Pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs), are popular business structures due to their tax benefits. In California, these entities are required to file Form 592, Pass-Through Entity Annual Tax Return. In this article, we will delve into the world of pass-through entity tax and provide a comprehensive guide to help you navigate the complexities of Form 592.

Understanding Pass-Through Entities

Pass-through entities are business structures that allow income to be passed through to the owners, who then report their share of income on their personal tax returns. This is in contrast to C corporations, which are taxed on their profits at the entity level. The main types of pass-through entities are:

- Partnerships (including limited partnerships and limited liability partnerships)

- S corporations

- Limited liability companies (LLCs)

Why File Form 592?

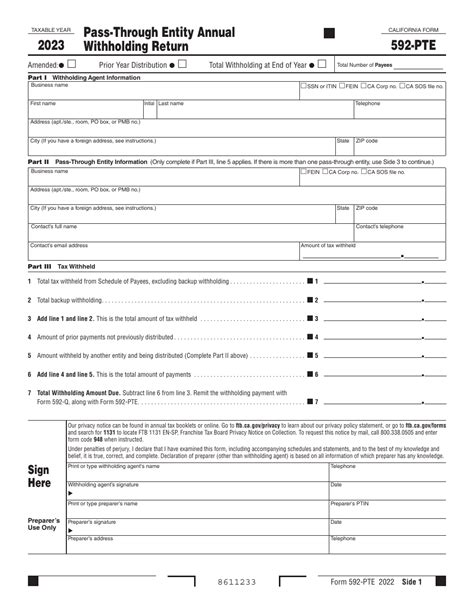

Form 592 is used to report the annual tax return of a pass-through entity in California. The form is required for all pass-through entities that have income, deductions, or credits that are subject to California tax. The purpose of Form 592 is to:

- Report the entity's income, deductions, and credits

- Calculate the entity's tax liability

- Claim any applicable credits or deductions

- Report the distribution of income to owners

Who Must File Form 592?

The following pass-through entities are required to file Form 592:

- Partnerships with California-source income

- S corporations with California-source income

- LLCs classified as partnerships or S corporations for federal tax purposes

What Information is Required on Form 592?

Form 592 requires the following information:

- Entity information, including name, address, and tax ID number

- Income and deductions, including California-source income and apportioned income

- Credits and deductions, including the research and development credit and the hiring credit

- Distribution of income to owners

- Tax liability and payment information

How to Complete Form 592

To complete Form 592, follow these steps:

- Gather all necessary information, including financial statements and tax returns

- Determine the entity's California-source income and apportioned income

- Calculate the entity's tax liability and credits

- Complete the entity information and income sections

- Complete the credits and deductions sections

- Complete the distribution of income section

- Sign and date the form

Tips for Filing Form 592

Here are some tips to keep in mind when filing Form 592:

- Ensure accurate and complete information

- Use the correct tax forms and schedules

- Take advantage of available credits and deductions

- Consult with a tax professional if necessary

- File on time to avoid penalties and interest

Common Errors to Avoid

Here are some common errors to avoid when filing Form 592:

- Incomplete or inaccurate information

- Failure to report all California-source income

- Failure to claim available credits and deductions

- Incorrect calculation of tax liability

- Failure to sign and date the form

Benefits of Filing Form 592

Filing Form 592 provides several benefits, including:

- Compliance with California tax laws

- Accurate reporting of income and deductions

- Claiming available credits and deductions

- Avoiding penalties and interest

- Maintaining accurate financial records

Conclusion

Filing Form 592 is a critical step in maintaining compliance with California tax laws for pass-through entities. By understanding the requirements and following the steps outlined in this guide, you can ensure accurate and complete reporting of your entity's income and deductions. Remember to take advantage of available credits and deductions, and consult with a tax professional if necessary. By doing so, you can minimize your tax liability and maintain a healthy financial position for your business.

FAQ Section

What is the deadline for filing Form 592?

+The deadline for filing Form 592 is the 15th day of the 3rd month after the close of the tax year.

Can I file Form 592 electronically?

+Yes, you can file Form 592 electronically through the California Franchise Tax Board's (FTB) website.

What is the penalty for failing to file Form 592?

+The penalty for failing to file Form 592 is 5% of the unpaid tax, plus interest and penalties.