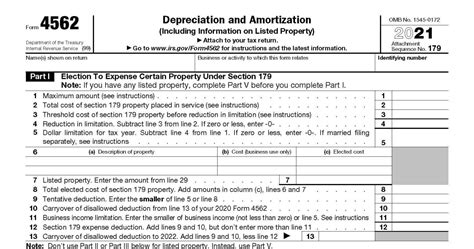

The IRS Form 4562, also known as the Depreciation and Amortization form, is a crucial document for businesses and individuals to report depreciation and amortization expenses on their tax returns. In this comprehensive guide, we will walk you through the filing instructions, explaining the purpose of the form, who needs to file it, and how to complete it accurately.

What is IRS Form 4562?

IRS Form 4562 is used to report depreciation and amortization expenses for assets acquired by a business or individual. Depreciation is the process of allocating the cost of a tangible asset over its useful life, while amortization is the process of allocating the cost of an intangible asset over its useful life. The form is used to calculate the depreciation and amortization expenses for the tax year, which can be claimed as deductions on the taxpayer's income tax return.

Who Needs to File IRS Form 4562?

Businesses and individuals who acquire assets that are subject to depreciation or amortization must file IRS Form 4562. This includes:

- Businesses that acquire tangible assets, such as buildings, equipment, and vehicles

- Businesses that acquire intangible assets, such as patents, copyrights, and trademarks

- Individuals who acquire assets for investment or business purposes

- Self-employed individuals who acquire assets for their business

How to Complete IRS Form 4562

To complete IRS Form 4562, follow these steps:

- Identify the assets: List all the assets acquired during the tax year, including tangible and intangible assets.

- Determine the depreciation method: Choose the depreciation method for each asset, such as the Modified Accelerated Cost Recovery System (MACRS) or the straight-line method.

- Calculate the depreciation expense: Calculate the depreciation expense for each asset using the chosen depreciation method.

- Calculate the amortization expense: Calculate the amortization expense for intangible assets.

- Complete the form: Complete the form by reporting the depreciation and amortization expenses for each asset.

Section 1: Depreciation

- Report the depreciation expenses for each asset in Section 1.

- List the asset type, cost, and depreciation method.

- Calculate the depreciation expense using the chosen method.

Section 2: Amortization

- Report the amortization expenses for intangible assets in Section 2.

- List the asset type, cost, and amortization method.

- Calculate the amortization expense using the chosen method.

Section 3: Summary

- Report the total depreciation and amortization expenses in Section 3.

- Calculate the total depreciation and amortization expenses for the tax year.

Example of Completing IRS Form 4562

Let's say a business acquired a piece of equipment for $10,000, with a useful life of 5 years. The business chooses to use the MACRS method to depreciate the asset.

| Asset Type | Cost | Depreciation Method | Depreciation Expense |

|---|---|---|---|

| Equipment | $10,000 | MACRS | $2,000 |

In this example, the business would report the depreciation expense of $2,000 on IRS Form 4562, Section 1.

Tips and Reminders

- Keep accurate records of asset acquisitions and disposals.

- Choose the correct depreciation method for each asset.

- Calculate depreciation and amortization expenses accurately.

- Report depreciation and amortization expenses on the correct tax return.

Conclusion

Filing IRS Form 4562 is a crucial step in reporting depreciation and amortization expenses on your tax return. By following the instructions and tips outlined in this guide, you can ensure accurate and timely filing of the form. Remember to keep accurate records, choose the correct depreciation method, and calculate depreciation and amortization expenses accurately.

We hope this guide has been helpful in understanding the IRS Form 4562 and its filing instructions. If you have any questions or need further clarification, please don't hesitate to ask.

What's your experience with filing IRS Form 4562? Share your tips and insights in the comments below!

Share this article with your friends and colleagues who may benefit from this information.

Follow us for more informative articles on tax-related topics!

What is the purpose of IRS Form 4562?

+IRS Form 4562 is used to report depreciation and amortization expenses for assets acquired by a business or individual.

Who needs to file IRS Form 4562?

+Businesses and individuals who acquire assets that are subject to depreciation or amortization must file IRS Form 4562.

How do I calculate depreciation expense on IRS Form 4562?

+Calculate the depreciation expense using the chosen depreciation method, such as the Modified Accelerated Cost Recovery System (MACRS) or the straight-line method.