money from an IRA. To calculate your distributions, you'll need to review your IRA distribution statements and identify the amount distributed.

For example, let's say you withdrew $5,000 from a traditional IRA in 2020. This amount would be reported on Form 8606 as a distribution.

Tip 5: Calculate the Total Basis

Now that you have all the necessary information, you can calculate the total basis. The total basis is the sum of your non-deductible contributions, conversions, and distributions.

Here's an example:

- Non-deductible contributions: $2,000

- Conversions: $10,000

- Distributions: $5,000

Total basis: $17,000

The total basis is reported on Form 8606 and is used to determine the taxable amount of distributions.

Common Mistakes to Avoid

When calculating the total basis, there are several common mistakes to avoid:

- Forgetting to include non-deductible contributions

- Failing to report conversions

- Not accounting for distributions

- Miscalculating the total basis

By avoiding these common mistakes, you can ensure accurate reporting on Form 8606.

Conclusion

Calculating the total basis on Form 8606 can be complex, but by following these 5 tips, you can ensure accurate reporting. Remember to gather all relevant documents, determine your non-deductible contributions, calculate your conversions, calculate your distributions, and calculate the total basis. By avoiding common mistakes, you can ensure a smooth and accurate reporting process.

We hope this article has provided you with valuable insights into calculating the total basis on Form 8606. If you have any questions or comments, please feel free to share them below.

What is Form 8606?

+Form 8606 is a tax form used to report non-deductible contributions to traditional IRAs, as well as conversions from traditional IRAs to Roth IRAs.

What is the total basis?

+The total basis is the sum of non-deductible contributions, conversions, and distributions.

Why is it important to calculate the total basis?

+Calculating the total basis is essential for determining the taxable amount of distributions.