Noncash charitable donations can be a significant way to support your favorite causes while also reducing your tax liability. However, to claim these deductions on your tax return, you must complete Form 8283, Noncash Charitable Contributions. The Internal Revenue Service (IRS) requires this form to ensure that donations are accurately reported and valued. In this article, we will guide you through the essential steps to complete Form 8283 correctly.

Completing Form 8283 accurately is crucial to avoid any potential issues with the IRS. Incomplete or incorrect forms can lead to delays in processing your tax return or even result in denied deductions. By following these steps, you can ensure that your noncash charitable contributions are properly documented and eligible for the deductions you deserve.

Donating to charity is a noble act, and receiving a tax deduction for your generosity is a welcome bonus. However, navigating the complexities of tax forms can be daunting. Form 8283 is a critical component of claiming noncash charitable deductions, and understanding how to complete it correctly is essential.

Step 1: Gather Required Documents and Information

Before starting to complete Form 8283, gather all necessary documents and information. This includes:

- Receipts from the charitable organization for each donation

- Appraisals for donations exceeding $5,000 (except for publicly traded securities)

- Records of the fair market value of the donated items

- Your name, address, and Social Security number or Employer Identification Number (EIN)

Understanding Fair Market Value

Fair market value is the price that a willing buyer would pay for the donated item in its current condition. This value is critical in determining the amount of your deduction. For donations of property other than cash, you must determine the fair market value on the date of the contribution.

Step 2: Determine the Type of Property Donated

Form 8283 requires you to identify the type of property donated. The IRS categorizes noncash charitable contributions into several types, including:

- Publicly traded securities (stocks, bonds, etc.)

- Real estate

- Tangible personal property (artwork, furniture, etc.)

- Other types of property (vehicles, intellectual property, etc.)

Identify the type of property donated and complete the corresponding section of Form 8283.

Publicly Traded Securities

For donations of publicly traded securities, you will need to report the name of the security, the number of shares donated, and the date of the donation. You can use the average of the high and low trading prices on the date of the donation to determine the fair market value.

Step 3: Complete Section A – Publicly Traded Securities

If you donated publicly traded securities, complete Section A of Form 8283. This section requires the following information:

- Name of the security

- Number of shares donated

- Date of the donation

- Fair market value of the donated securities

Use the instructions provided in the form to calculate the total value of the donated securities.

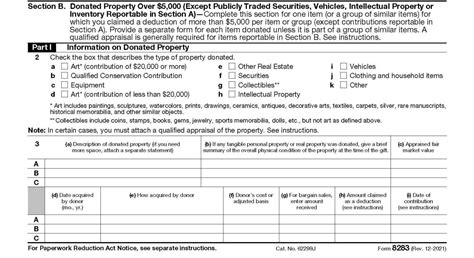

Step 4: Complete Section B – Other Types of Property

For donations of property other than publicly traded securities, complete Section B of Form 8283. This section requires the following information:

- Description of the donated property

- Fair market value of the donated property

- Date of the donation

Use the instructions provided in the form to calculate the total value of the donated property.

Appraisals and Section B

For donations exceeding $5,000 (except for publicly traded securities), you must obtain an appraisal from a qualified appraiser. Attach the appraisal to Form 8283 and complete Section B accordingly.

Step 5: Calculate the Total Value of Donations

Calculate the total value of your noncash charitable donations by adding the values reported in Sections A and B. This total value will be reported on your tax return as a charitable deduction.

Step 6: Complete Form 8283 and Attach Supporting Documents

Complete Form 8283 according to the instructions provided, ensuring that all required information is included. Attach supporting documents, such as receipts, appraisals, and records of fair market value, to the form.

Step 7: File Form 8283 with Your Tax Return

File Form 8283 with your tax return (Form 1040) to claim your noncash charitable deductions. Ensure that you keep a copy of the completed form and supporting documents for your records.

By following these essential steps, you can ensure that your noncash charitable contributions are properly documented and eligible for the deductions you deserve. Remember to gather required documents, determine the type of property donated, and complete Form 8283 accurately to avoid any potential issues with the IRS.

What is Form 8283, and why is it required?

+Form 8283 is required by the IRS to report noncash charitable contributions. It ensures that donations are accurately reported and valued, and it helps prevent overstated or false deductions.

What types of property can be donated and reported on Form 8283?

+Form 8283 reports various types of noncash charitable contributions, including publicly traded securities, real estate, tangible personal property, and other types of property.

Do I need an appraisal for all noncash charitable donations?

+No, an appraisal is not required for all noncash charitable donations. However, for donations exceeding $5,000 (except for publicly traded securities), an appraisal from a qualified appraiser is necessary.