The California Limited Liability Company (LLC) Return Form 568 is an annual tax form required by the California Franchise Tax Board (FTB) for all LLCs operating in the state. As an LLC owner, understanding the complexities of this form is crucial to ensure compliance with state tax regulations and avoid potential penalties. In this comprehensive guide, we will delve into the details of the California LLC Return Form 568, highlighting key requirements, deductions, and essential information for the 2019 tax year.

Overview of the California LLC Return Form 568

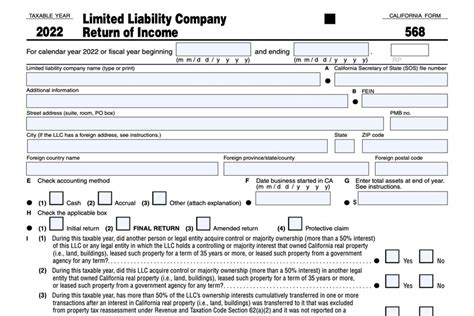

The California LLC Return Form 568 is designed to report the income, deductions, and credits of an LLC operating in the state. This form is typically used in conjunction with the LLC's federal tax return, Form 1065, Partnership Return of Income. The information provided on the Form 568 helps the FTB calculate the LLC's annual tax liability, which is used to determine the amount of taxes owed to the state.

Who Needs to File Form 568?

All LLCs registered in California or operating in the state must file the Form 568, regardless of their tax classification. This includes:

- Single-member LLCs (disregarded entities)

- Multi-member LLCs (partnerships)

- Limited liability partnerships (LLPs)

- Limited liability limited partnerships (LLLPs)

Key Components of the Form 568

The Form 568 is comprised of several sections, each designed to gather specific information about the LLC's income, deductions, and credits.

- Identification Section: This section requires the LLC's name, address, and Employer Identification Number (EIN).

- Income Section: This section reports the LLC's total income, including:

- Gross income from sales and services

- Interest and dividend income

- Capital gains and losses

- Other income

- Deduction Section: This section lists the LLC's deductible expenses, including:

- Business expenses

- Depreciation and amortization

- Charitable contributions

- Other deductions

- Credit Section: This section reports the LLC's tax credits, including:

- Research and development credits

- Low-income housing credits

- Other credits

- Tax Calculation Section: This section calculates the LLC's annual tax liability based on the income and deductions reported.

Important Deadlines and Penalties

The Form 568 is due on the 15th day of the 4th month following the close of the LLC's taxable year. For example, if the LLC's taxable year ends on December 31, the Form 568 is due on April 15th. Failure to file the Form 568 or making late payments may result in penalties and interest.

Tips and Strategies for Filing Form 568

To ensure a smooth filing process and minimize potential penalties, consider the following tips and strategies:

- Maintain accurate records: Keep detailed records of the LLC's income, deductions, and credits throughout the year.

- Consult a tax professional: If you're unsure about any aspect of the Form 568, consider consulting a tax professional or accountant.

- Take advantage of deductions and credits: Claim all eligible deductions and credits to minimize the LLC's tax liability.

- File electronically: Filing the Form 568 electronically can help reduce errors and expedite processing.

Additional Requirements and Forms

In addition to the Form 568, LLCs may be required to file other forms and schedules, including:

- Schedule K-1: This schedule reports the LLC's income, deductions, and credits allocated to each member.

- Schedule D: This schedule reports the LLC's capital gains and losses.

- Form FTB 3805E: This form reports the LLC's annual tax liability and any payments made.

Conclusion

The California LLC Return Form 568 is a critical component of an LLC's annual tax obligations. By understanding the form's requirements, deductions, and credits, LLC owners can ensure compliance with state tax regulations and minimize potential penalties. Remember to maintain accurate records, consult a tax professional if needed, and take advantage of eligible deductions and credits to optimize the LLC's tax position.

What is the deadline for filing the Form 568?

+The Form 568 is due on the 15th day of the 4th month following the close of the LLC's taxable year.

What are the penalties for failing to file the Form 568?

+Failure to file the Form 568 or making late payments may result in penalties and interest.

Can I file the Form 568 electronically?

+Yes, filing the Form 568 electronically can help reduce errors and expedite processing.