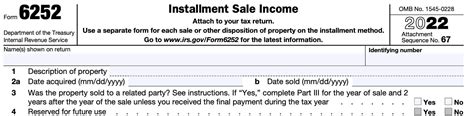

As the tax season approaches, many individuals and businesses are preparing to file their returns. One of the forms that may be required for certain taxpayers is Form 6252, Installment Sale Income. In this article, we will discuss the purpose of Form 6252, how to complete it, and how to use TurboTax to make the process easier.

What is Form 6252?

Form 6252 is used to report income from an installment sale. An installment sale is a sale of property where at least one payment is received after the tax year of the sale. This type of sale can provide tax benefits to the seller, as the income is reported over time rather than all at once.

Who Needs to File Form 6252?

You will need to file Form 6252 if you sold property under an installment sale contract and received payments in the current tax year. This includes sales of:

- Real estate

- Stocks or securities

- Business assets

- Personal property

How to Complete Form 6252

To complete Form 6252, you will need to gather information about the sale, including:

- The date of the sale

- The gross profit from the sale

- The total contract price

- The number of payments received in the current tax year

- The amount of each payment

You will also need to calculate the gross profit percentage, which is the percentage of the total contract price that represents the gross profit.

Step-by-Step Instructions for Completing Form 6252

Here are the step-by-step instructions for completing Form 6252:

- Enter the date of the sale in the top left corner of the form.

- Enter the gross profit from the sale in Line 1.

- Enter the total contract price in Line 2.

- Enter the number of payments received in the current tax year in Line 3.

- Enter the amount of each payment in Line 4.

- Calculate the gross profit percentage by dividing the gross profit by the total contract price.

- Enter the gross profit percentage in Line 5.

- Multiply the gross profit percentage by the total payments received in the current tax year to calculate the taxable income.

- Enter the taxable income in Line 6.

Using TurboTax to Complete Form 6252

TurboTax can make it easier to complete Form 6252 by guiding you through the process and performing the calculations for you.

How to Use TurboTax to Complete Form 6252

Here are the steps to follow to use TurboTax to complete Form 6252:

- Open TurboTax and select the "Investments" or "Business" section, depending on the type of property sold.

- Select "Installment Sale" and follow the prompts to enter the required information.

- Enter the date of the sale, gross profit, total contract price, and number of payments received.

- TurboTax will calculate the gross profit percentage and taxable income for you.

- Review the information and make any necessary adjustments.

- TurboTax will generate the completed Form 6252 for you.

Benefits of Using TurboTax

Using TurboTax to complete Form 6252 can provide several benefits, including:

- Accuracy: TurboTax performs the calculations for you, reducing the risk of errors.

- Convenience: TurboTax guides you through the process, making it easier to complete the form.

- Time-saving: TurboTax saves you time by automating the calculations and generating the completed form.

Common Errors to Avoid

When completing Form 6252, there are several common errors to avoid, including:

- Incorrect gross profit percentage

- Incorrect taxable income calculation

- Failure to report all payments received

Conclusion

Completing Form 6252 can be a complex process, but using TurboTax can make it easier. By following the steps outlined in this article and using TurboTax, you can ensure that your Form 6252 is accurate and complete.

Invite to Comment and Share

If you have any questions or comments about completing Form 6252 or using TurboTax, please leave them in the comments section below. Share this article with others who may be interested in learning more about installment sale income and how to report it on their tax return.

What is an installment sale?

+An installment sale is a sale of property where at least one payment is received after the tax year of the sale.

Who needs to file Form 6252?

+You will need to file Form 6252 if you sold property under an installment sale contract and received payments in the current tax year.

How do I calculate the gross profit percentage?

+The gross profit percentage is calculated by dividing the gross profit by the total contract price.