As a business owner in Florida, it's essential to understand the importance of the Annual Resale Certificate Form DR-13. This certificate is a crucial document that allows your business to purchase items tax-free for resale purposes. In this article, we will delve into the world of the DR-13 form, exploring its significance, benefits, and providing valuable tips to help you navigate the process.

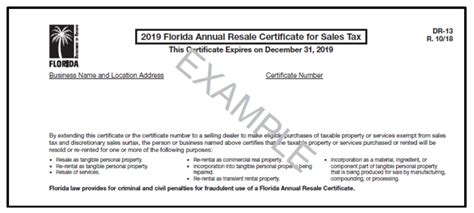

The Annual Resale Certificate Form DR-13 is a document issued by the Florida Department of Revenue, which certifies that your business is eligible to purchase items for resale without paying sales tax. This certificate is a must-have for any business that intends to resell goods, as it helps to avoid unnecessary tax liabilities.

Why is the DR-13 Form Important?

The DR-13 form is essential for businesses that engage in resale activities, such as retailers, wholesalers, and distributors. Without this certificate, your business may be required to pay sales tax on purchases, which can significantly impact your profit margins.

Benefits of the DR-13 Form

The DR-13 form offers several benefits to businesses, including:

- Tax Savings: By purchasing items tax-free, your business can save a significant amount on sales tax.

- Increased Profit Margins: With reduced tax liabilities, your business can enjoy increased profit margins.

- Competitive Advantage: Having a DR-13 form can give your business a competitive edge in the market, as you can offer products at a lower price point.

5 Tips for Florida Annual Resale Certificate Form DR-13

To ensure a smooth and successful application process, follow these 5 tips:

1. Understand the Eligibility Criteria

Before applying for the DR-13 form, it's essential to understand the eligibility criteria set by the Florida Department of Revenue. Your business must be registered with the state and have a valid Federal Tax ID Number.

2. Gather Required Documents

To apply for the DR-13 form, you'll need to gather the required documents, including:

- Business Registration: A copy of your business registration certificate.

- Federal Tax ID Number: A copy of your Federal Tax ID Number certificate.

- Sales Tax Permit: A copy of your sales tax permit, if applicable.

3. Complete the Application Form

The DR-13 form is available on the Florida Department of Revenue website. Complete the application form carefully, ensuring that all information is accurate and up-to-date.

4. Submit the Application

Once you've completed the application form, submit it to the Florida Department of Revenue. You can submit the application online or by mail.

5. Renew Your Certificate Annually

The DR-13 form is valid for one year from the date of issuance. It's essential to renew your certificate annually to avoid any disruptions to your business operations.

Steps to Obtain the DR-13 Form

To obtain the DR-13 form, follow these steps:

Step 1: Register Your Business

Register your business with the Florida Department of State.

Step 2: Obtain a Federal Tax ID Number

Obtain a Federal Tax ID Number from the IRS.

Step 3: Apply for a Sales Tax Permit

Apply for a sales tax permit from the Florida Department of Revenue, if applicable.

Step 4: Complete the DR-13 Application Form

Complete the DR-13 application form, ensuring that all information is accurate and up-to-date.

Step 5: Submit the Application

Submit the application to the Florida Department of Revenue.

Practical Examples

Here are a few practical examples of businesses that require the DR-13 form:

- Retail Stores: Retail stores that purchase products for resale purposes.

- Wholesale Distributors: Wholesale distributors that purchase products for resale to retailers.

- Online Sellers: Online sellers that purchase products for resale purposes.

Statistical Data

According to the Florida Department of Revenue, the DR-13 form is required for over 200,000 businesses in the state. This number continues to grow as more businesses engage in resale activities.

Conclusion

In conclusion, the Annual Resale Certificate Form DR-13 is a critical document for businesses that engage in resale activities in Florida. By understanding the eligibility criteria, gathering required documents, and completing the application form accurately, you can ensure a smooth and successful application process.

We invite you to share your experiences with the DR-13 form in the comments section below. Have you encountered any challenges during the application process? How has the DR-13 form benefited your business?

What is the Annual Resale Certificate Form DR-13?

+The Annual Resale Certificate Form DR-13 is a document issued by the Florida Department of Revenue, which certifies that your business is eligible to purchase items for resale without paying sales tax.

Who is eligible for the DR-13 form?

+Your business must be registered with the state and have a valid Federal Tax ID Number to be eligible for the DR-13 form.

How do I apply for the DR-13 form?

+To apply for the DR-13 form, complete the application form on the Florida Department of Revenue website, gather required documents, and submit the application online or by mail.