PNC Bank Direct Deposit Authorization Form: A Comprehensive Guide

As a PNC Bank customer, setting up direct deposit can save you time and hassle when it comes to receiving your paychecks, tax refunds, or other regular deposits. To initiate direct deposit, you'll need to complete a direct deposit authorization form. In this article, we'll guide you through the process, explain the benefits, and provide a step-by-step tutorial on filling out the form.

What is a Direct Deposit Authorization Form?

A direct deposit authorization form is a document that allows you to grant permission to PNC Bank to receive direct deposits on your behalf. The form typically requires your personal and account information, as well as the details of the depositor (e.g., your employer or the government).

Benefits of Direct Deposit

Direct deposit offers several advantages over traditional payment methods:

- Convenience: Direct deposit eliminates the need to physically visit a bank branch or ATM to deposit your paycheck or other funds.

- Speed: Deposits are typically made available in your account on the same day they are received by the bank.

- Security: Direct deposit reduces the risk of lost or stolen checks.

- Flexibility: You can have your deposits directed to multiple accounts, such as a checking and savings account.

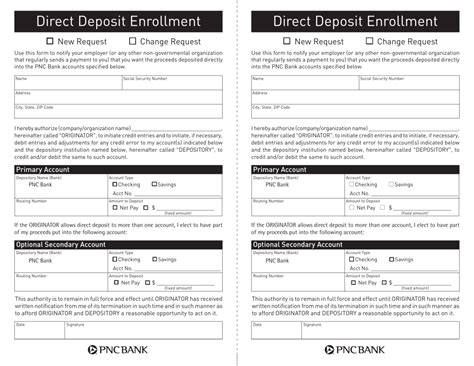

How to Fill Out the PNC Bank Direct Deposit Authorization Form

To complete the direct deposit authorization form, follow these steps:

- Download and print the form: You can obtain the form from the PNC Bank website or by visiting a local branch. Make sure to print the form in its entirety, as it may have multiple pages.

- Gather required information: You'll need to provide your personal and account information, including:

- Your name and address

- Your PNC Bank account number and type (e.g., checking or savings)

- Your employer's name and address (if applicable)

- The depositor's name and address (if different from your employer)

- Fill out the form: Complete the form by filling in the required information. Make sure to sign and date the form.

- Submit the form: Return the completed form to PNC Bank by mail, fax, or in person. You may also be able to submit the form online, depending on the specific requirements of your employer or the depositor.

Common Mistakes to Avoid When Filling Out the Form

When completing the direct deposit authorization form, be aware of the following common mistakes:

- Inaccurate account information: Double-check your account number and type to ensure accurate deposits.

- Missing or incomplete information: Make sure to provide all required information, including signatures and dates.

- Incorrect depositor information: Verify the depositor's name and address to avoid delays or rejected deposits.

Troubleshooting Common Issues with Direct Deposit

If you encounter issues with direct deposit, such as delayed or rejected deposits, contact PNC Bank's customer service for assistance. They can help you troubleshoot the problem and provide guidance on resolving the issue.

Additional Tips for Managing Your Direct Deposit

To get the most out of direct deposit, consider the following tips:

- Monitor your account activity: Regularly review your account statements to ensure accurate deposits.

- Update your account information: Notify PNC Bank of any changes to your account or personal information.

- Take advantage of mobile banking: Use PNC Bank's mobile app to track your deposits and account activity on the go.

By following these guidelines and avoiding common mistakes, you can successfully set up direct deposit with PNC Bank and enjoy the convenience and benefits it provides.

What is the deadline for submitting the direct deposit authorization form?

+The deadline for submitting the form varies depending on the depositor's requirements. It's best to check with your employer or the depositor for specific deadlines.

Can I cancel or change my direct deposit authorization?

+Is direct deposit secure?

+We hope this comprehensive guide has helped you understand the process of setting up direct deposit with PNC Bank. If you have any further questions or concerns, feel free to comment below or contact PNC Bank's customer service for assistance.