The state of Kentucky requires its residents to file a state income tax return, known as Form 740, if they have earned income from various sources. This comprehensive guide will walk you through the process of filing Kentucky Form 740, highlighting the benefits, working mechanisms, and steps involved.

Understanding Kentucky Form 740

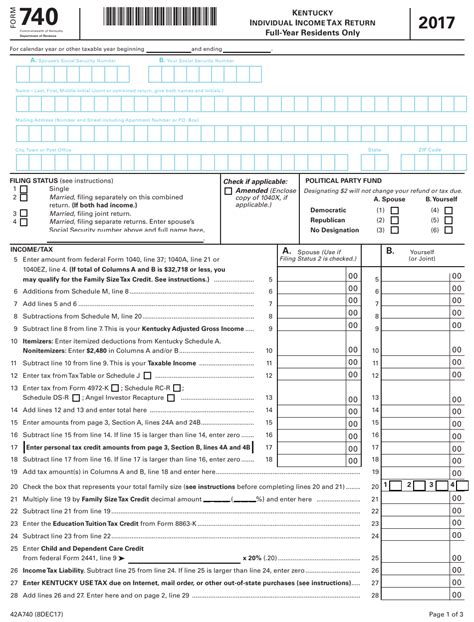

Kentucky Form 740 is the official state income tax return form for residents and non-residents who have earned income from sources within the state. The form is used to report and calculate state income tax liability. The Kentucky Department of Revenue (DOR) provides this form and instructions for filing.

Who Needs to File Kentucky Form 740?

Residents and non-residents with income from Kentucky sources must file Form 740 if their gross income meets or exceeds the minimum filing requirements. These requirements vary depending on the taxpayer's filing status, age, and type of income.

- Residents: If you are a Kentucky resident, you must file Form 740 if your gross income is $12,500 or more, regardless of your age.

- Non-residents: If you are a non-resident with Kentucky-sourced income, you must file Form 740 if your gross income from Kentucky sources is $5,000 or more.

Benefits of Filing Kentucky Form 740

Filing Kentucky Form 740 provides several benefits to taxpayers, including:

- Claiming tax credits and deductions: By filing Form 740, you can claim tax credits and deductions that reduce your state income tax liability.

- Reporting income: Filing Form 740 allows you to report your income from various sources, ensuring compliance with state tax laws.

- Avoiding penalties: Failing to file Form 740 can result in penalties and interest. By filing on time, you avoid these additional costs.

Working Mechanisms of Kentucky Form 740

Kentucky Form 740 is designed to calculate your state income tax liability based on your reported income and deductions. Here's a step-by-step guide to understanding the working mechanisms of Form 740:

- Gross income: Report your total gross income from all sources, including wages, salaries, tips, and self-employment income.

- Deductions and exemptions: Claim deductions and exemptions to reduce your taxable income. These may include standard deductions, itemized deductions, and personal exemptions.

- Tax credits: Claim tax credits, such as the earned income tax credit (EITC) or the Kentucky Education Savings Plan (KESP) credit, to reduce your tax liability.

- Tax calculation: The Kentucky DOR will calculate your state income tax liability based on your reported income, deductions, and credits.

Filing Requirements and Deadlines

Kentucky Form 740 must be filed by April 15th of each year, unless you have an approved extension. Here are the filing requirements and deadlines:

- Filing status: You can file Form 740 as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Filing deadline: The filing deadline is April 15th of each year. If you need an extension, you can file Form 740-EXT by April 15th to extend the deadline to October 15th.

- Payment deadline: If you owe state income tax, you must pay by April 15th to avoid penalties and interest.

Steps to File Kentucky Form 740

Filing Kentucky Form 740 involves several steps:

- Gather necessary documents: Collect your W-2 forms, 1099 forms, and other supporting documentation.

- Complete Form 740: Fill out Form 740, following the instructions provided by the Kentucky DOR.

- Calculate your tax liability: Use the tax tables or tax calculator to determine your state income tax liability.

- Submit your return: File your return electronically or by mail, along with any required supporting documentation.

- Pay any tax due: If you owe state income tax, pay by the deadline to avoid penalties and interest.

Additional Resources

The Kentucky DOR provides several resources to help you file Kentucky Form 740:

- Kentucky Taxpayer Service Center: The Taxpayer Service Center offers assistance with filing, payment, and other tax-related questions.

- Kentucky Tax Forms: The Kentucky DOR website provides access to Form 740 and other tax forms, instructions, and publications.

- Kentucky Tax Calculator: The Kentucky Tax Calculator helps you estimate your state income tax liability.

Common Mistakes to Avoid

When filing Kentucky Form 740, avoid these common mistakes:

- Incorrect filing status: Ensure you file with the correct filing status, as this affects your tax liability.

- Missing documentation: Provide all required supporting documentation, such as W-2 forms and 1099 forms.

- Incorrect tax calculations: Double-check your tax calculations to avoid errors.

Conclusion and Next Steps

Filing Kentucky Form 740 is a straightforward process that requires attention to detail and adherence to deadlines. By following this guide, you'll be well on your way to accurately filing your state income tax return. If you have questions or need assistance, don't hesitate to reach out to the Kentucky DOR or a tax professional.

What is the deadline for filing Kentucky Form 740?

+The deadline for filing Kentucky Form 740 is April 15th of each year, unless you have an approved extension.

What is the minimum filing requirement for Kentucky Form 740?

+The minimum filing requirement for Kentucky Form 740 is $12,500 or more for residents, and $5,000 or more for non-residents with Kentucky-sourced income.

Can I file Kentucky Form 740 electronically?

+Yes, you can file Kentucky Form 740 electronically through the Kentucky DOR's website or through a tax preparation software.