Completing tax forms can be a daunting task, especially for those who are new to filing taxes or have complex financial situations. Idaho Form 42, also known as the Idaho Individual Income Tax Return, is a crucial document for Idaho residents to report their income and claim tax credits. In this article, we will provide you with five ways to complete Idaho Form 42 easily, ensuring that you take advantage of all the tax benefits you're eligible for.

Idaho Form 42 is used by residents to report their state income tax, which is a vital part of the state's revenue. The form requires you to report your federal adjusted gross income, as well as any income earned from Idaho sources. You'll also need to claim any tax credits you're eligible for, such as the Idaho Child Tax Credit or the Idaho Education Tax Credit. With the right guidance, completing Idaho Form 42 can be a straightforward process.

One of the most significant challenges when completing Idaho Form 42 is ensuring that you have all the necessary documentation. This includes your W-2 forms, 1099 forms, and any other relevant tax documents. Having these documents readily available will save you time and reduce the likelihood of errors.

Understanding Idaho Form 42

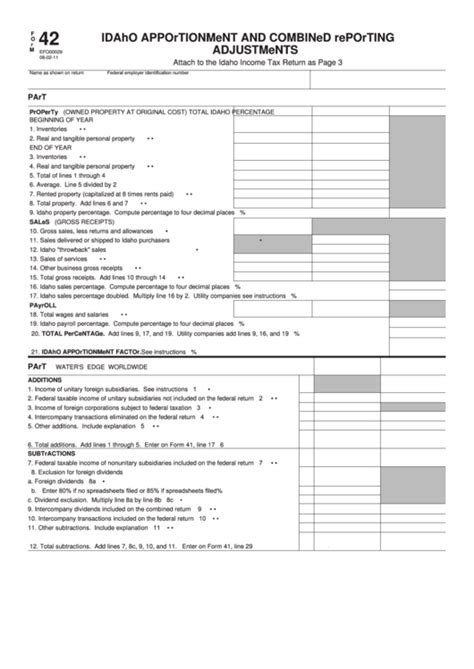

Before we dive into the five ways to complete Idaho Form 42 easily, let's take a closer look at the form itself. Idaho Form 42 is divided into several sections, each requiring specific information. The form includes:

- Identification information, such as your name, address, and Social Security number

- Income information, including your federal adjusted gross income and any income earned from Idaho sources

- Tax credits, such as the Idaho Child Tax Credit or the Idaho Education Tax Credit

- Tax deductions, including the standard deduction or itemized deductions

Section 1: Identification Information

The first section of Idaho Form 42 requires you to provide identification information, including your name, address, and Social Security number. This section is straightforward, but it's essential to ensure that your information is accurate and up-to-date.

Section 2: Income Information

The second section of Idaho Form 42 requires you to report your income, including your federal adjusted gross income and any income earned from Idaho sources. You'll need to have your W-2 forms and 1099 forms readily available to complete this section accurately.

Section 3: Tax Credits

The third section of Idaho Form 42 allows you to claim tax credits, such as the Idaho Child Tax Credit or the Idaho Education Tax Credit. These credits can significantly reduce your tax liability, so it's essential to ensure that you're eligible and claim them correctly.

5 Ways to Complete Idaho Form 42 Easily

Now that we've covered the basics of Idaho Form 42, let's dive into the five ways to complete it easily:

1. Use Tax Preparation Software

One of the easiest ways to complete Idaho Form 42 is to use tax preparation software, such as TurboTax or H&R Block. These programs guide you through the tax preparation process, ensuring that you're taking advantage of all the tax credits and deductions you're eligible for. They also reduce the likelihood of errors, which can save you time and stress.

2. Hire a Tax Professional

If you're not comfortable using tax preparation software or have complex financial situations, hiring a tax professional may be the best option. Tax professionals have the expertise and knowledge to ensure that you're taking advantage of all the tax credits and deductions you're eligible for. They can also help you navigate any complex tax issues that may arise.

3. Use the Idaho State Tax Commission Website

The Idaho State Tax Commission website provides a wealth of information and resources to help you complete Idaho Form 42. You can access the form, instructions, and frequently asked questions, as well as contact the commission directly for assistance.

4. Take Advantage of Tax Credits

Idaho offers several tax credits that can significantly reduce your tax liability. The Idaho Child Tax Credit and the Idaho Education Tax Credit are two examples of credits that you may be eligible for. Make sure you understand the eligibility requirements and claim these credits correctly to maximize your tax savings.

5. Review and Double-Check Your Return

Finally, it's essential to review and double-check your return before submitting it. Ensure that you've completed all the necessary sections, and that your math is accurate. This will reduce the likelihood of errors, which can save you time and stress.

Conclusion

Completing Idaho Form 42 can seem daunting, but with the right guidance, it can be a straightforward process. By using tax preparation software, hiring a tax professional, using the Idaho State Tax Commission website, taking advantage of tax credits, and reviewing and double-checking your return, you can ensure that you're taking advantage of all the tax benefits you're eligible for. Don't hesitate to reach out to a tax professional or the Idaho State Tax Commission if you have any questions or concerns.

We hope this article has provided you with valuable insights and tips to complete Idaho Form 42 easily. If you have any questions or comments, please feel free to share them below.

What is Idaho Form 42?

+Idaho Form 42 is the Idaho Individual Income Tax Return, which is used by residents to report their state income tax.

How do I complete Idaho Form 42?

+You can complete Idaho Form 42 by using tax preparation software, hiring a tax professional, using the Idaho State Tax Commission website, taking advantage of tax credits, and reviewing and double-checking your return.

What tax credits am I eligible for in Idaho?

+You may be eligible for tax credits such as the Idaho Child Tax Credit or the Idaho Education Tax Credit. Consult the Idaho State Tax Commission website or a tax professional to determine your eligibility.